Beginning of the End?

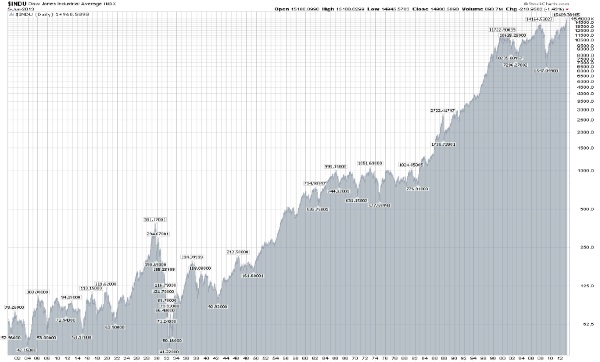

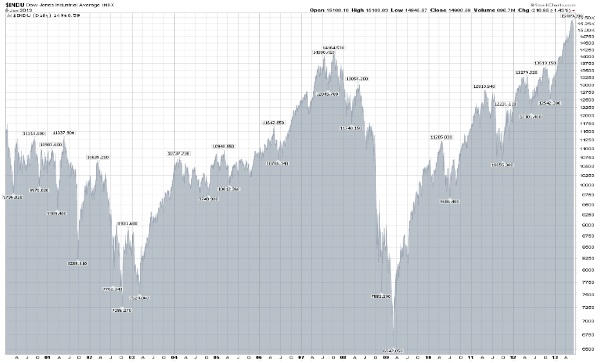

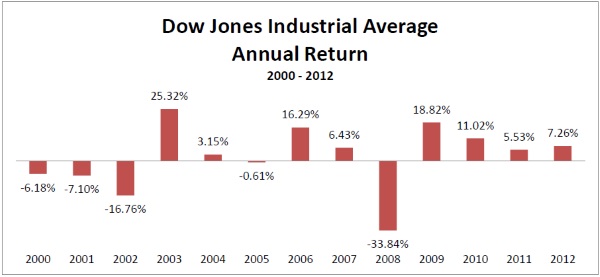

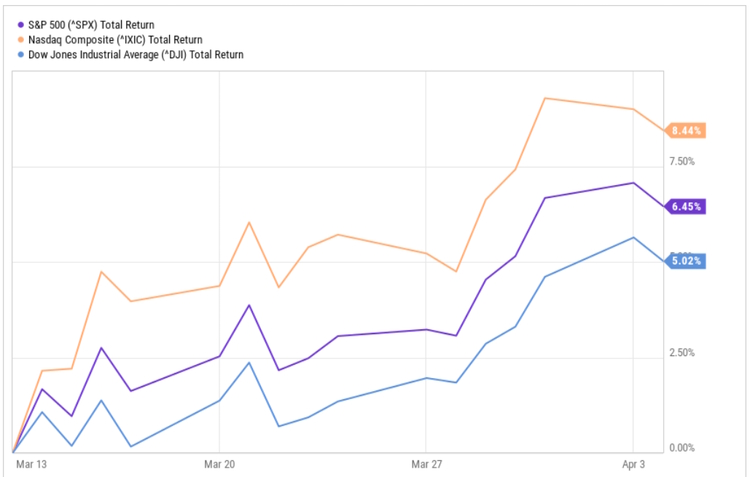

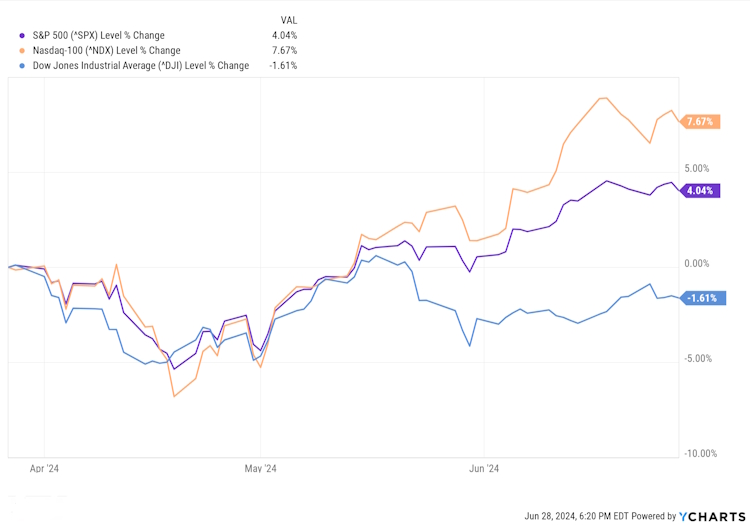

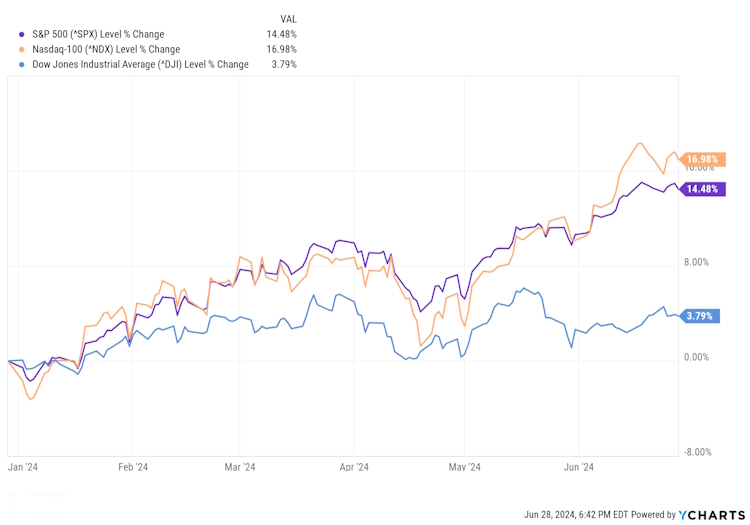

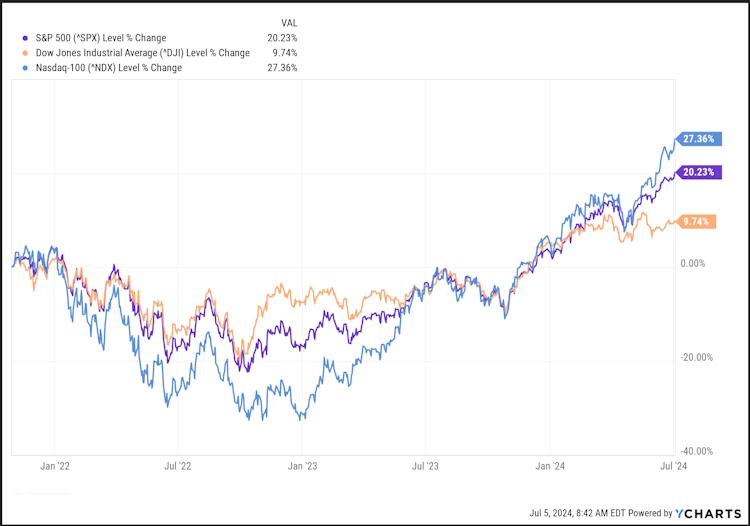

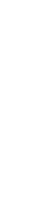

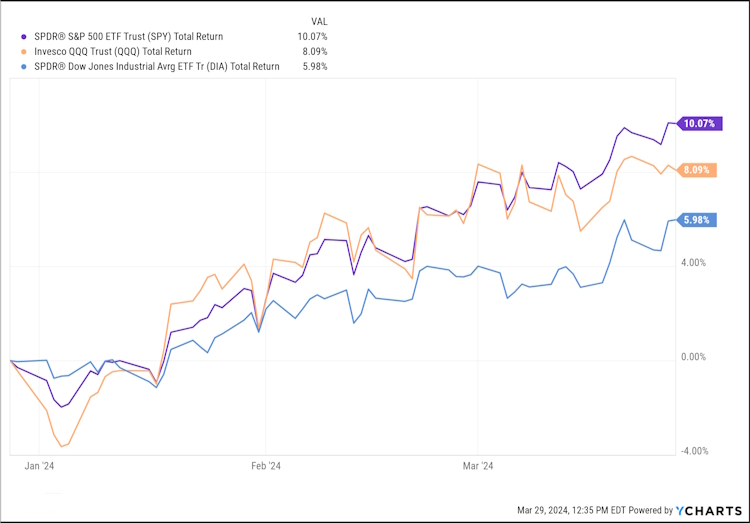

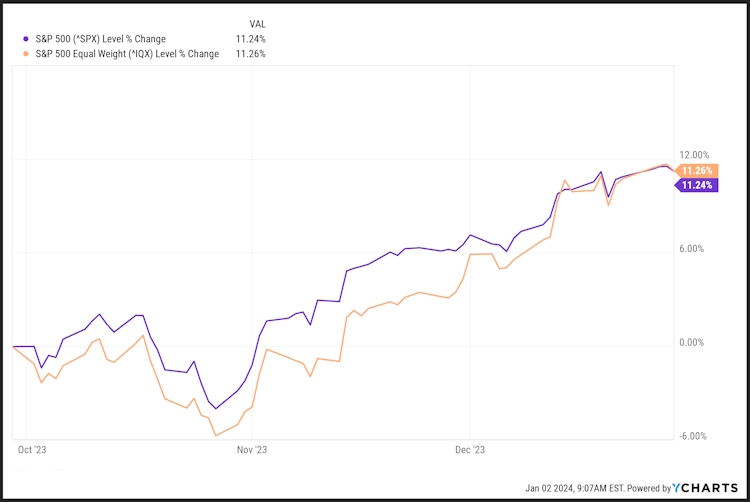

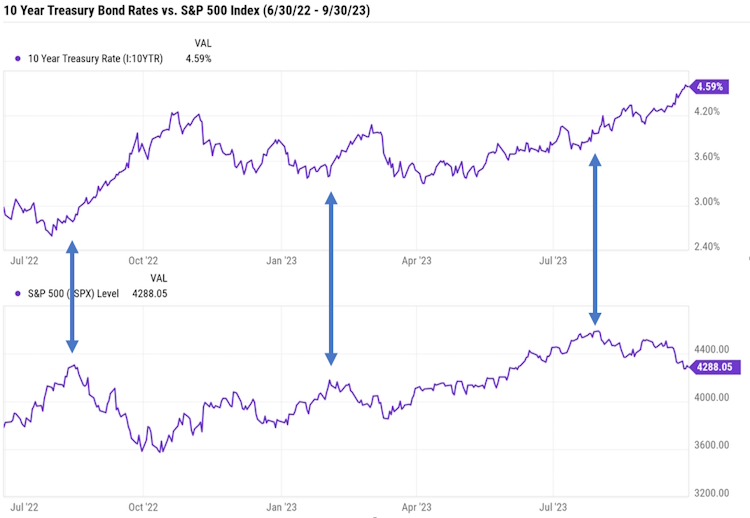

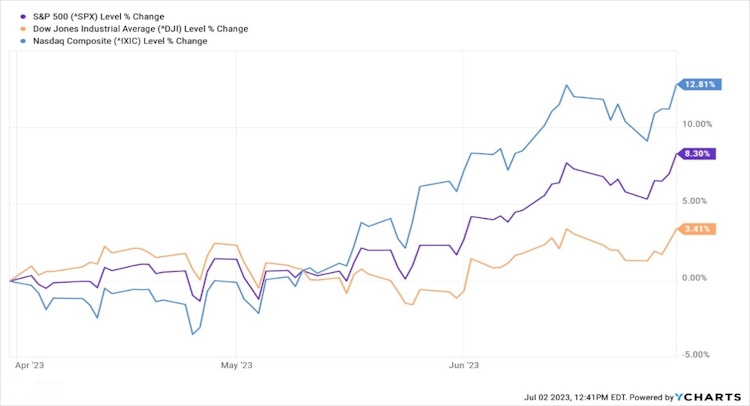

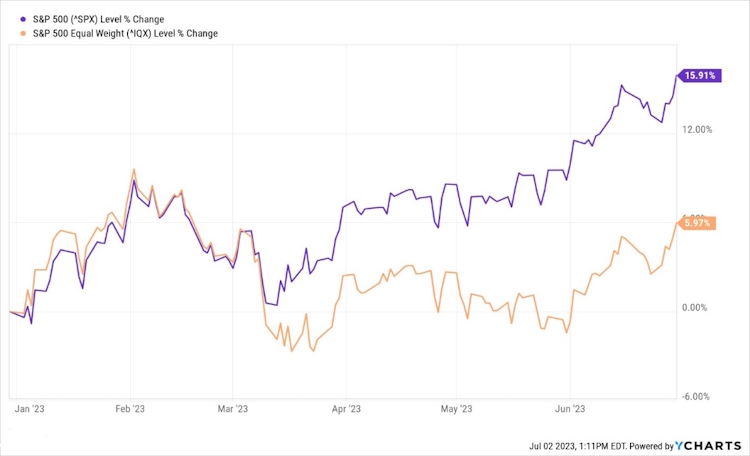

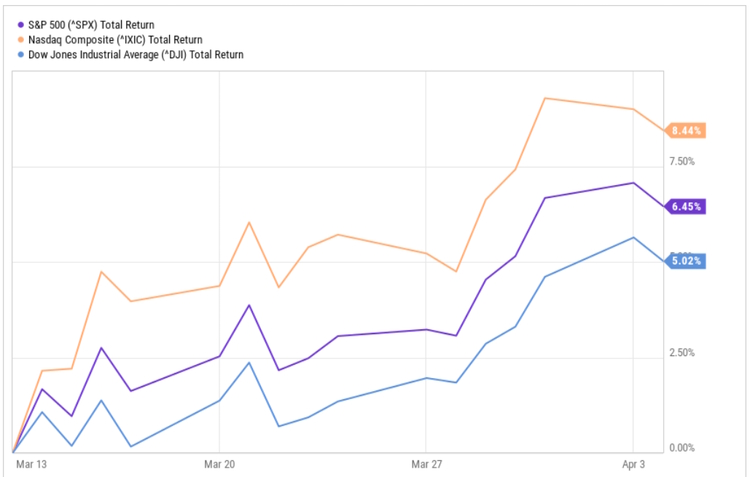

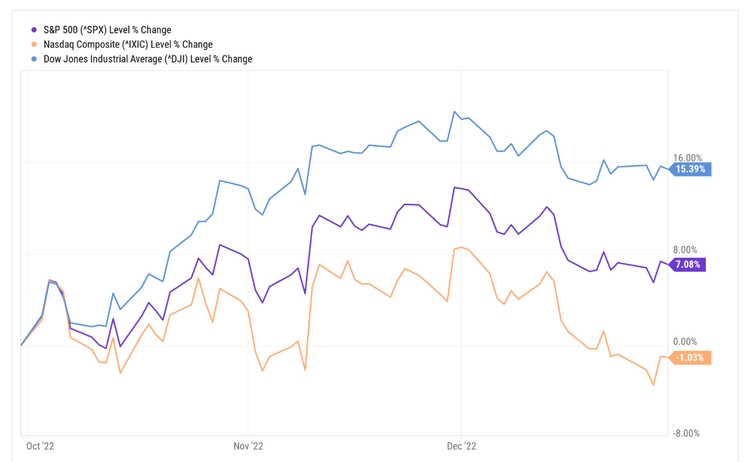

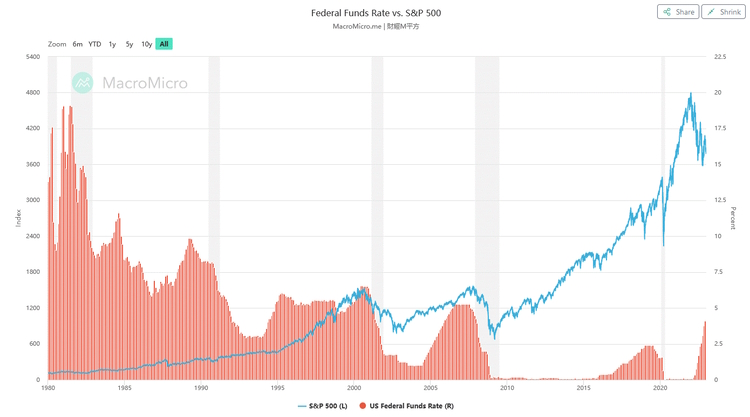

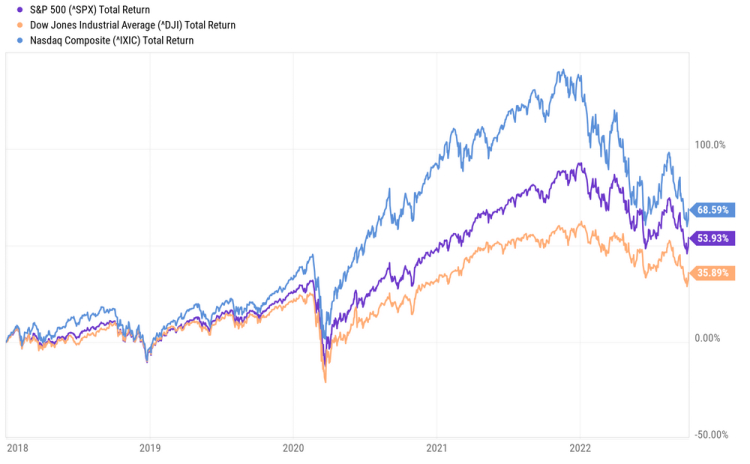

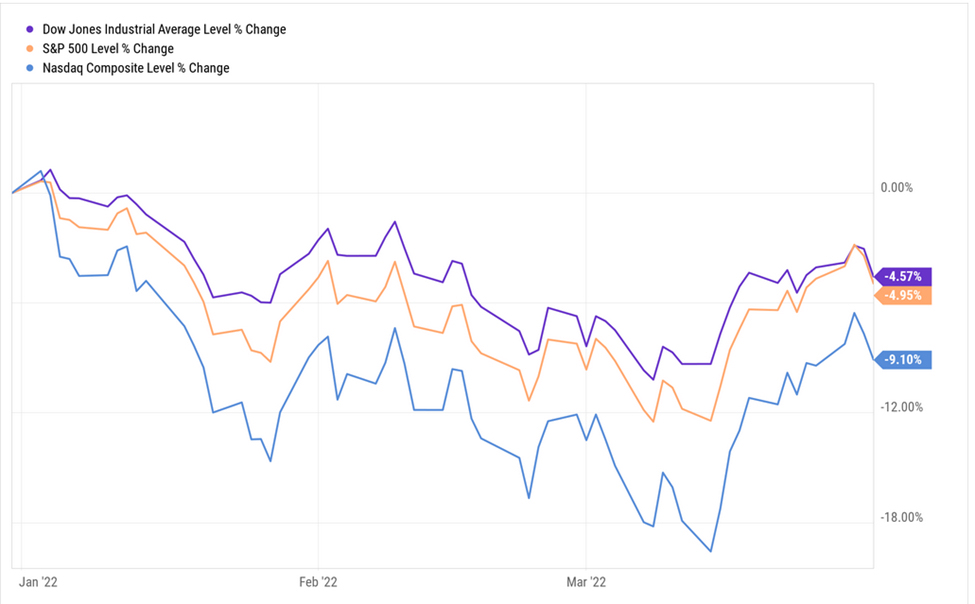

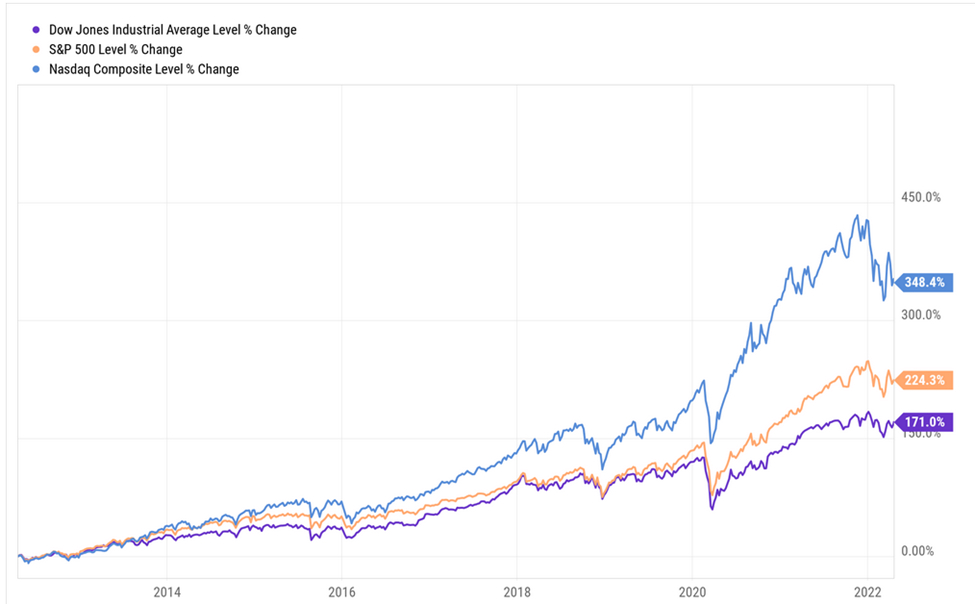

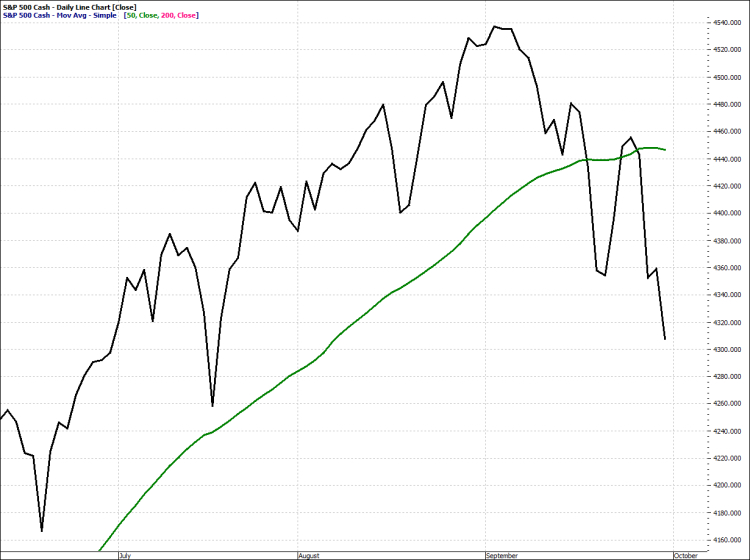

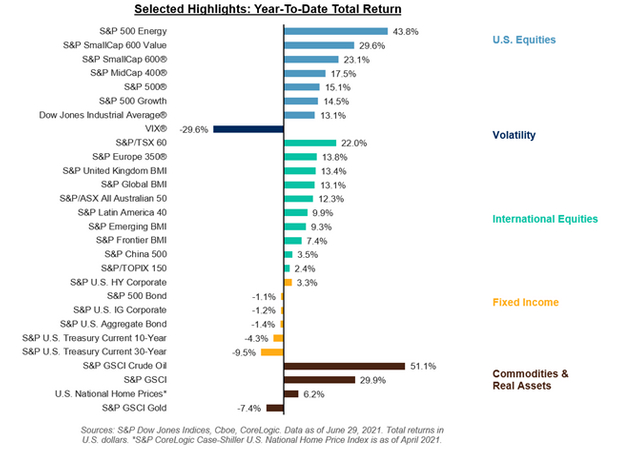

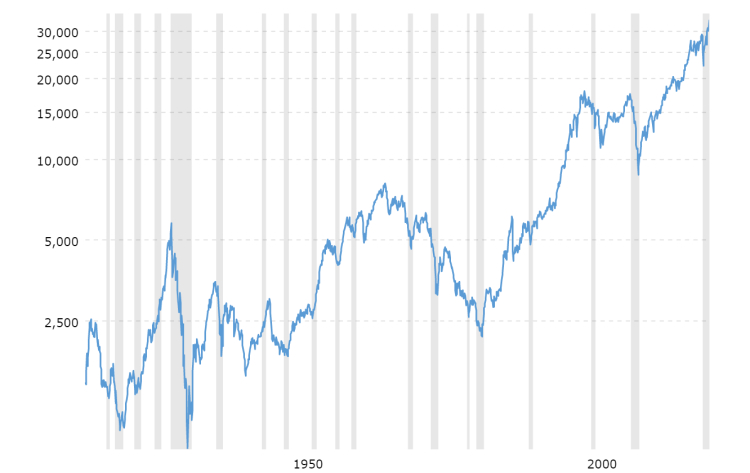

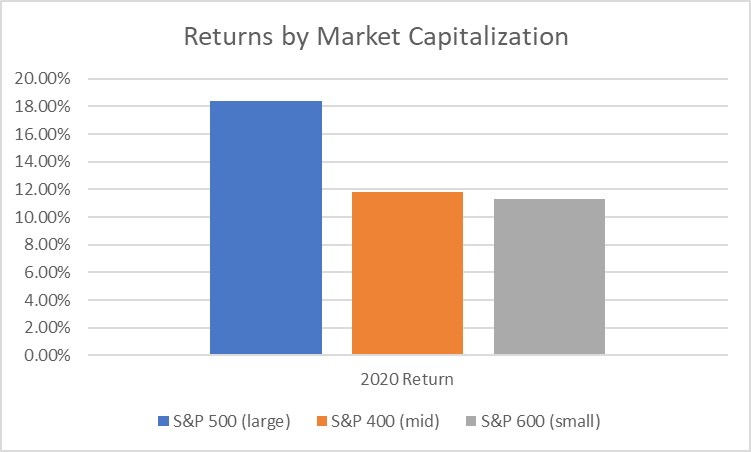

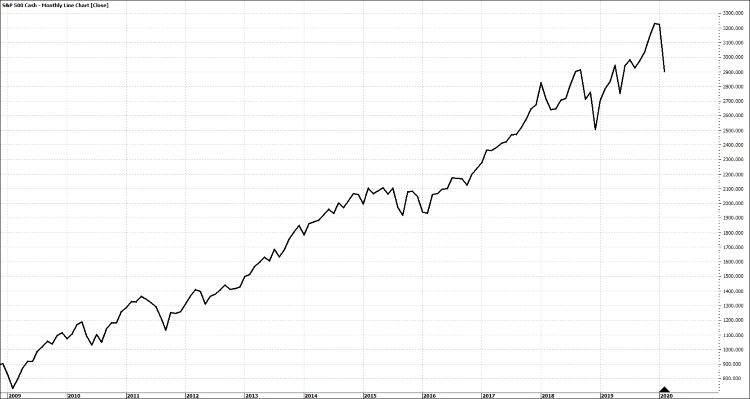

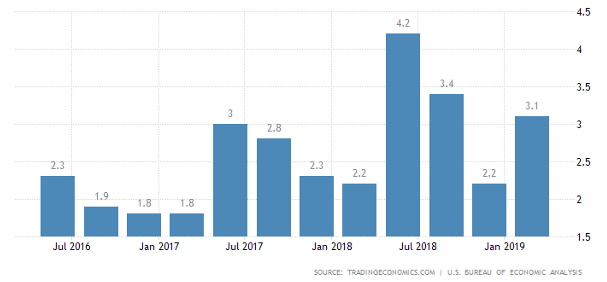

All the major indices ended the first quarter in positive territory, led by the tech-heavy Nasdaq composite up 17.05% and driven by anticipation of an end to the fastest series of interest rate hikes in the last 50 years.

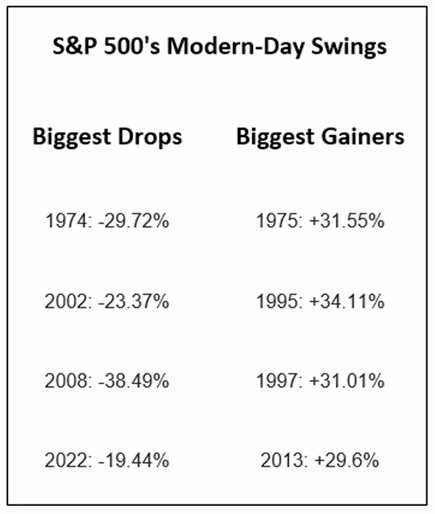

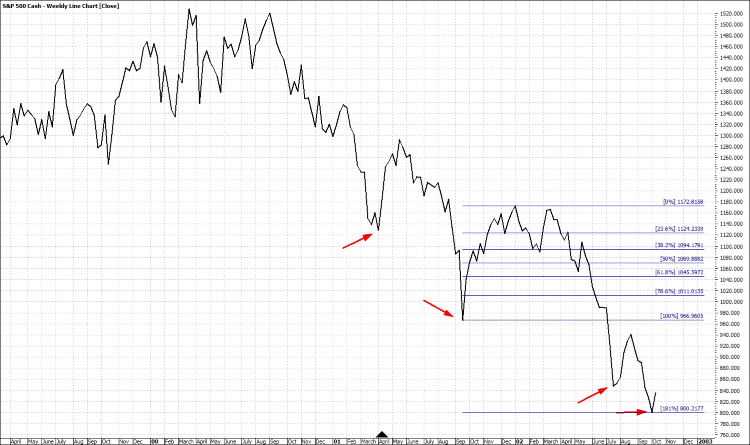

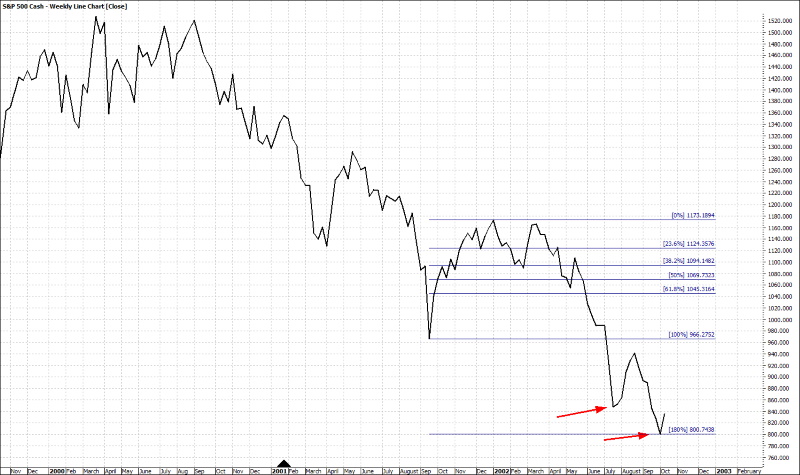

If you recall, the Dow Jones “outperformed” both the Nasdaq as well as the S&P 500 in 2022 so it wasn’t surprising to see it lag a bit this quarter. Is this the beginning of a new Bull Market, or just a pause on the way to lower lows? We don’t know the answer (no one does until the old trend is over and the new trend is confirmed), but we will look at the potential catalysts as well as risks heading into Q2.

Something Finally Broke

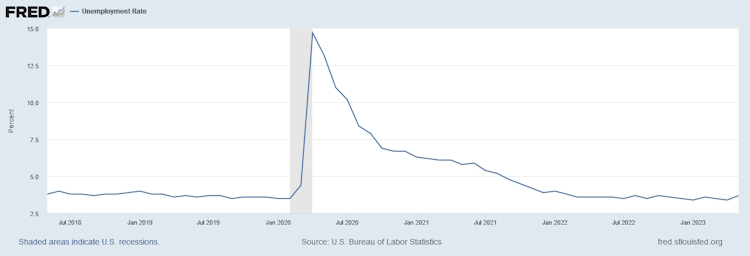

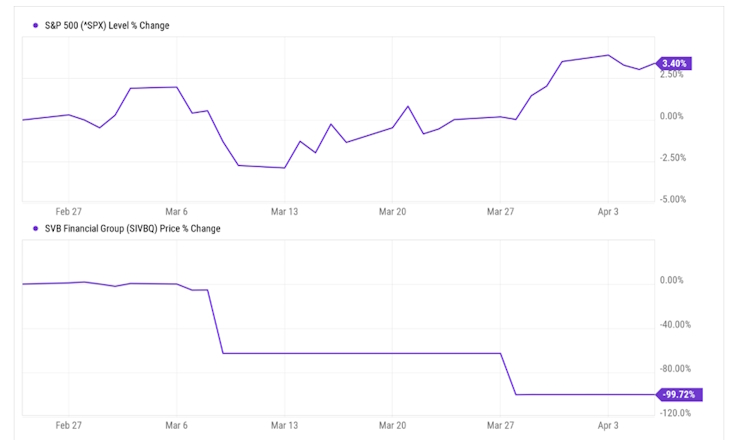

On Friday, March 10, Regulators closed troubled Silicon Valley Bank after deposit outflows and a failed capital raise plunged the country’s 16th largest bank into crisis, sending shock waves through the banking sector.

California state regulators seized the Santa Clara institution and appointed the Federal Deposit Insurance Corporation as receiver, meaning the FDIC will be able to sell off assets and return money to insured depositors.

We note that while SVB was not part of any of the portfolios we manage, it was only a month earlier that, during a February 8 episode of MSBNC’s Mad Money, host Jim Cramer instructed viewers to buy Silicon Valley Bank (courtesy of @watcher.guru). We don’t know how many people view this show as nothing more than entertainment versus solid investment advice, but we’re pretty sure that it may have triggered some people to invest.

Most people are now aware of the SVB collapse and multiple articles have been written about it as well, so we won’t spend a lot of time on what you already know but focus on details that resonate around investing themes.

Silicon Valley Bank had been around since 1983 and offered one-stop shopping to the tech community. They made loans to venture capital (VC) funds that would use those funds to make private equity investments in start-ups and small to medium size companies considered to have high growth potential.

If they weren’t already, many of these small companies became customers of SVB and SVB would make loans directly to them for funding operations and growth. In fact, SVB would often require borrowers to deposit the loan proceeds in their account and it is reported that some loan agreements even prohibited any deposits by the borrower at other banks. This meant that SVB dominated Silicon Valley finance by controlling both sides of the balance sheet. Its assets were loans to entrepreneurs, and its liabilities were deposits from those same entrepreneurs.

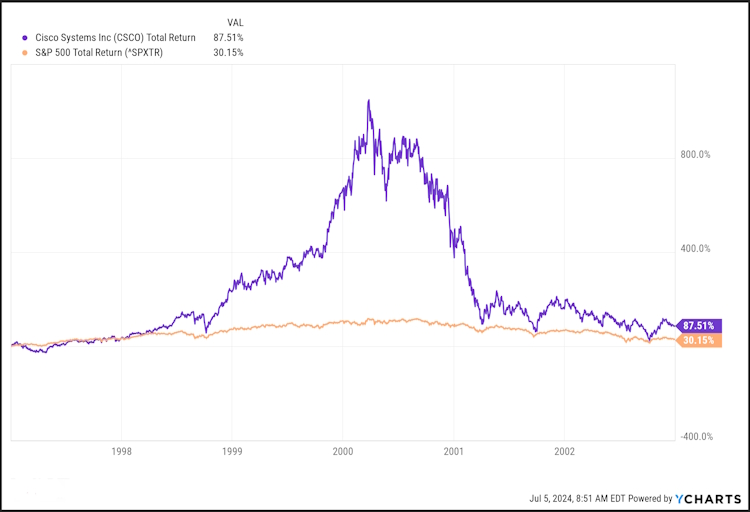

Many companies that had been SVB clients in their start-up stage went on to great success and built multi-billion-dollar cash positions. The CEOs of those successful clients, including Roku, Vox, Etsy, Cisco, and Coinbase, were loyal to SVB and continued to keep huge deposits there until the end.

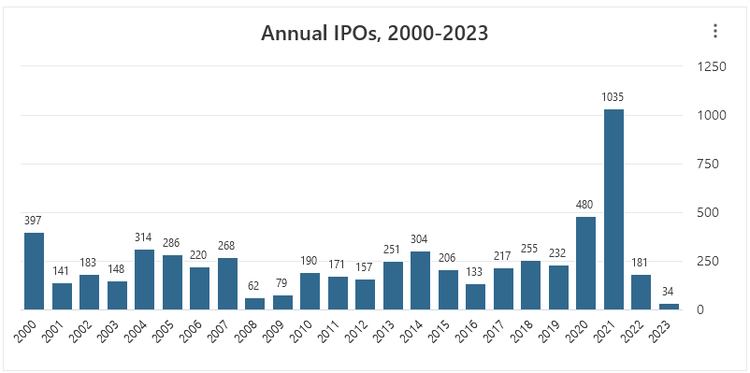

SVB had always been vulnerable to startup booms and busts and had difficulties during the popping of the dot-com bubble and the Great Recession of 2007-2009 but it survived.

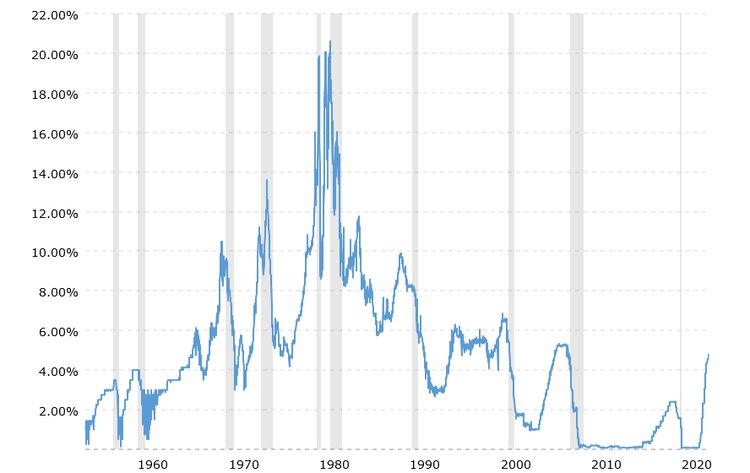

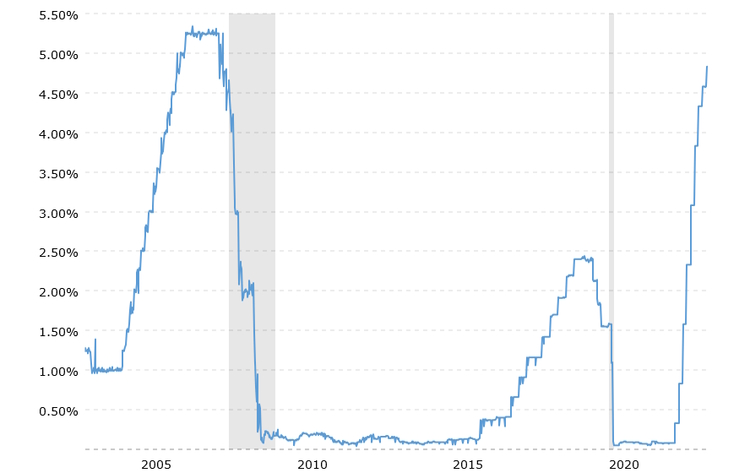

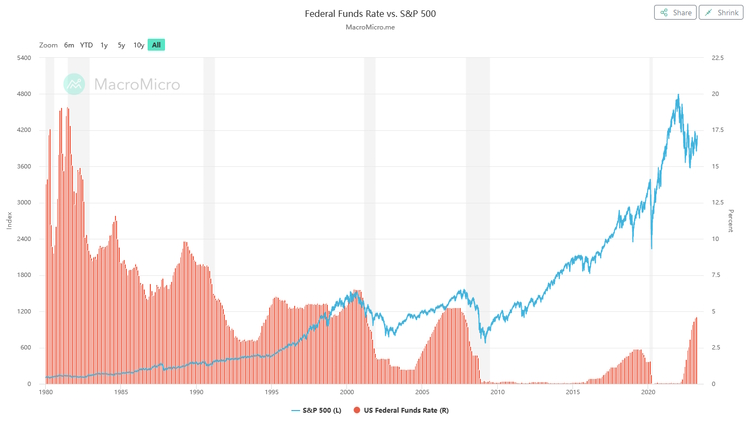

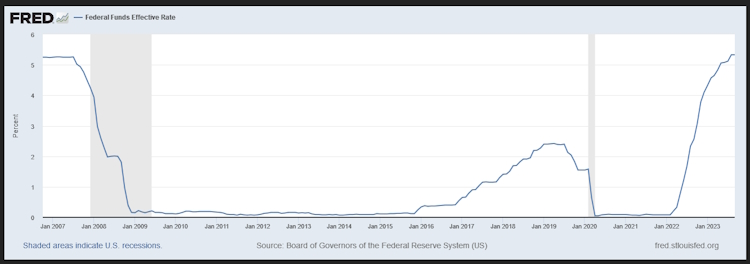

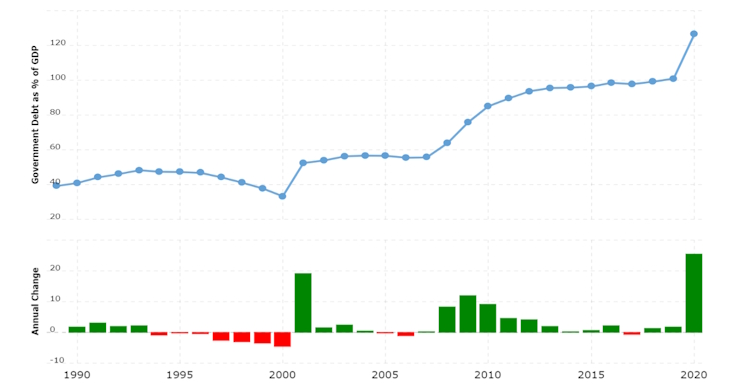

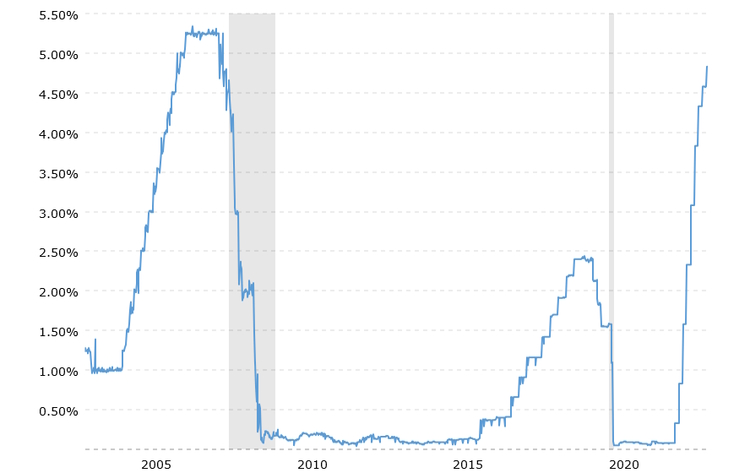

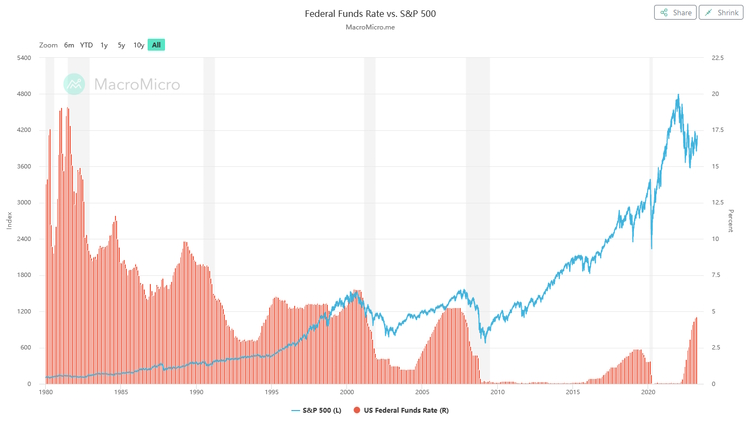

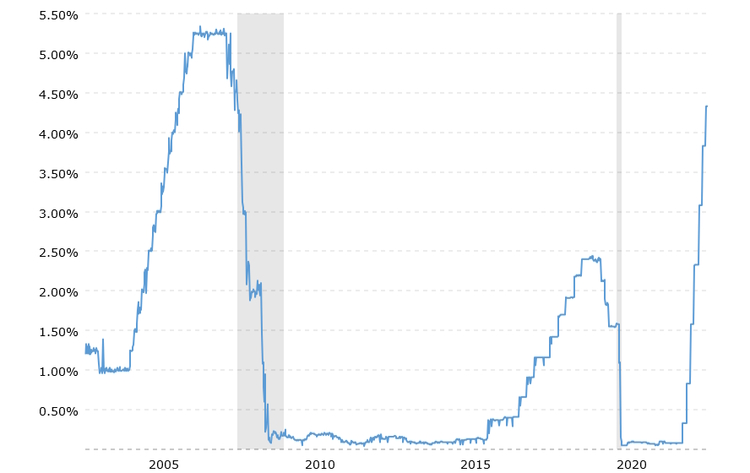

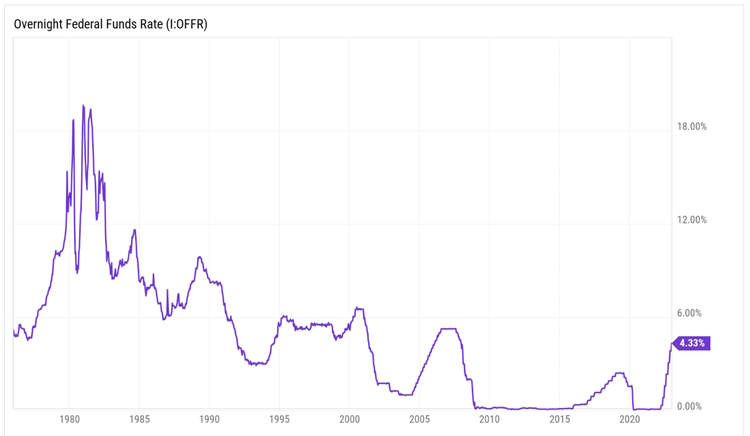

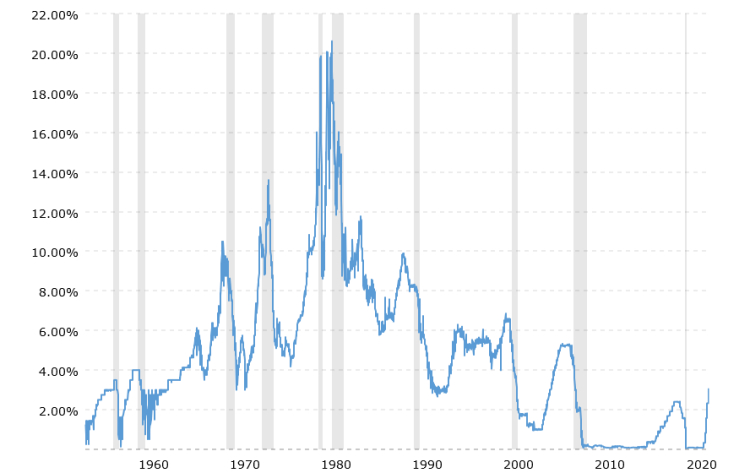

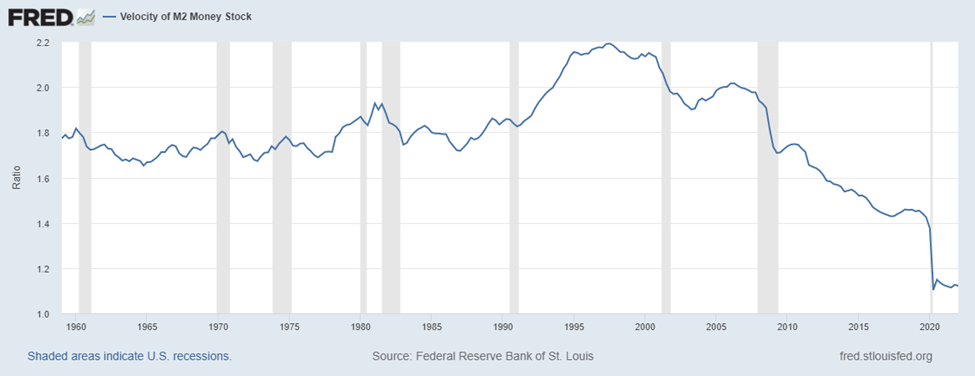

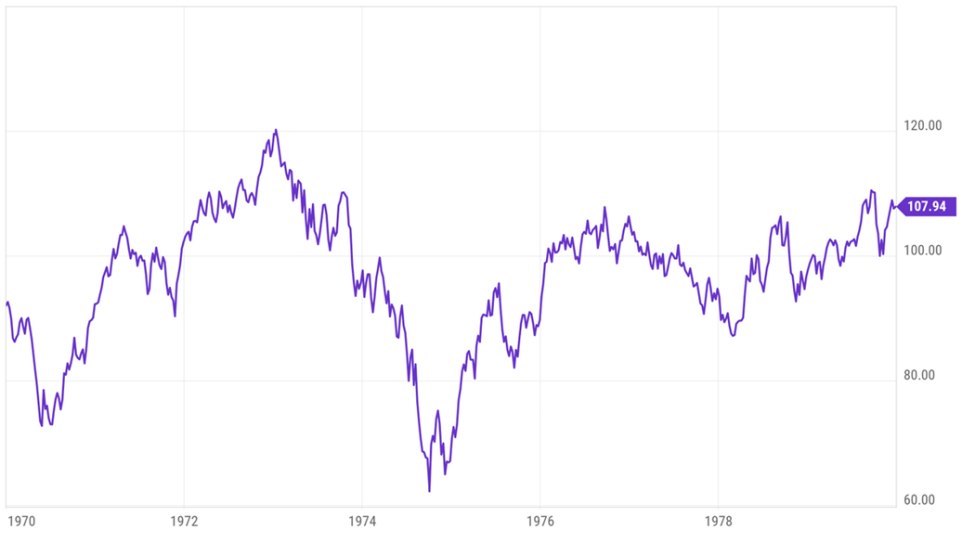

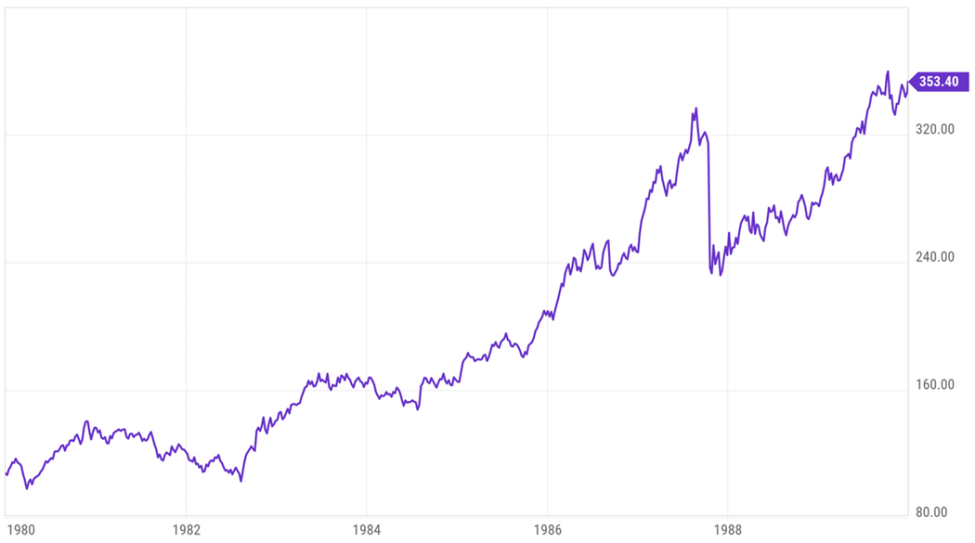

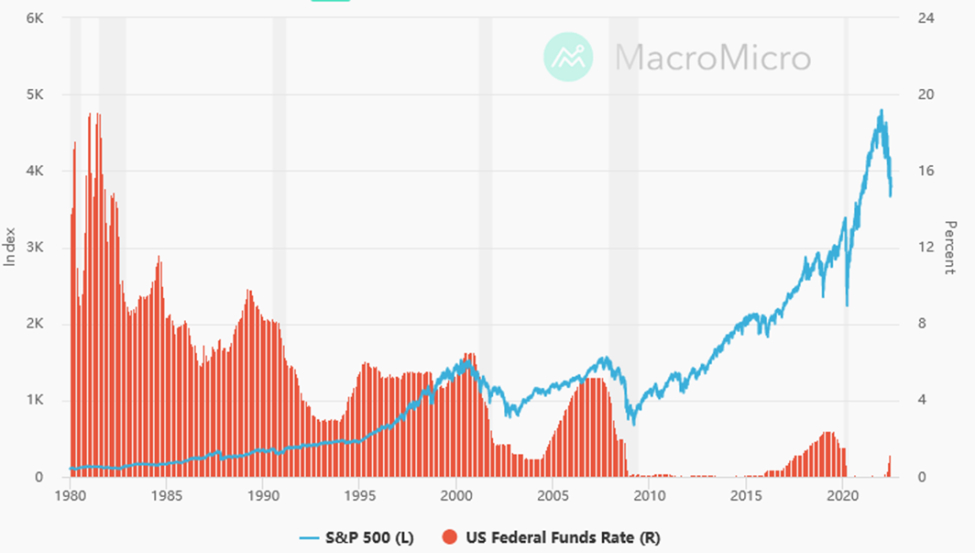

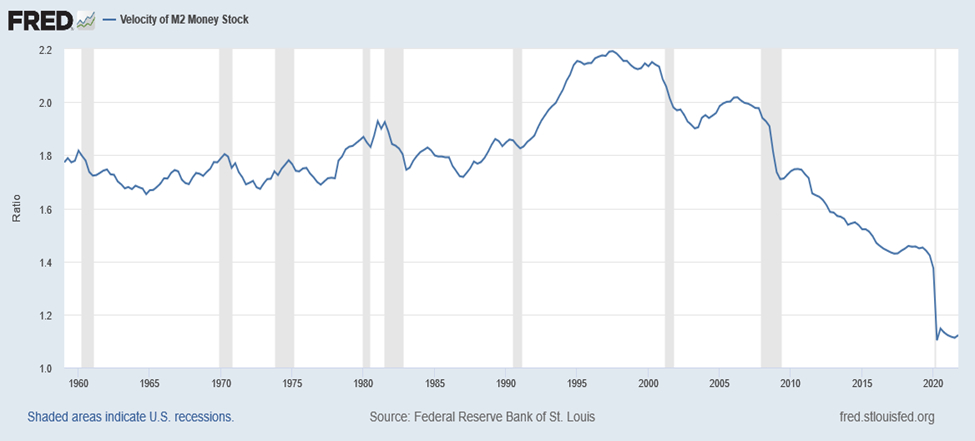

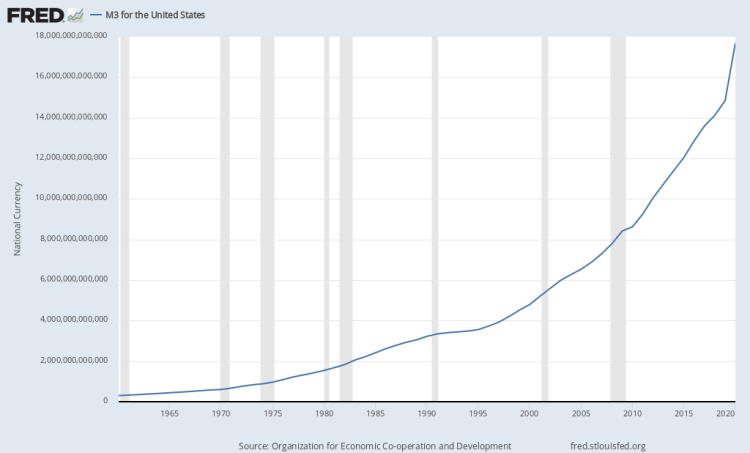

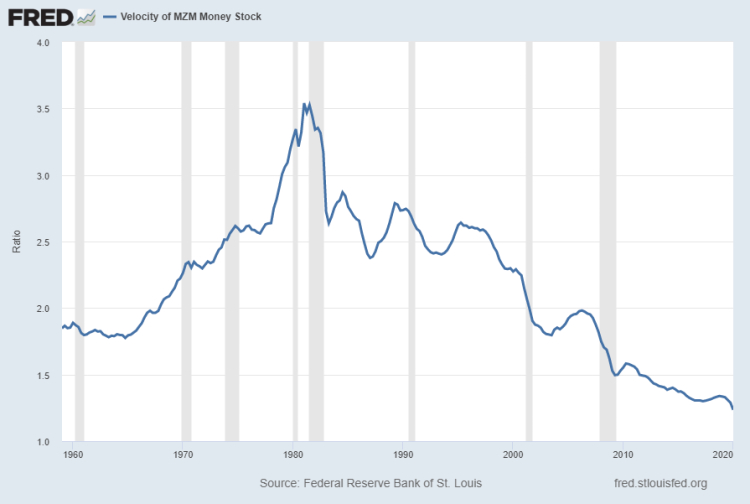

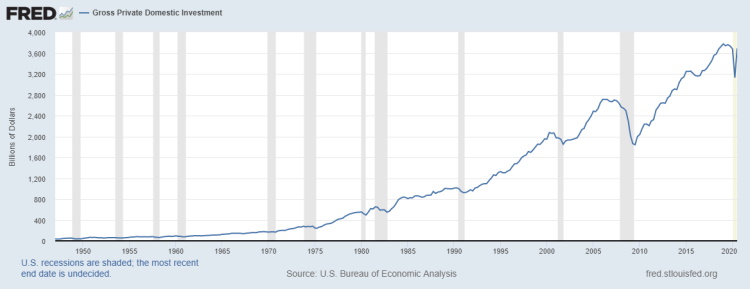

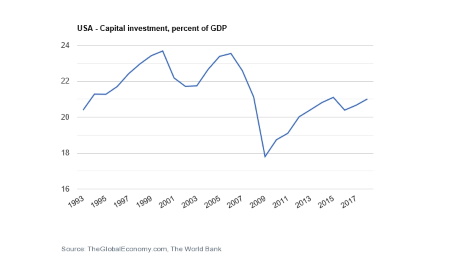

However, things changed after the Great Recession. Even though interest rates had been as low as 1% prior to 2008, they had never gone below 1% even looking all the way back to 1971 when Nixon ended the gold standard. Nor were they held so low for such a long period of time as they were from 2009 until 2017.

Federal Funds Rate – 62 Year Historical Chart

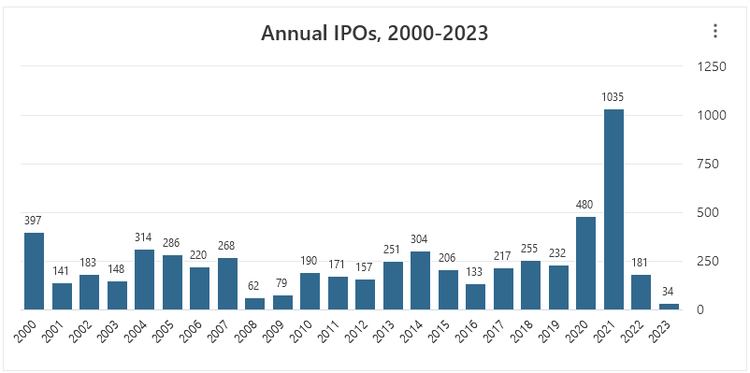

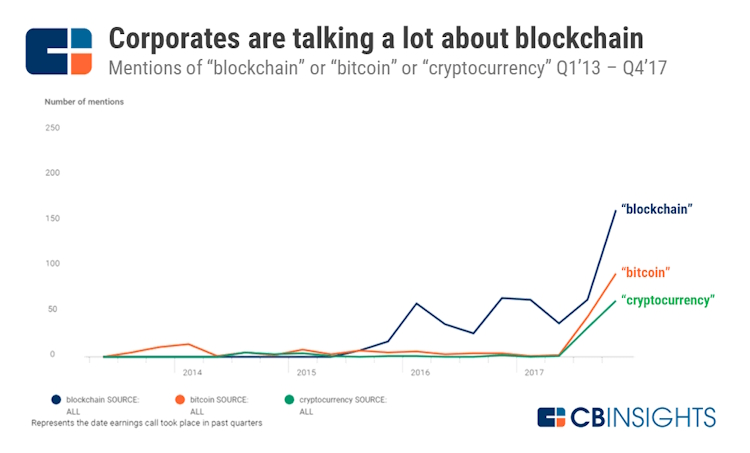

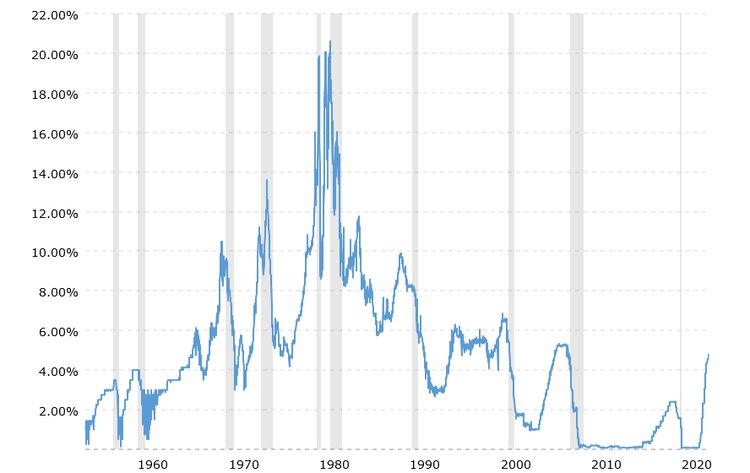

With interest rates so low, we see a situation similar to the one which led to the housing crisis. Venture capitalists, with easy access to cash, became less choosy about the ventures they were investing in and more concerned about “flipping” these businesses either to the public via

Initial Public Offerings (IPO) or to larger companies via acquisition.

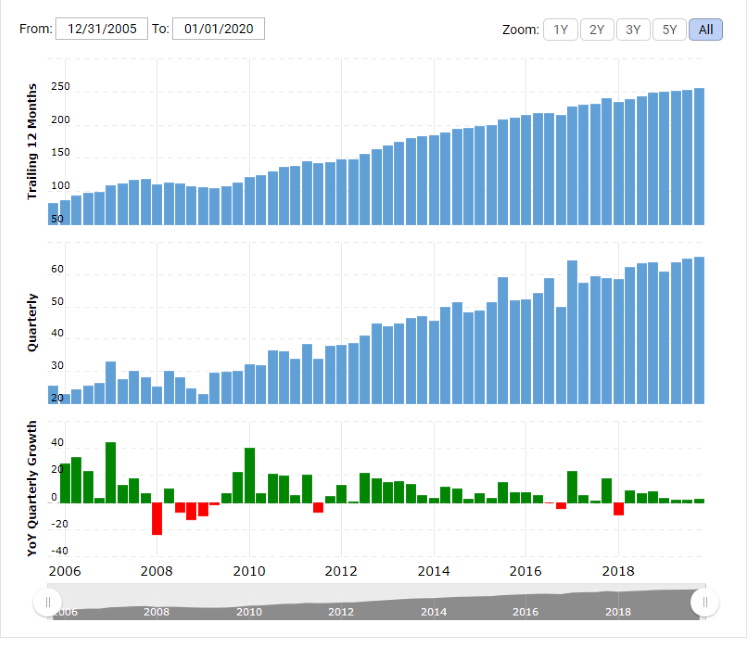

Source: Stockanalysis.com

It is speculated that the quality of loans to some riskier venture-backed companies with deposits at SVB had deteriorated over the past year. Many of those firms have come under significant financial pressure as rates have risen and securing capital has become more difficult compared to the low interest rate environment from just a couple of years ago.

With a portfolio full of potentially non-performing loans and deposit accounts owned by shaky start-up companies that received those loans, it was only a matter of time that the high inflation / rising interest rate environment would start wreaking havoc on the business.

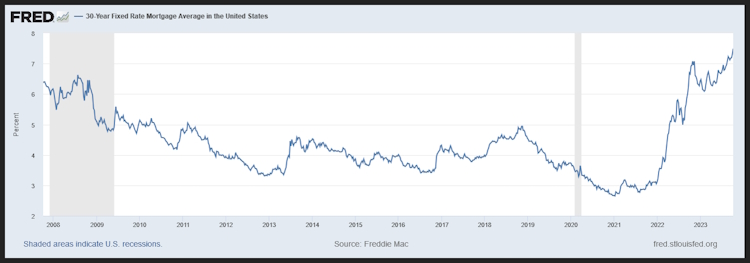

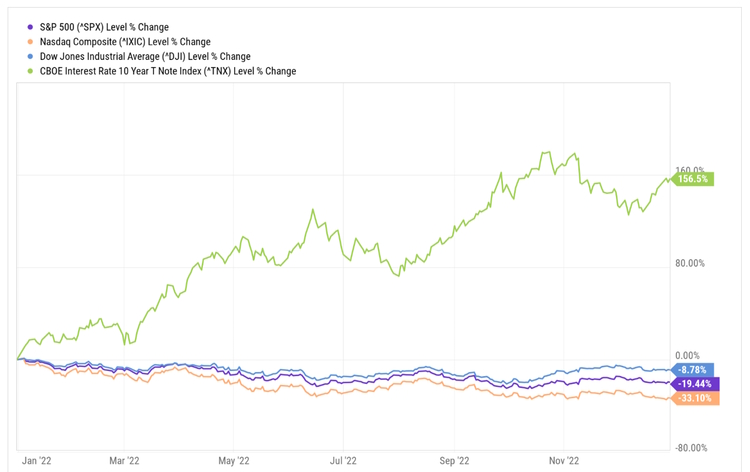

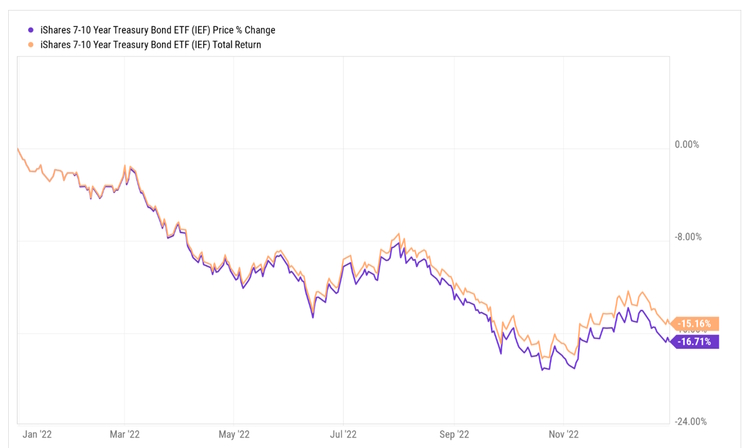

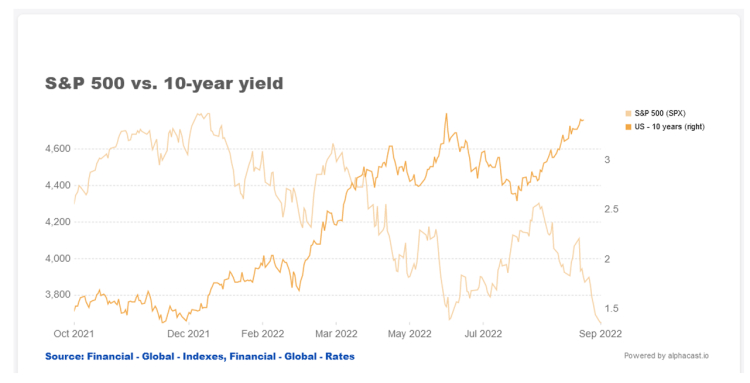

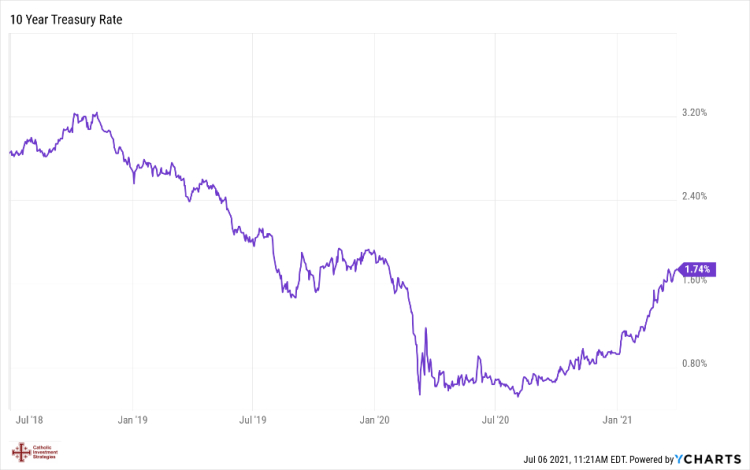

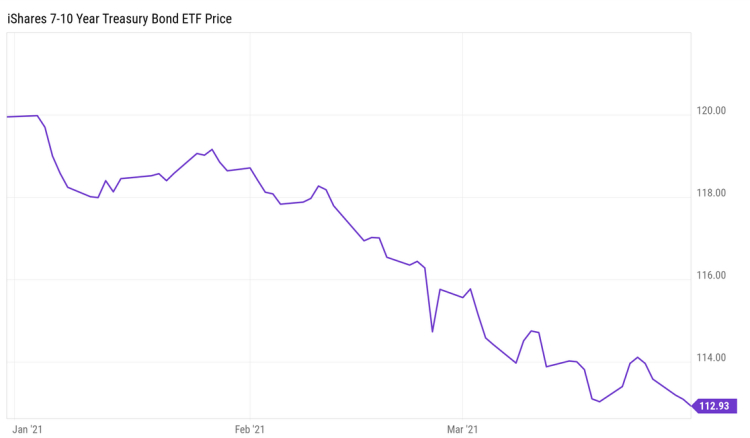

To make matters worse, SVB was ill-prepared for their depositors to need their money. In the interest of maximizing profits, SVB bought longer-term, higher-yielding bonds when it was cash rich. While these bonds are considered “conservative” from a default risk perspective, their longer terms made them more susceptible to declines in value as interest rates rose. And the bank had loaded up on them, to the point that they accounted for 57% of the bank’s investment portfolio.

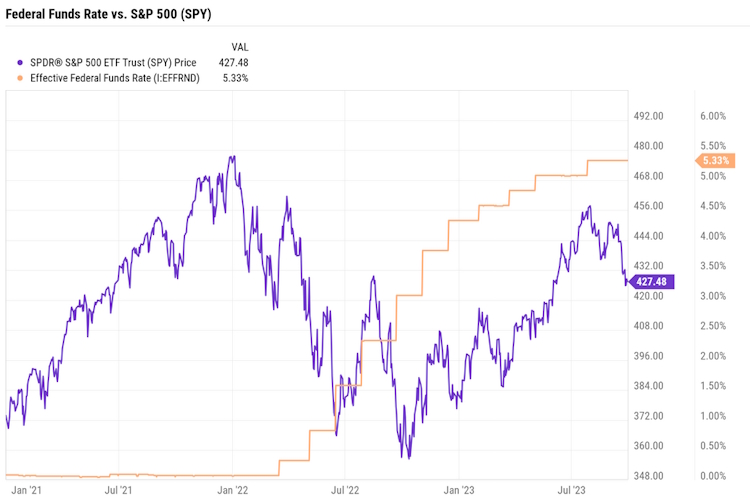

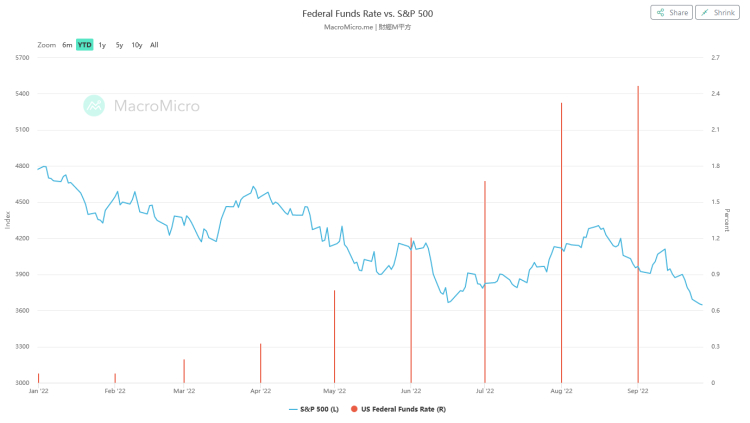

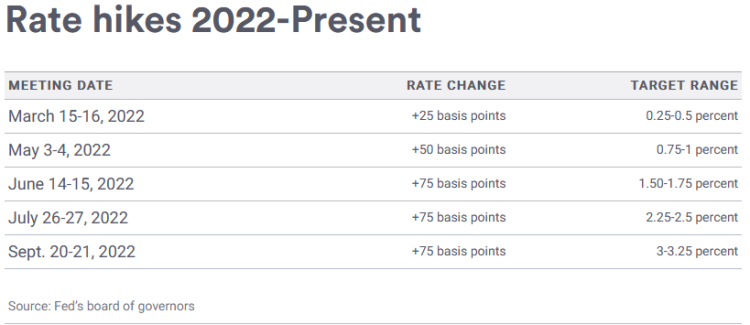

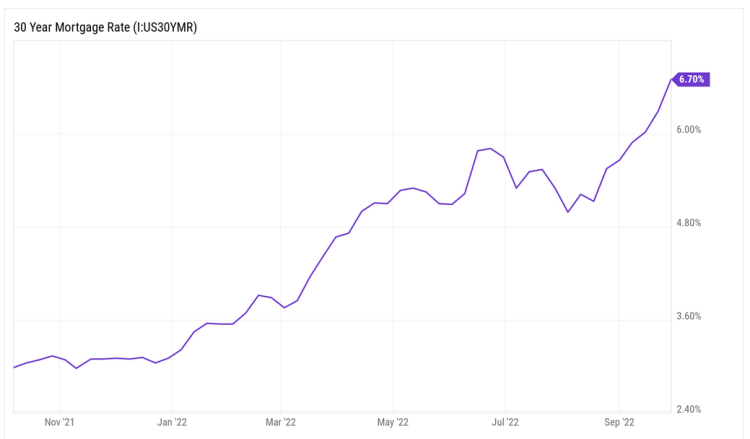

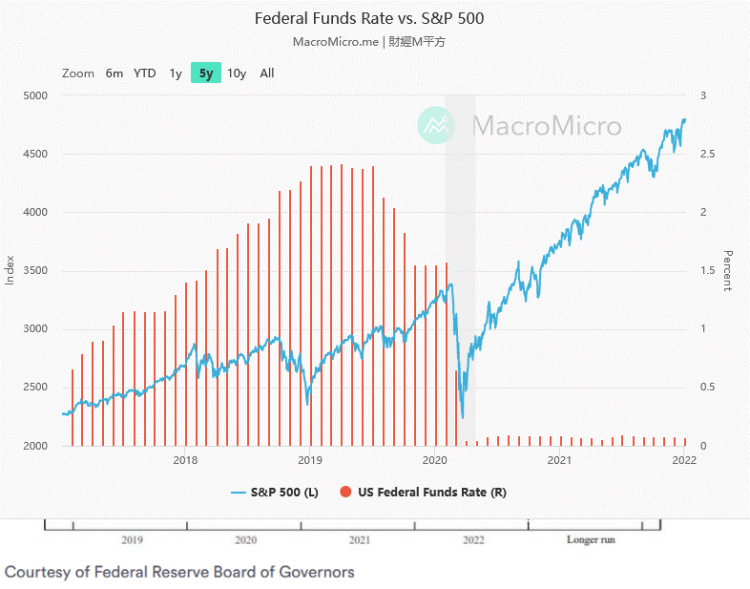

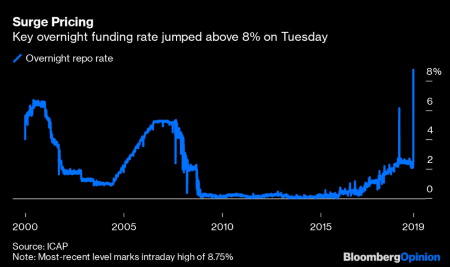

In a classic example of the phrase “slowly, then suddenly”, the value of SVB’s long-term investment portfolio declined over the past year as the Fed Funds rate jumped from 0.25% in March 2022 to 4.75% by February 2023 at the same time depositors needed to withdraw money.

In February, Moody’s told bank management that it was planning to reduce the bank’s credit rating. To pay depositors and head off a ratings downgrade, SVB sold $21 billion of bonds at a $1.8 billion loss. Then SVB’s management announced that SVB would raise $2.25 billion in new capital to cover the loss. Instead of being reassured, depositors panicked and withdrew $42 billion the day following the announcement. SVB was insolvent, unable to pay its depositors. The FDIC seized SVB.

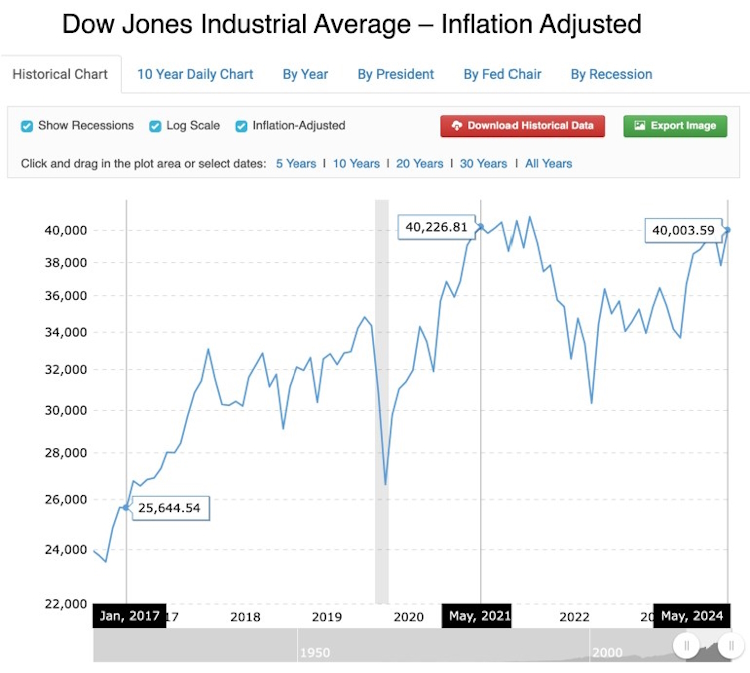

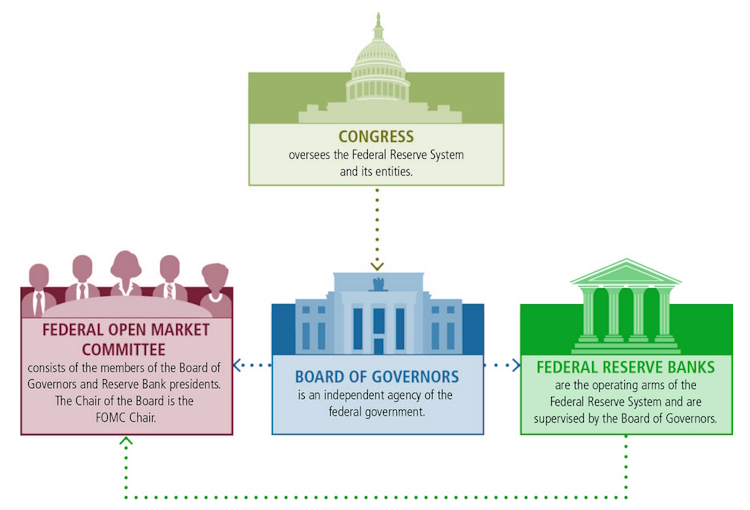

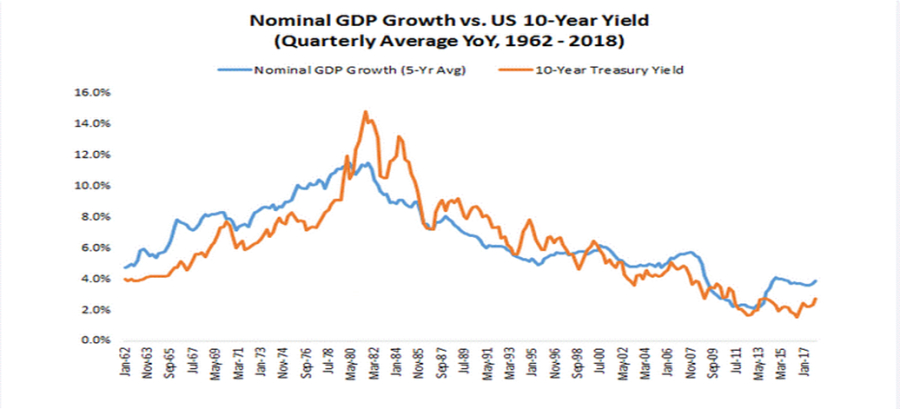

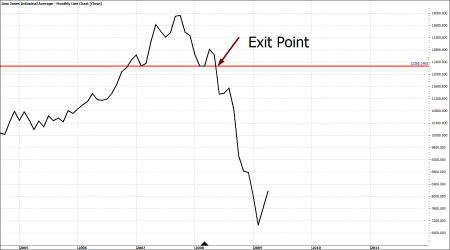

The Board of Governors of the Federal Reserve certainly deserves blame for the Fed’s failure to regulate Silicon Valley Bank (SVB). Responsibility should begin with Fed Chair Jay Powell and his Vice Chair for Supervision, Michael Barr. However, if you are a long-time client, you know that we have railed that interest rates should have started to rise in 2013 when the major indices had recovered to their previous levels and the economy was growing again.

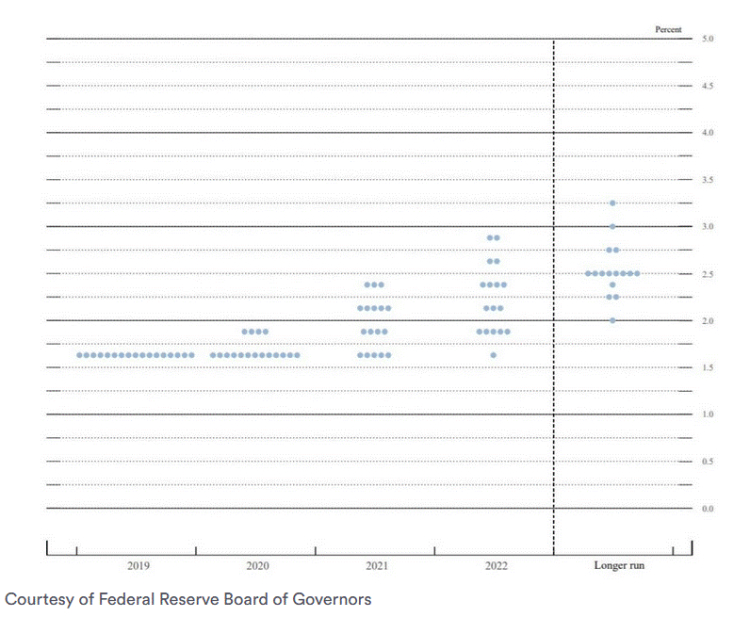

Federal Funds Rate

There was no sound economic justification for continuing the low-rate policy, yet Ben Bernanke refused to budge. His successor, Janet Yellen, who took over in 2014 after serving as the President of the Federal Reserve Bank of San Francisco, kept rates below 1% until 2017.

Still, the responsibility lies even closer to home than in Washington, D.C. The Federal Reserve is a system of twelve regional Federal Reserve Banks around the country that report to a Board in Washington. The regional bank responsible for the regulation of SVB is the aforementioned Federal Reserve Bank of San Francisco. According to an article published in the New York Times, Silicon Valley Bank’s risky practices were on the Federal Reserve’s radar for more than a year, to the point of receiving six citations in 2021.

Those citations, known as “matters requiring attention” and “matters requiring immediate attention,” flagged that the firm was doing a bad job of ensuring that it would have enough easily available cash on hand in the event of trouble. But neither the bank nor the Fed took any decisive actions before the bank was seized. So, this looks more like a failure of supervision by the regulator rather than the failure of the regulation regime itself.

We also note that during this time, right up to the moment of the bank’s seizure, one of the members of the Board of Directors of the San Francisco Fed was Greg Becker, who happened to be the CEO of Silicon Valley Bank. While we have no proof of cronyism within the walls of the San Francisco Fed, it could appear to an outsider that, at least in San Francisco, you get to regulate yourself.

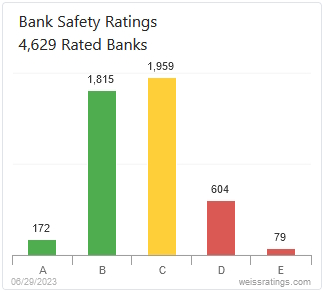

The FDIC estimates the cost to the Deposit Insurance Fund to cover the collapse of Silicon Valley Bank to be $20 billion — including $18 billion to cover uninsured deposits, according to FDIC Chairman Martin Gruenberg. And the failure of Signature Bank is likely to require about $2.5 billion, including $1.6 billion to cover its uninsured deposits.

Like most insurance policies, whenever a claim is made, insurance rates will go up. This will impact all the FDIC-insured banks in the U.S. (approximately 4,700 institutions), most likely through special assessments on member banks. So, while, technically, no taxes collected by the U.S. Treasury will be used in this bail out, all taxpayers who bank at these institutions can expect to see higher fees in the future as banks take steps to protect their profitability.

For us, there are several investment lessons here to be learned:

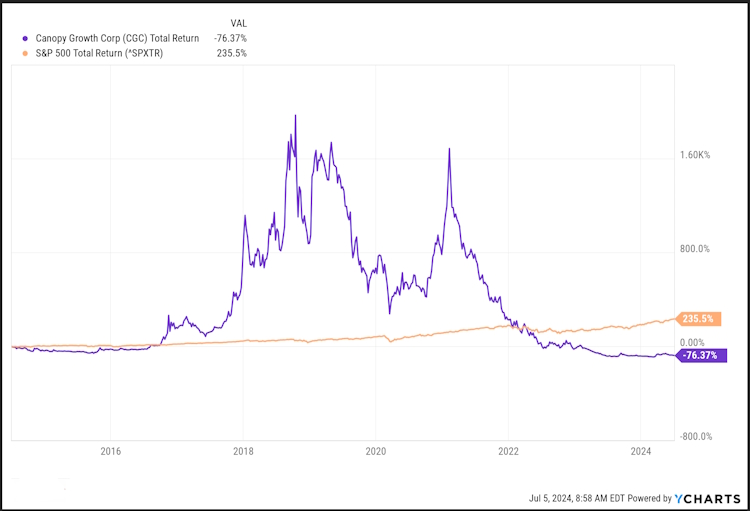

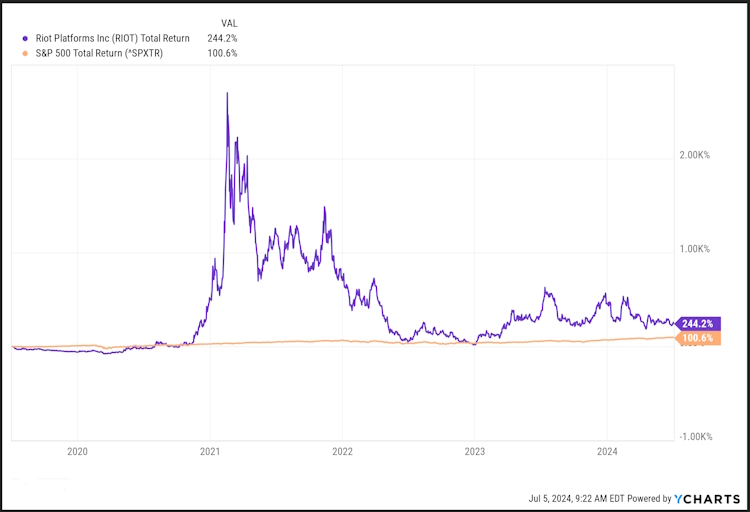

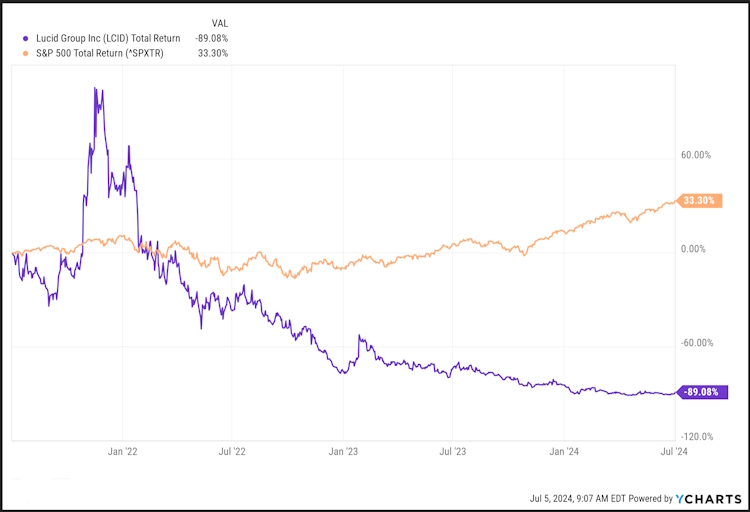

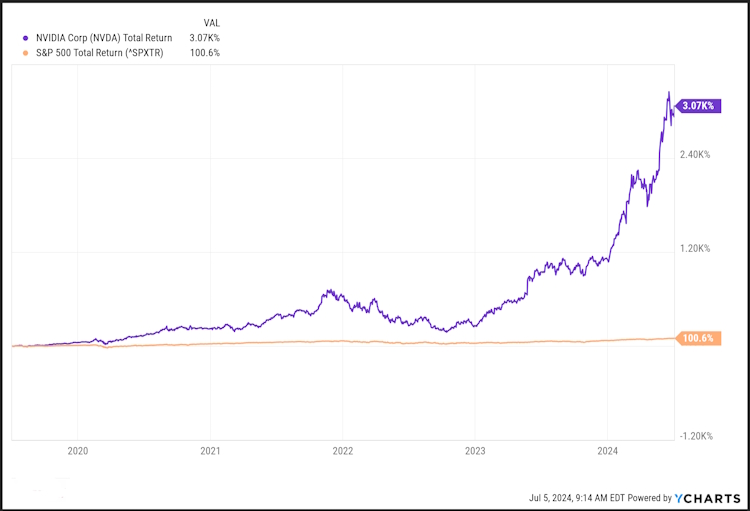

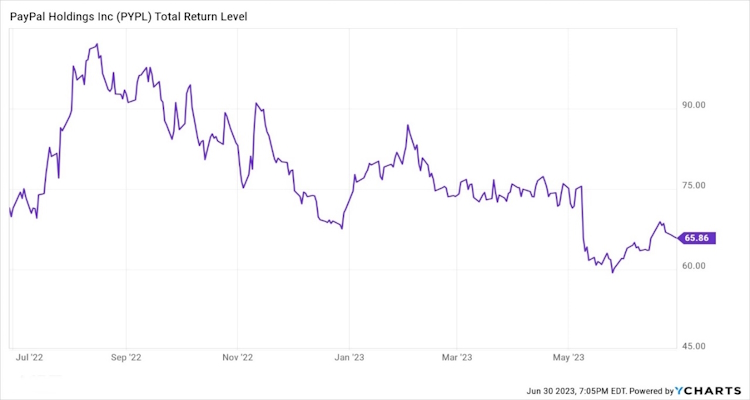

Buy Quality

There is nothing more alluring than reading an email about a $5 stock that could become the next Google, Amazon, Tesla…take your pick. We get those same emails and research the recommendations. Often, we see statements like this:

“Currently unprofitable and not forecast to become profitable over the next 3 years”

While that doesn’t mean that the price of these stocks can’t rise under the right circumstances, it does mean that there is no fundamental basis for their valuations and eventually, those valuations matter.

August 2022 email – The Next Tesla?

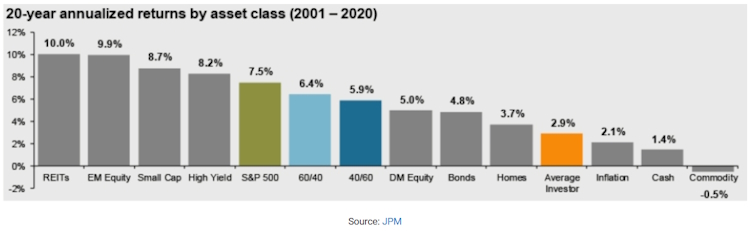

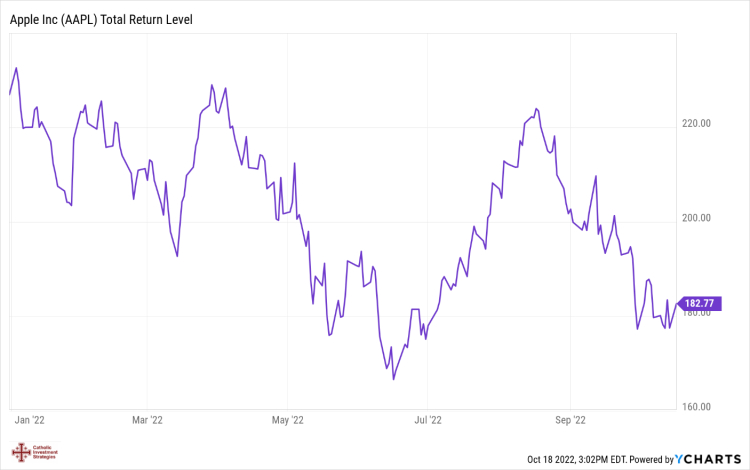

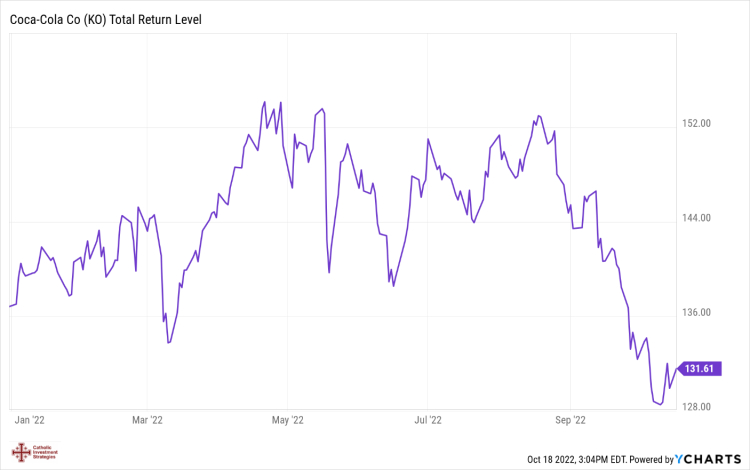

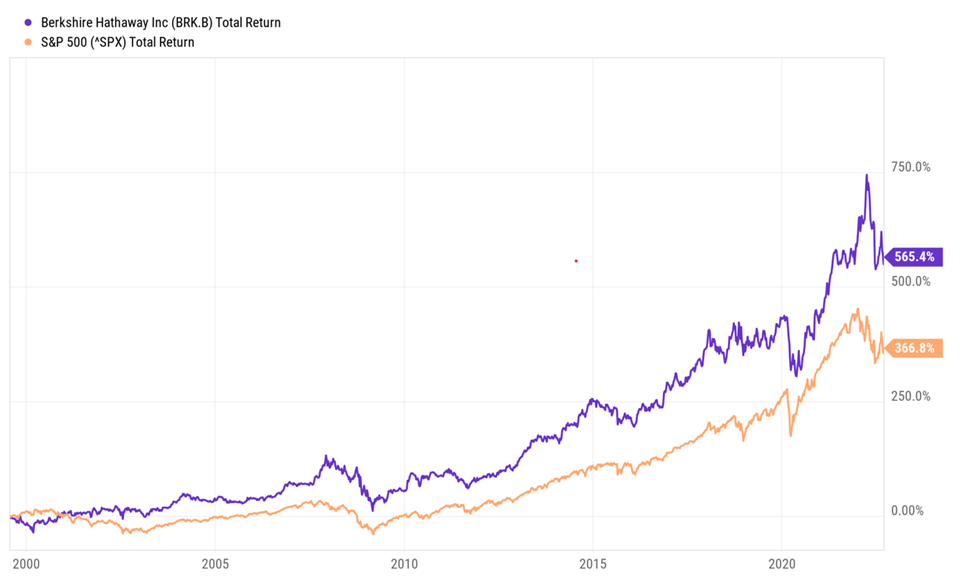

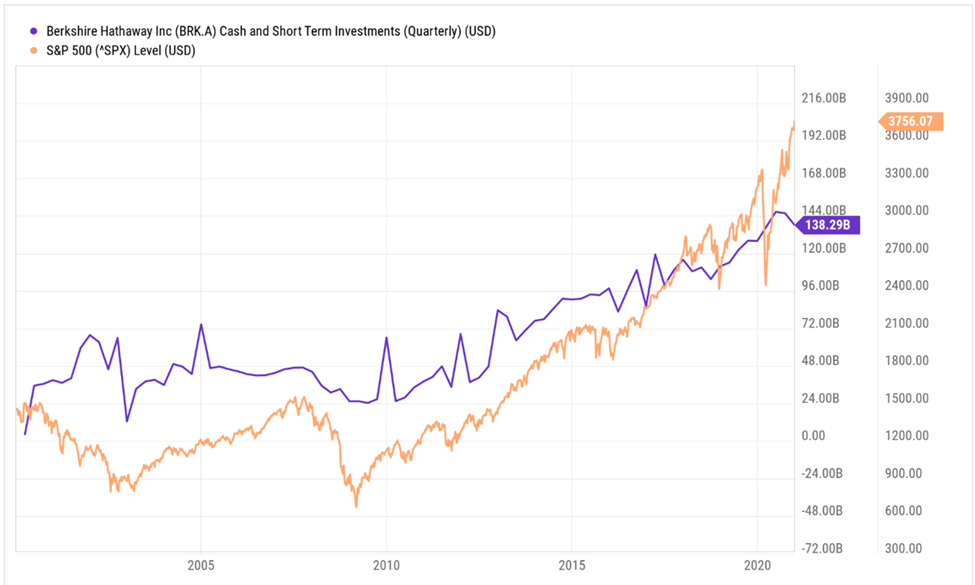

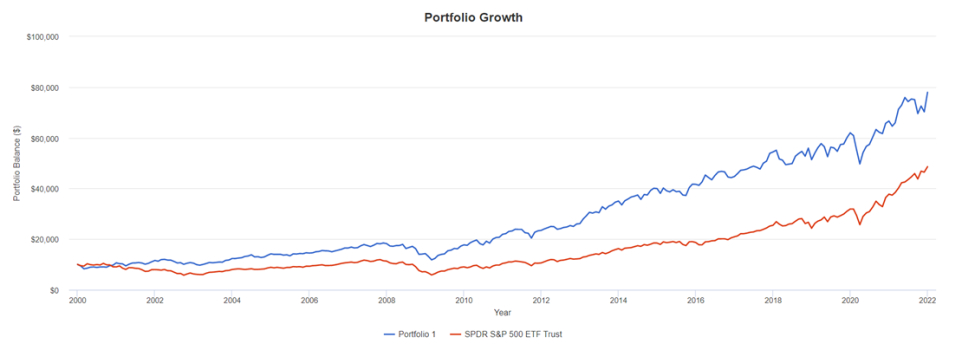

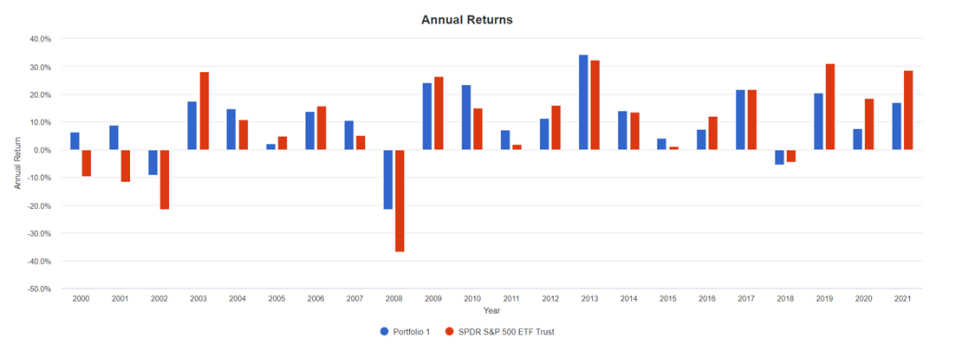

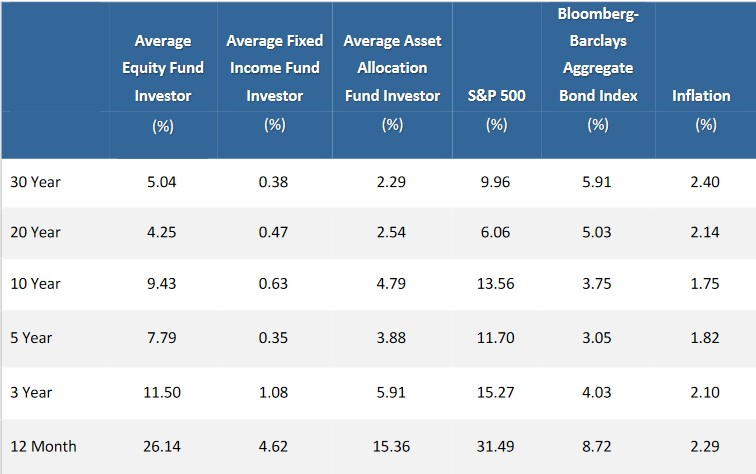

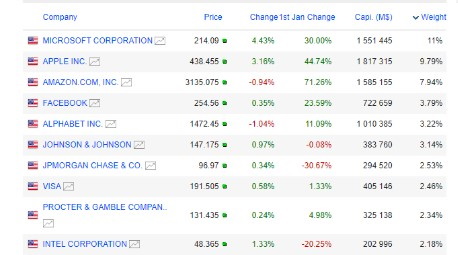

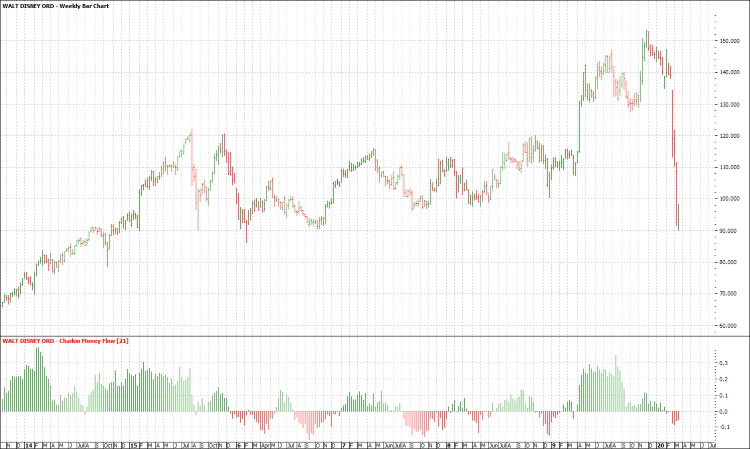

Alternatively, there is nothing more boring than a portfolio of well-managed companies that manage to grow and return value to shareholders despite economic downturns, wars, weather events, and even Presidential elections. While the average investor was panic-selling their high-flying stocks and moving to cash in 2022, the truly successful investors, as well as insiders of these better-run companies, were holding on and even getting out of cash and loading up on more bargains, all while probably sleeping better at night.

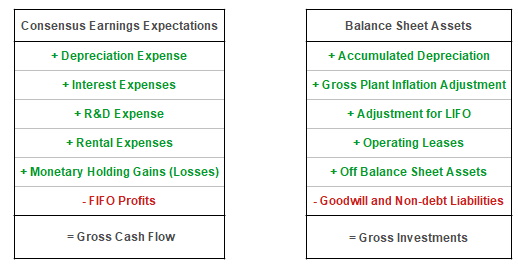

Cash (Flow) is King

In basic terms, SVB’s problem was cash flow management. They did not have sufficient cash to meet their obligations. To pay all the depositors, SVB sold $21 billion of bonds at a $1.8 billion loss. Those of you who are long time clients know how much we decry the depletion model of retirement based on withdrawal models like the “4% Rule.” We decry it because we know what can happen during bear markets.

At the worst possible time, the market will be down when you need to raise cash. It is reported that by the end of 2022, SVB had lost $16 billion in their bond portfolio. Interestingly, they, like all banks, had restrictions on how they could invest.

As small, private investors, we don’t have those restrictions. We are free to build a portfolio of quality businesses with a history of steady, or growing, profits and dividend distributions. If their fundamentals change, then we sell and go shopping for something better. Some of these companies have been around longer than we have and are adept at navigating rough waters. Also, we use bonds strategically; driving you crazy with questions about future expenditures to make sure that the cash is there when you need to write the check. If we believe that we can safely make a little bit of interest, we will. If not, then we advise you to stay in cash or cash equivalents.

Greed Kills

While their loan portfolio was less than AAA quality, SVB was not directly done in by those loans. Many analysts point out that if Silicon Valley Bank had exposed itself to less interest-rate risk by limiting its investment assets to much shorter durations, it would not have lost as much money when interest rates increased. SVB purchased most of these bonds when interest rates were near historic lows because they yielded a bit more than short-term securities. The pursuit of an extra fraction of a percentage point without considering what could go wrong is what ultimately led to their downfall.

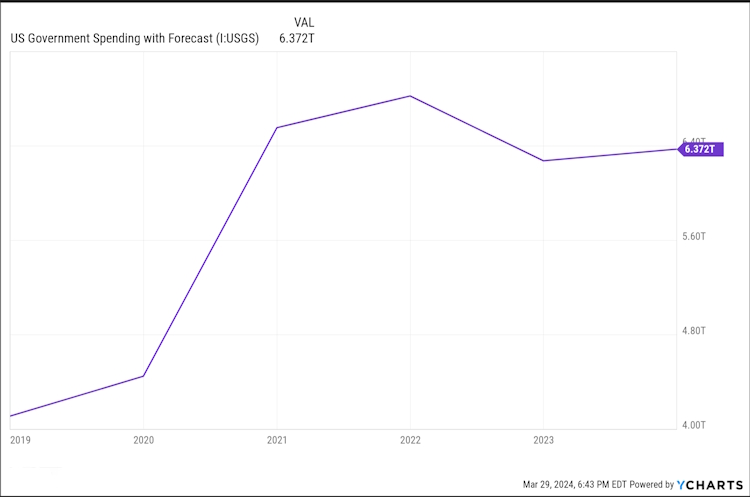

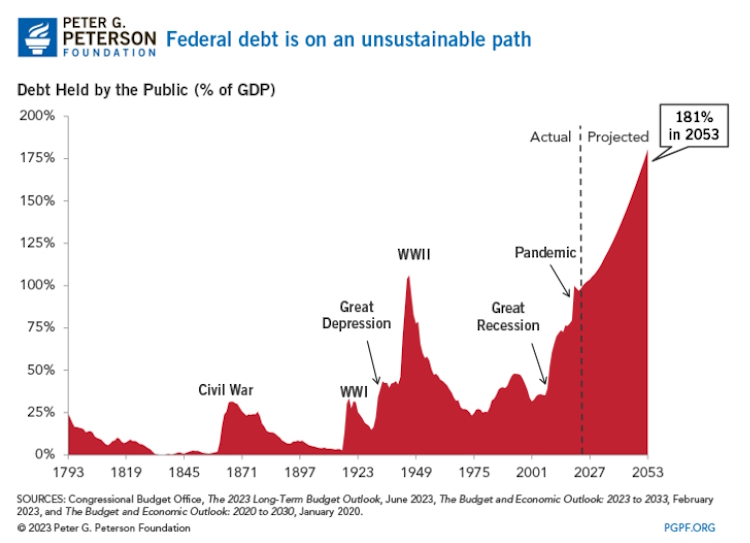

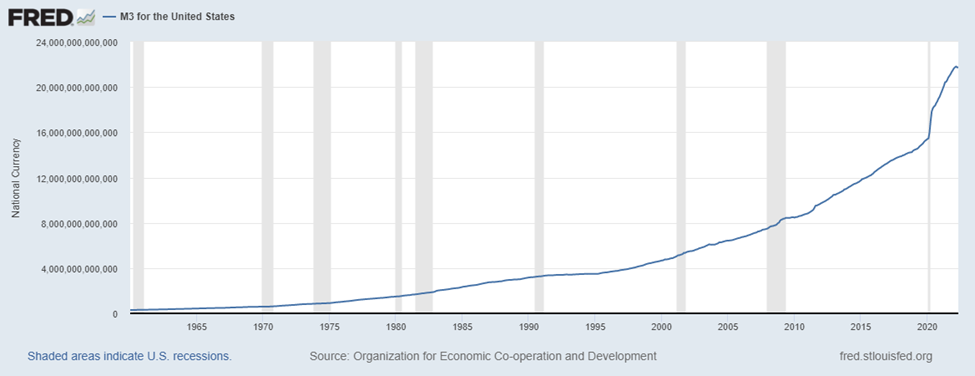

Government Distorts

The fuse for the 2008 financial crisis was an obscure Bill signed by President Jimmy Carter called the Community Reinvestment Act of 1977 . While certainly well-intentioned, by the early 2000’s it had become a bludgeon used on the banking sector to make loans to the objectively uncreditworthy. To get these unmanageable portfolios of sub-prime loans off their books, banks bundled them into “collateralized default obligations,” or CDOs. It’s complicated, but by a process of breaking these pools into “tranches,” the banks were able to “create” AAA rated securities from what were originally BBB rated bonds. As implausible as it seems now, institutions hungry for yield bought these securities as they yielded more than other bonds with the same rating. Later, when the entire market fell apart, they were appropriately named “Toxic Assets.”

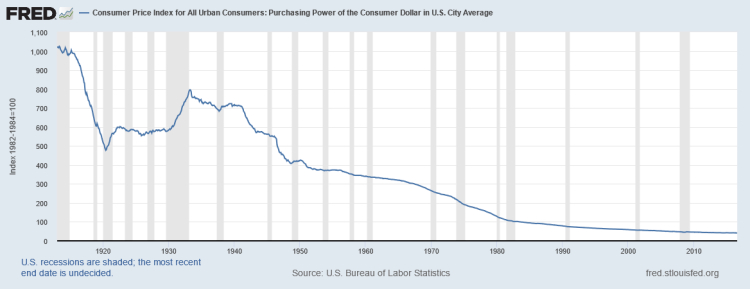

Similarly, the Fed’s maintenance of artificially low interest rates punished savers and caused many people to take unreasonable risk in order to get some level of return on their money by investing in vehicles including low quality bonds, land developments, managed futures, or structured products. When inflation raises its ugly head, whether due to profligate spending, government shutdowns, or war, it’s critical that your investments are allocated in such a way that these events do not upend your plan.

There are no Experts

The current President of the San Francisco Fed Bank is Mary Daly. She has worked at that institution since 1996, but has never actually worked at a bank. Her predecessor, John C. Williams, didn’t work in the banking sector either, nor did his predecessor, our current Treasury Secretary Janet Yellen. Most of these people came out of academia, with lofty college degrees and went straight into government or quasi-government roles. In fact, when we look at the various Fed Chairs, going back to Author Burns, we find very few people who actually ever worked in the private sector. To his credit, Jerome Powell spent some time working as a lawyer and investment banker in New York, so at least the word “bank” appears in his resume.

Joking aside, these people make policy decisions that impact us, our businesses, and institutions, like banks, that we rely on to conduct our daily activities. A strong, sound banking system is crucial to our economic well-being. By all accounts, SVB was an avoidable crisis that somehow the “experts” running the bank and regulating the bank all missed. The crisis was “contained’ only by extraordinary government intervention. It may well lead to more distortions down the road. We all want to believe that the people running our institutions are the best and the brightest that America has to offer, always acting in good faith for the benefit of the citizens. But alas, as Louisa Alcott wrote in her story, Jo’s Boys,

“The youngest, aged twelve, could not conceal her disappointment, and turned away, feeling as so many of us have felt when we discover that our idols are very ordinary men and women.”

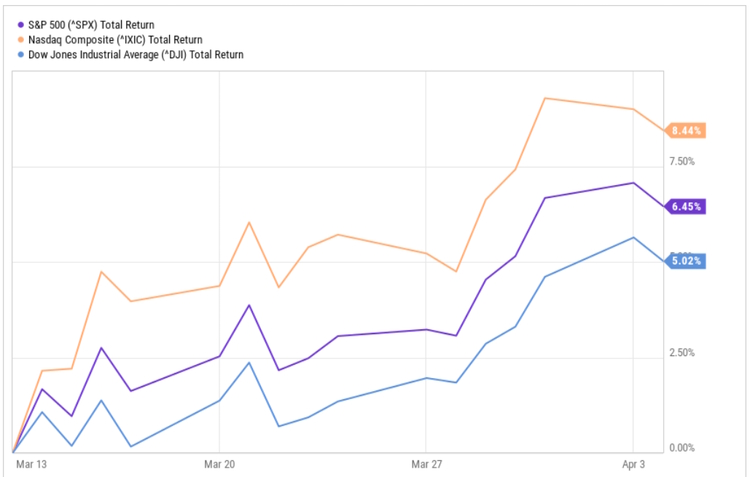

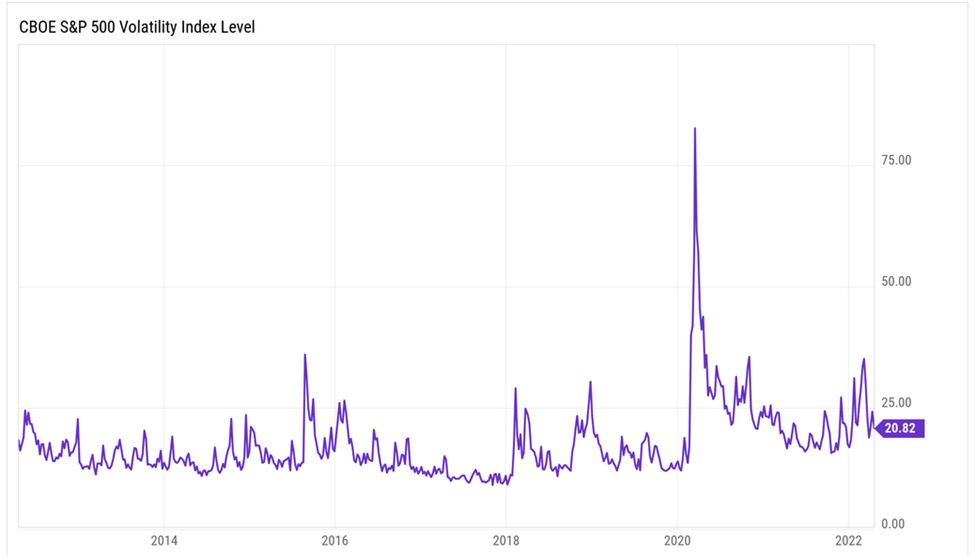

We note that the extraordinary measures taken by the government (guaranteeing all deposits at both Silicon Valley Bank and Signature Bank beyond the stated FDIC insured limit of $250,000) helped reduce the potential of runs on more traditionally managed banks. While both SVB and Signature (which was heavily exposed to crypto currency) were unique in their client base and business practices, almost any bank would be severely strained by the coincident withdrawal of a significant portion of their uninsured deposits. For now, that fear has waned as reflected by the rally in all three major indices since March 13th.

In the meantime, there are still many other things to worry about.

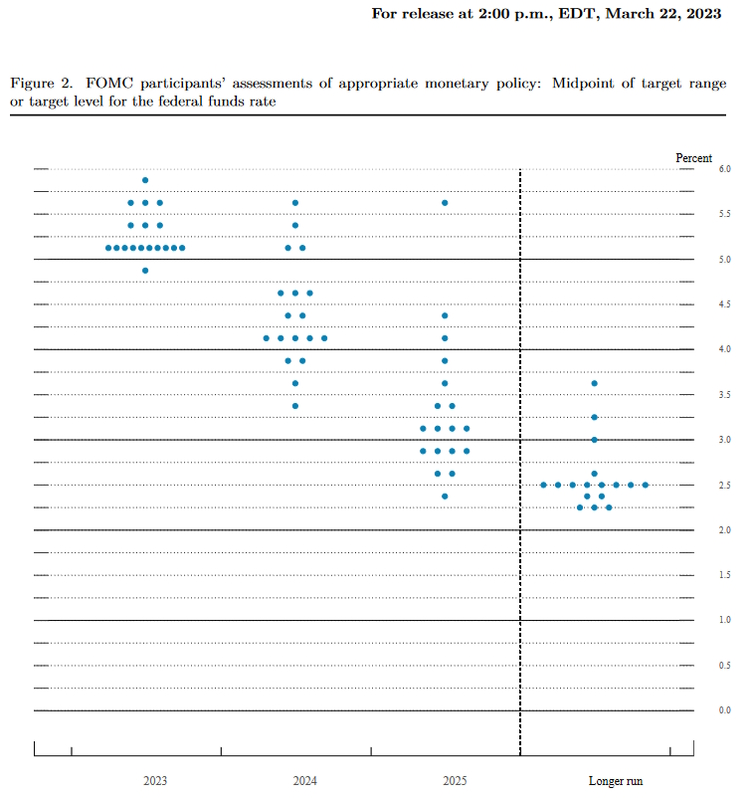

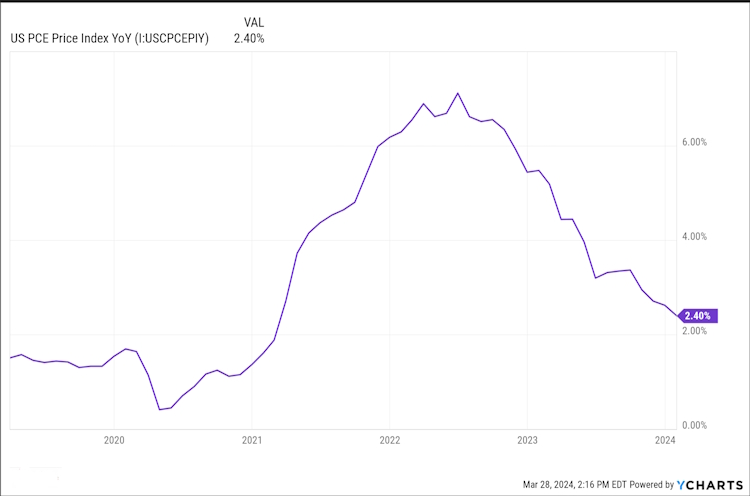

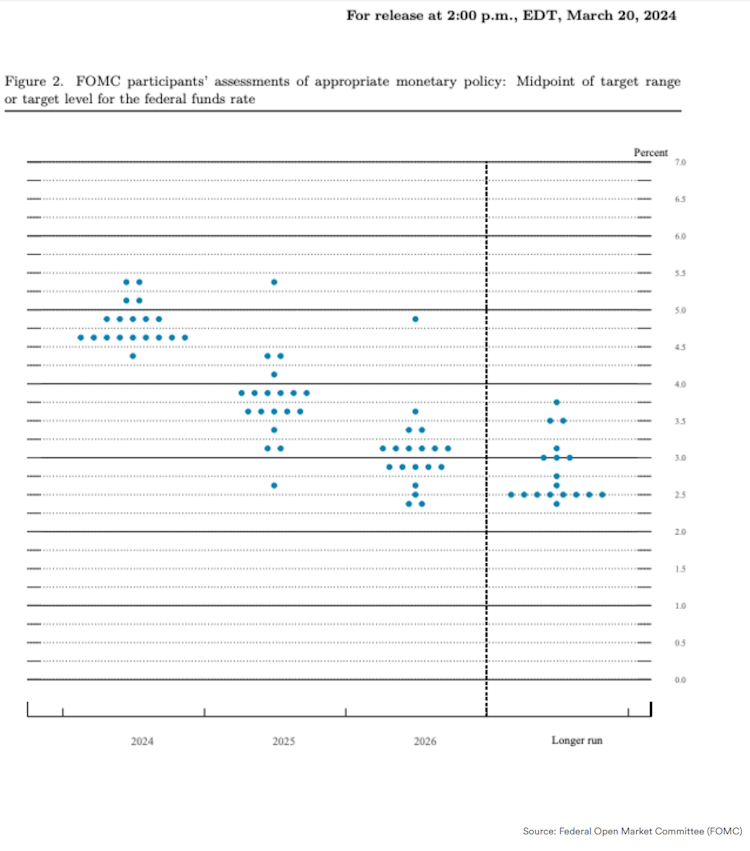

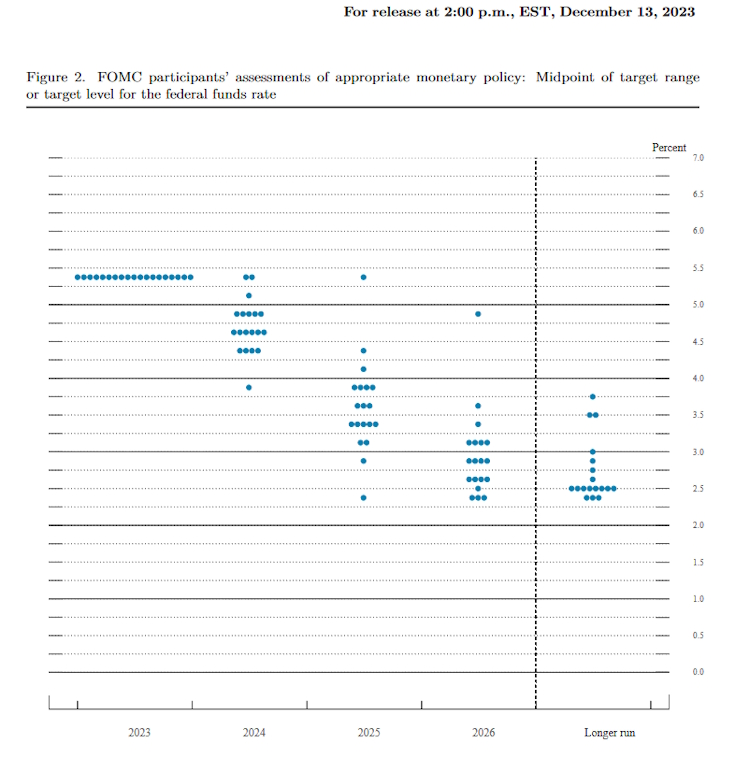

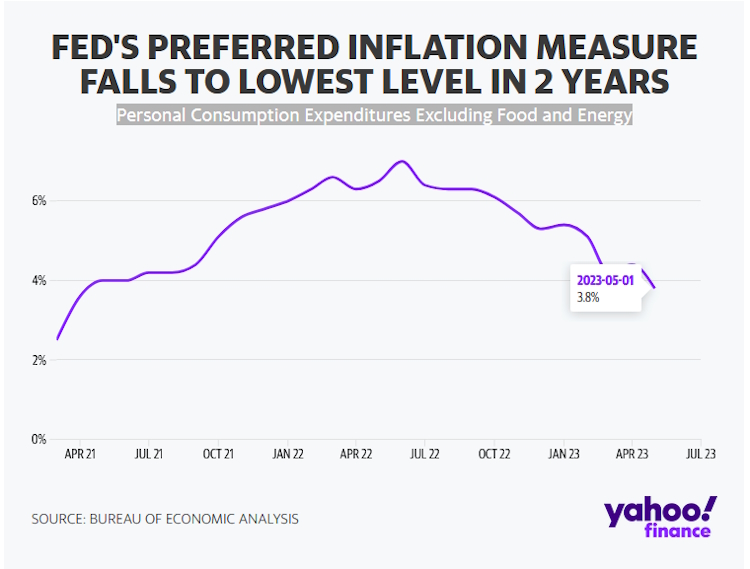

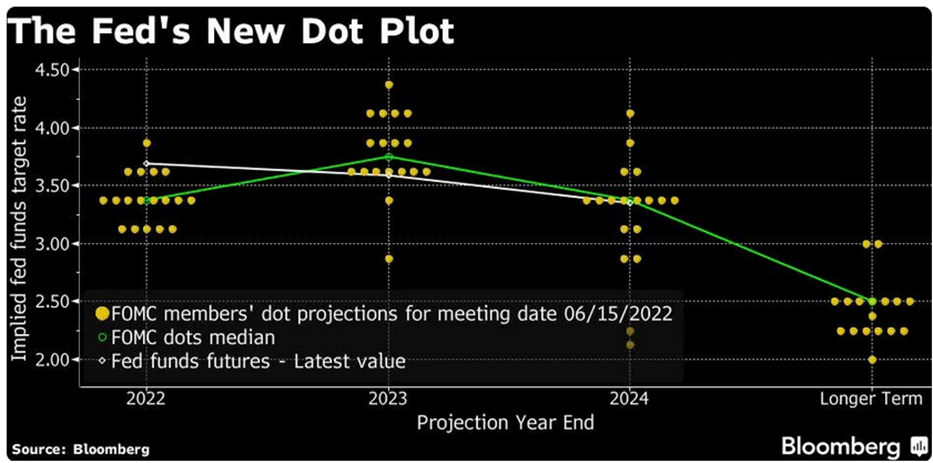

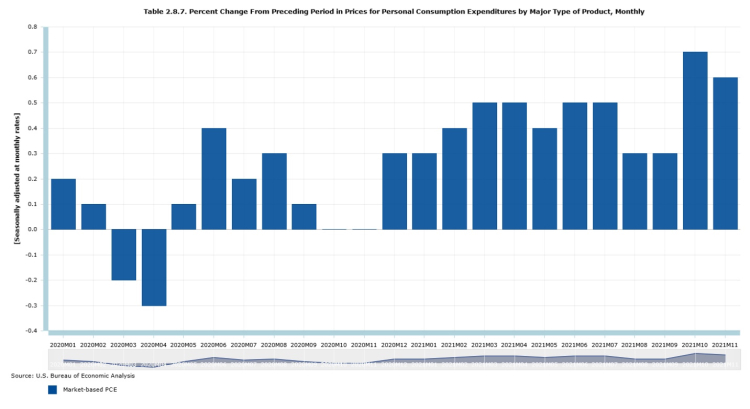

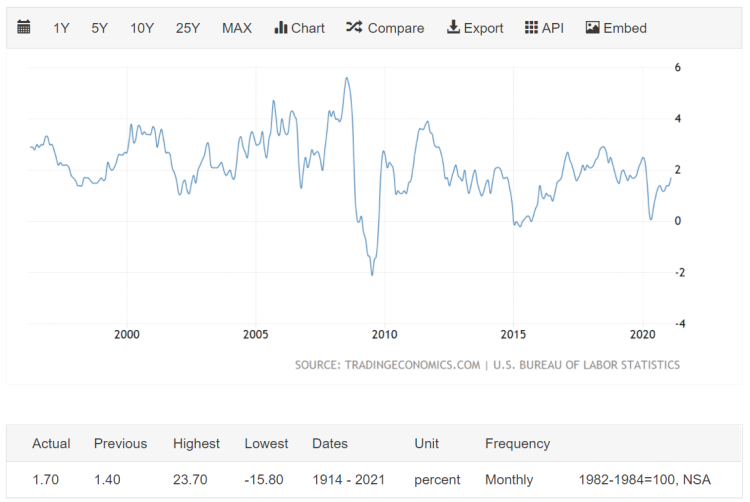

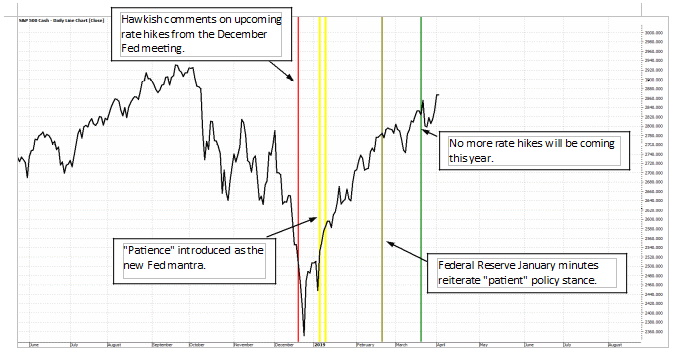

The Federal Reserve and Inflation

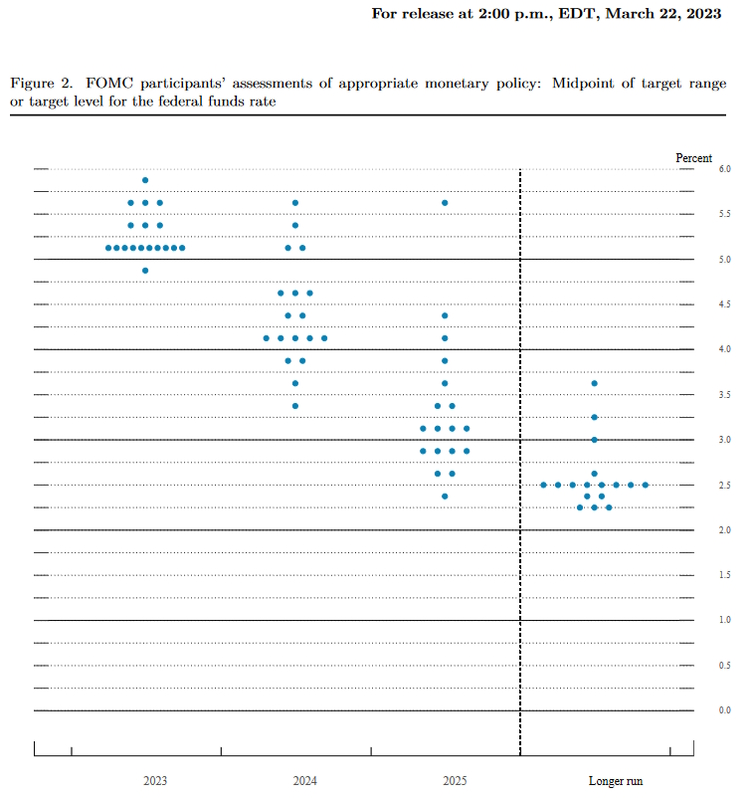

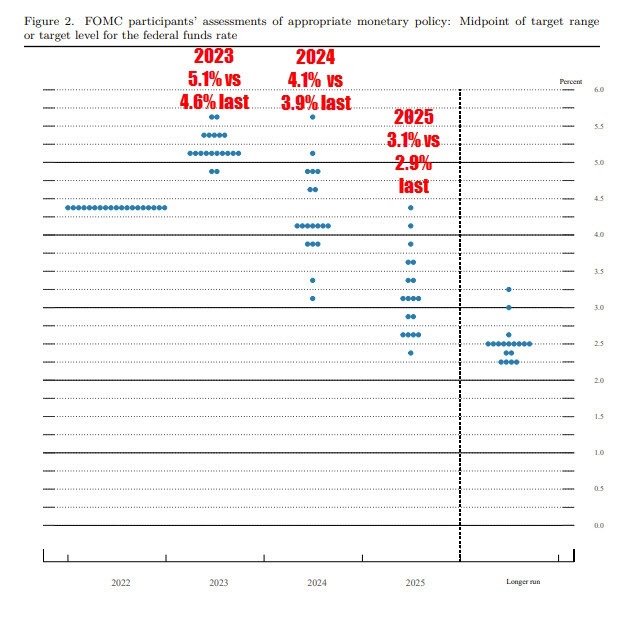

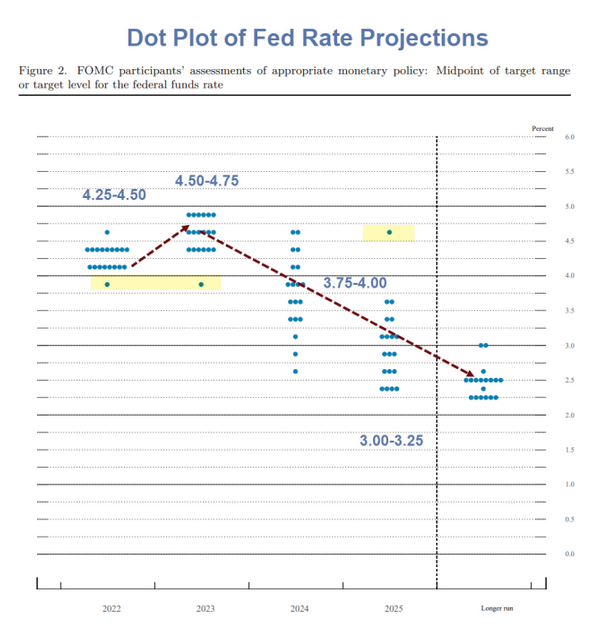

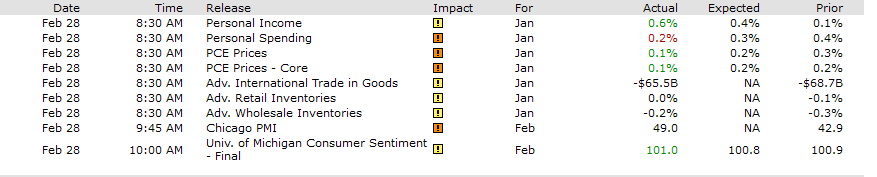

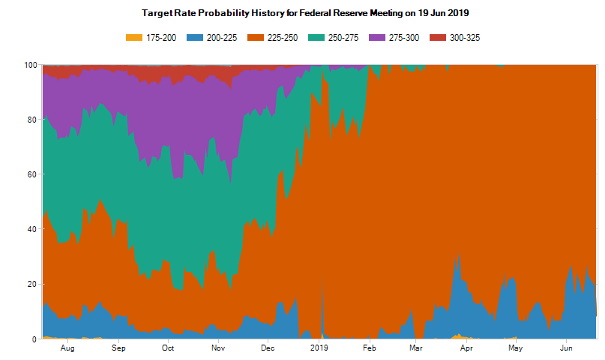

While many pundits predicted that the Fed would put a pause on rate increases, they continued in March by increasing the Fed Funds Rate by another 25 basis points (bps), following their 25 bps increase in January. The targeted range is now between 4.75% and 5.0%. The current Dot Plot is still projecting 5.1% for end of year 2023 without a pivot from rate hikes to rate cuts until 2024.

A Funny Thing Happened on the Way to the March Meeting

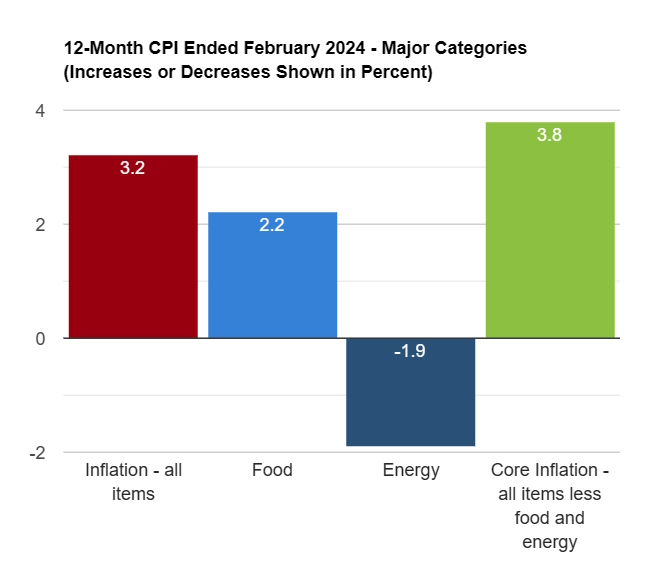

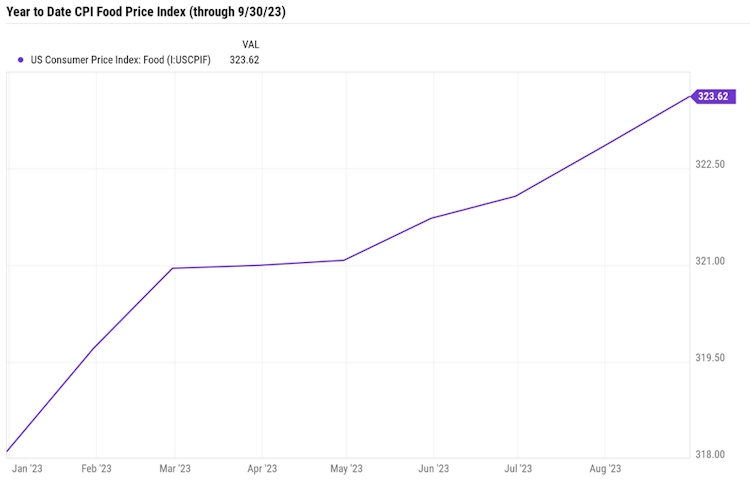

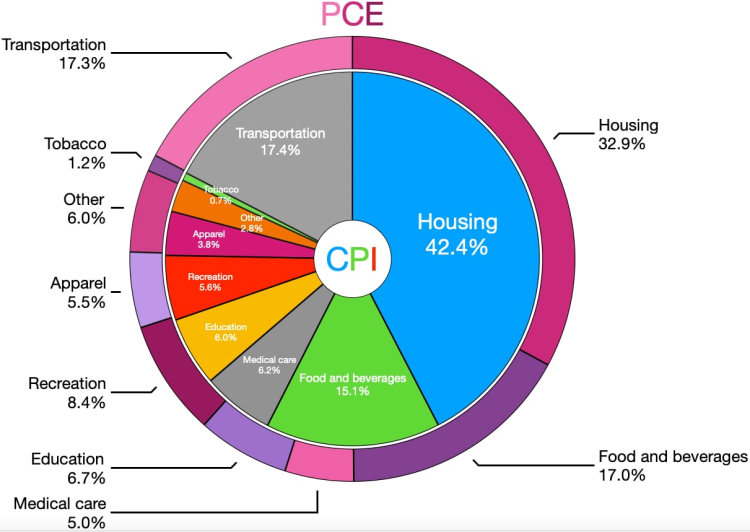

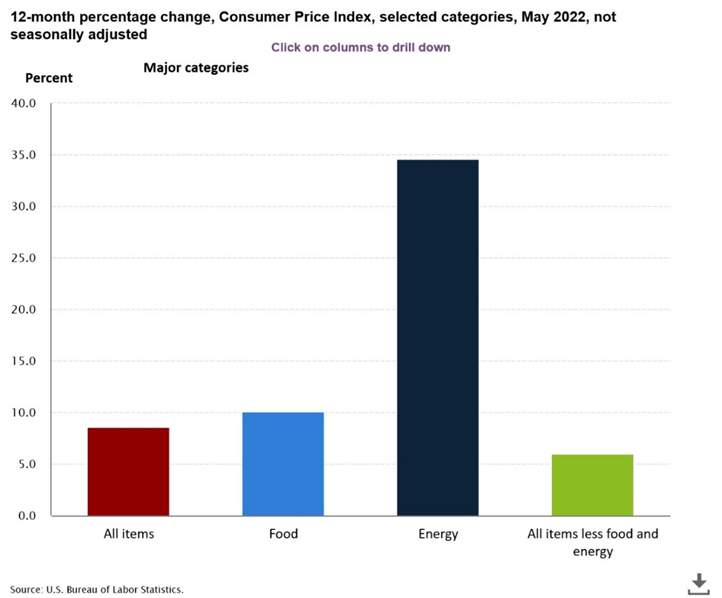

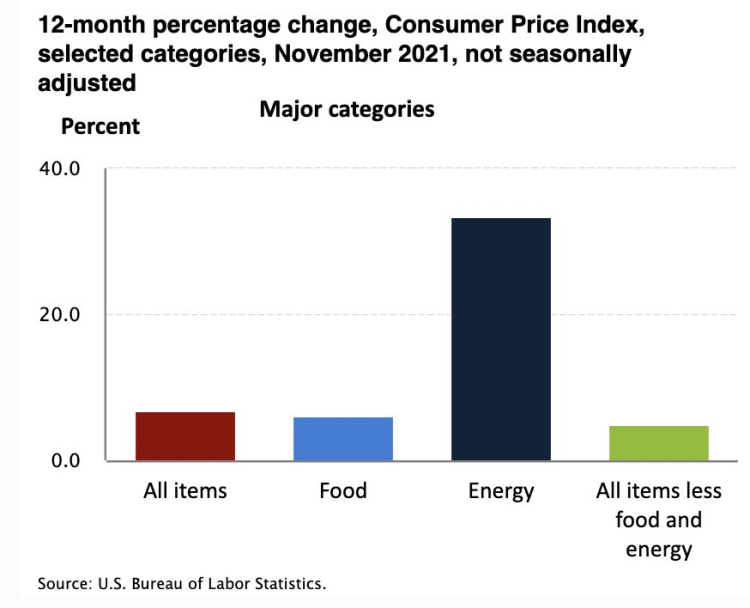

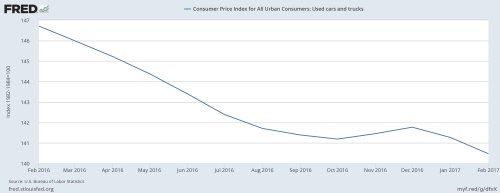

The U.S. Bureau of Labor Statistics recently changed its Consumer Price Index weightings for housing and gasoline in a way that will lower the Consumer Price Index (CPI). Here are the details:

In late 2022, the U.S. Bureau of Labor Statistics (“BLS”) announced that the weightings in the index will now be based on a single year’s spending patterns rather than the previous method of a two-year blend. That means that this year’s weightings will be based on spending habits in 2021. Under the previous method, the spending calculation would have been based on 2019 and 2020.

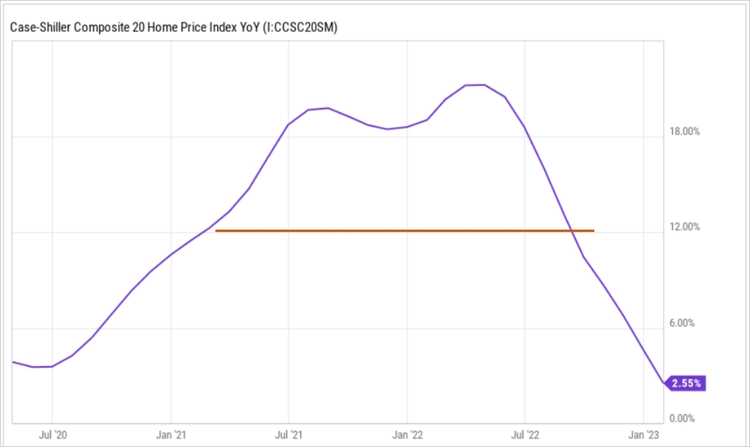

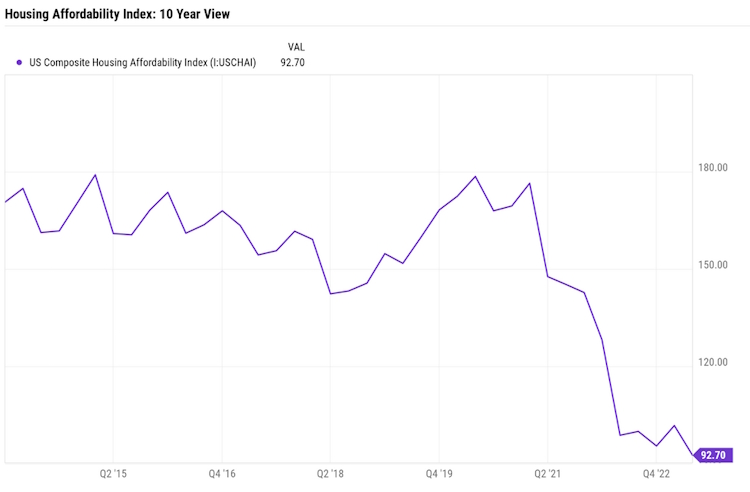

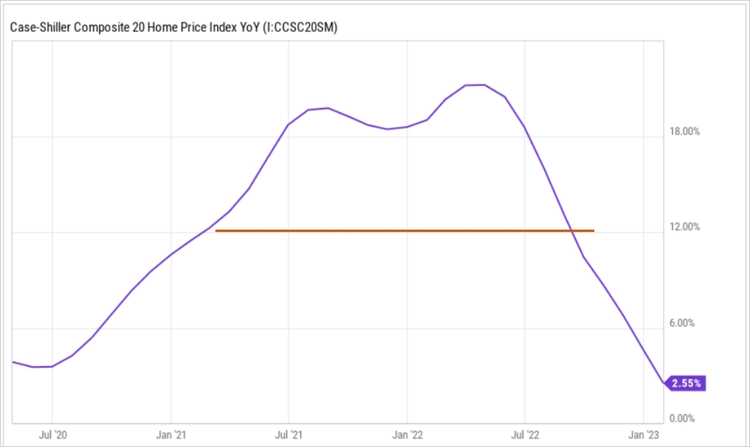

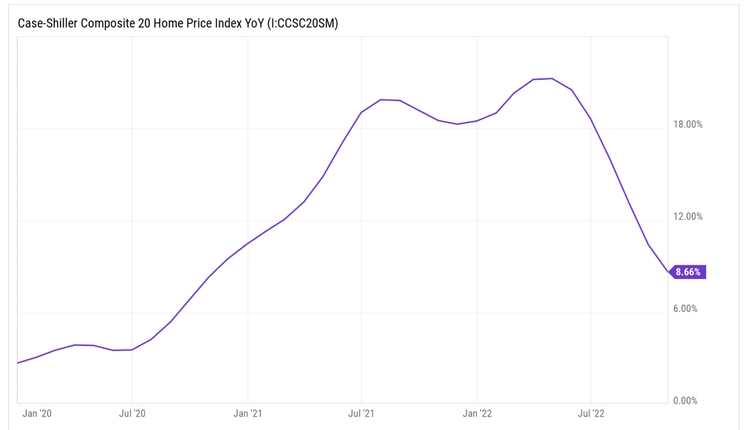

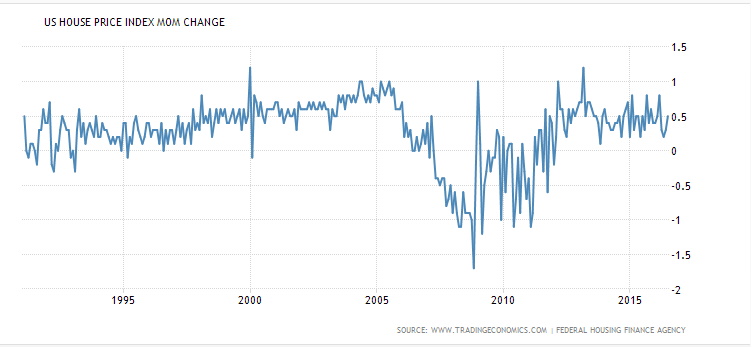

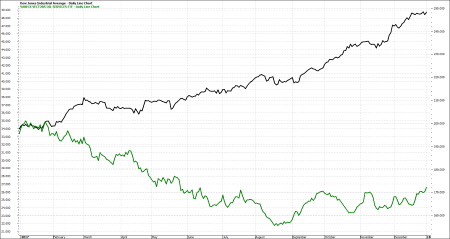

One of the biggest changes was the weighting for housing. As we covered in our Q3 2022 letter, Housing has accounted for nearly 43% of the index for the past decades. But now it will now make up 45%, thus giving it even more weight than before. While predicting a lower CPI level in light of an increased housing weight may seem counter-intuitive since housing prices “always” tend to rise, look at the Case-Shiller Home Price Index since the Fed started raising rates last March (Red Line):

If you want to look like you’re winning the battle against inflation, while making sure that you don’t raise rates so high that you do some major economic damage, you change the way that inflation is measured so that it fits your narrative.

As home prices fall, they’ll bring down housing inflation. And, if housing has a larger weighting in the CPI, the overall inflation reading should tend to come down as well.

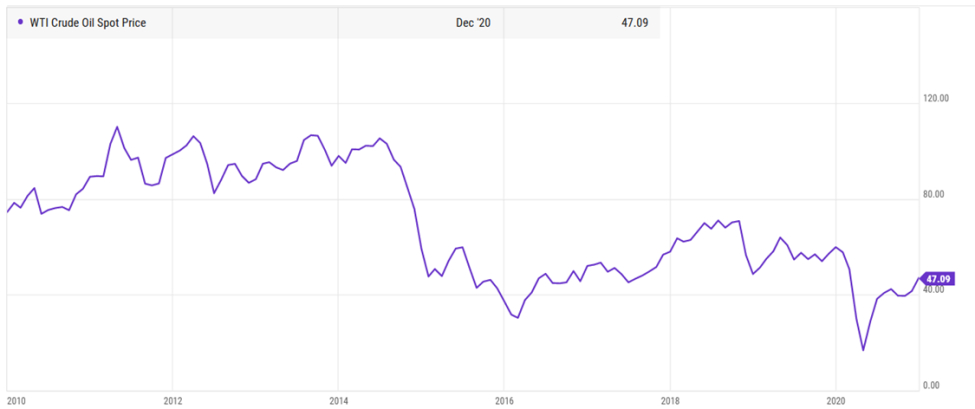

While they were at it, the BLS also changed the weighting for gasoline prices from 4% to 3.2%. And as we mentioned, the reading is now based on 2021’s spending habits.

While it is clear that government officials are changing the standard for inflation, this isn’t the first. The last change was in 2002 when George W. Bush was the sitting President. The economy was struggling after 9/11 and it was feared that things would go badly if the Fed started raising interest rates. So, the BLS changed its CPI methodology. It adjusted the index weightings from a 10-year spending average to a two-year average. It wanted to reflect consumers’ spending habits “more accurately.” The outcome was a slowdown in inflation growth and interest rates staying lower for longer.

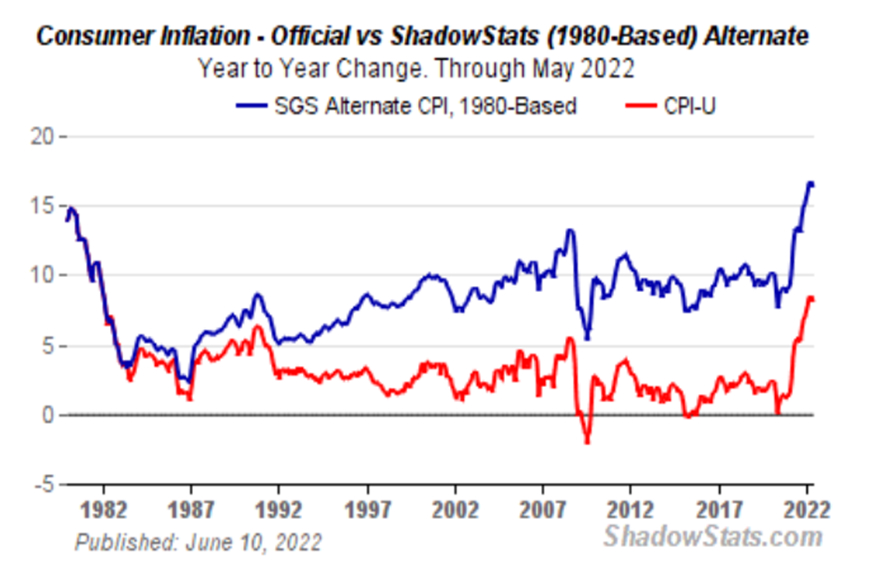

Of course, as we have said before, none of this is new, from unemployment to inflation to GDP, the government has made changes when it has been in their best interest to do so. For more on this subject, we suggest that you visit John Williams’ Shadow Government Statistics although you may want to make sure that you’re sitting down before you look at the data.

If you recall, from our Q3 2022 letter, we stated:

So, the Fed doesn’t need prices to “come down” to declare victory, they only need the increases to be around 2% from the year prior. Therefore, beginning in March of 2023, we should see year over year inflation increases begin to approach that level.

With these new adjustments in place, it’s only a matter of time before slowing inflation starts showing up. We might be off by a month or two, but we feel very confident that Powell and company will be taking victory laps by summer and the administration will be touting the Inflation Reduction Act passed last September as the catalyst behind this.

Then, it will be on to the next crisis.

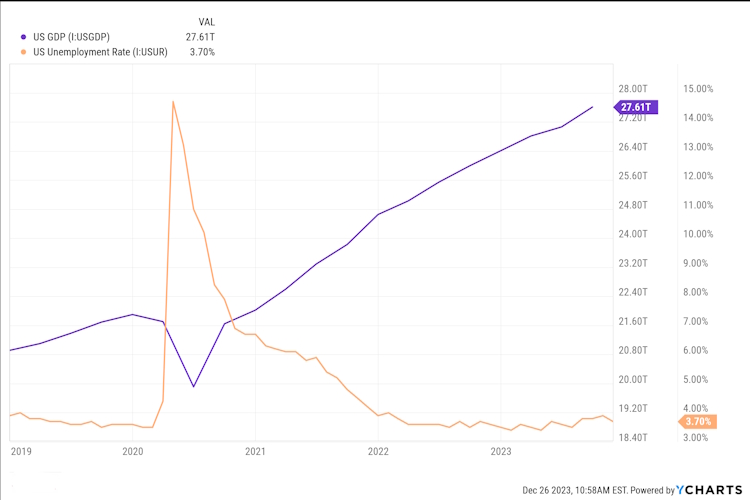

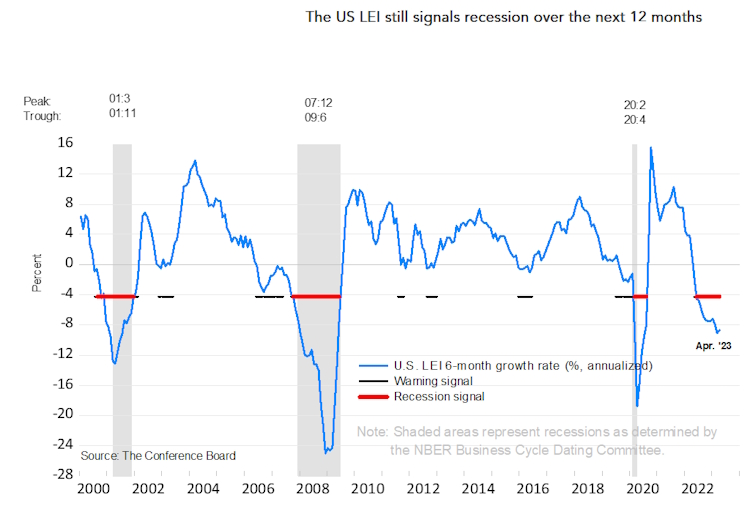

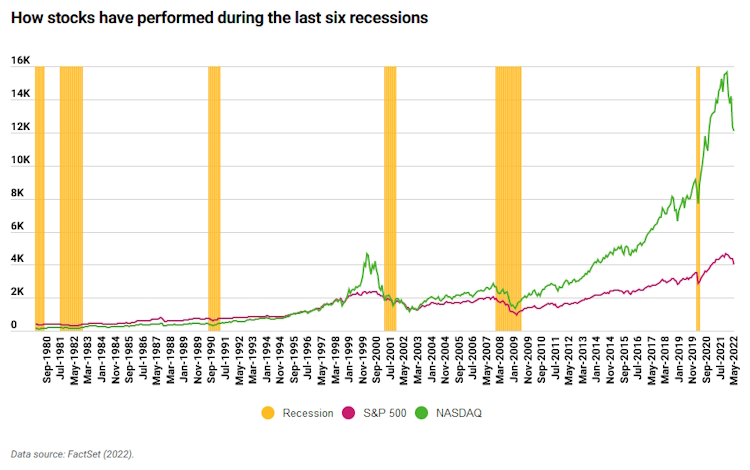

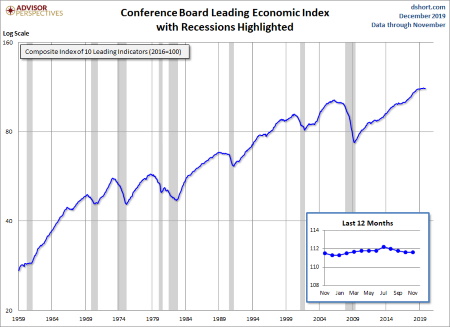

Recession Risk

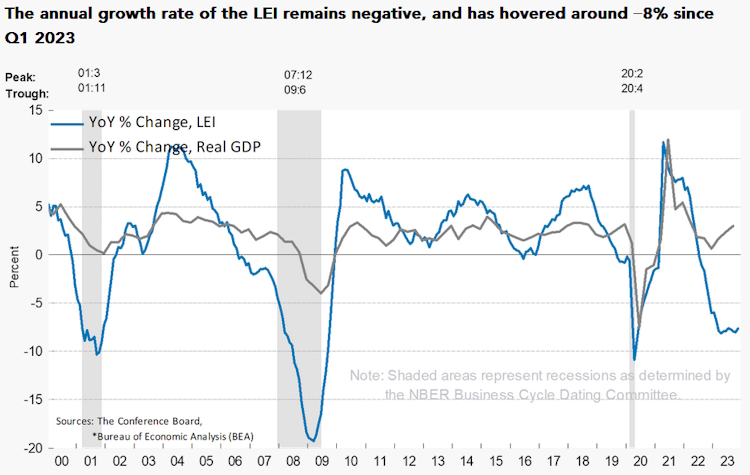

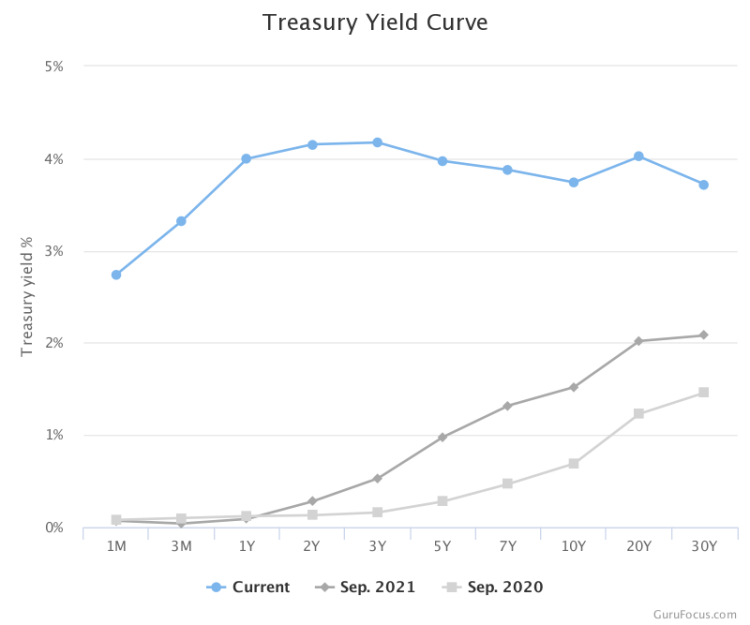

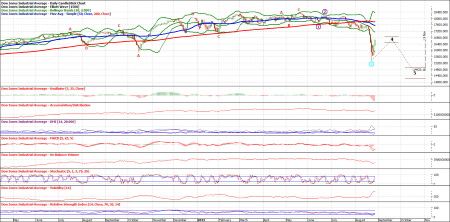

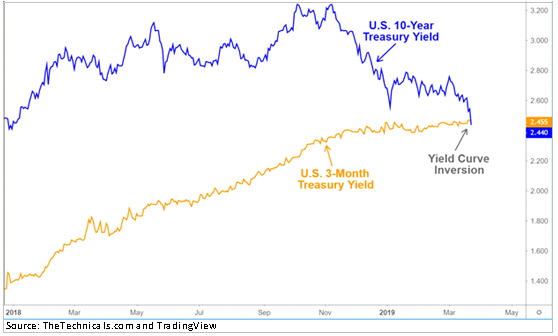

One of our investing mentors always told us to keep the investment channels on mute so that we wouldn’t be influenced by people who knew nothing about what they were talking about and to trust the markets instead. In that spirit we consult the bond market to gauge expectations for the economy.

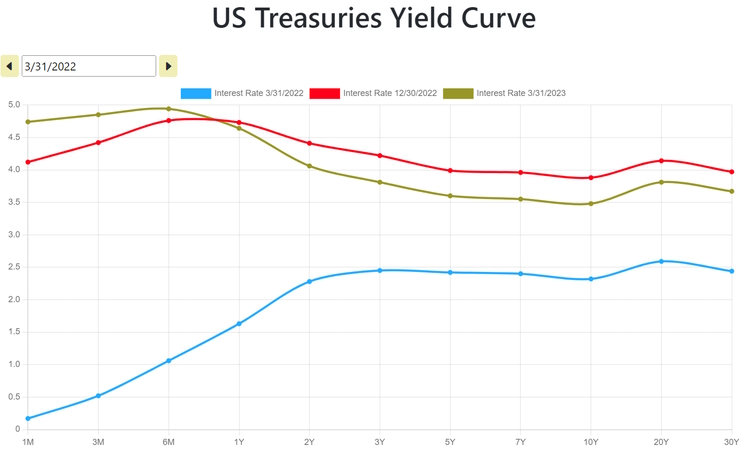

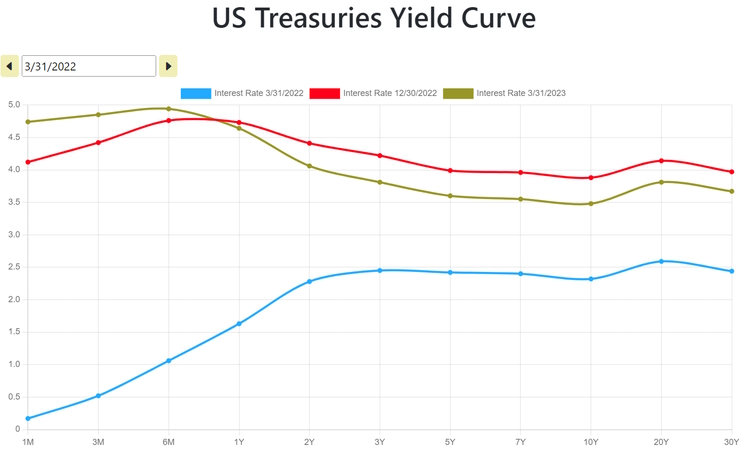

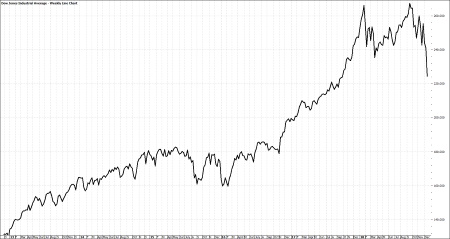

As you can see below, the yield curve remains inverted, and we note that the current inversion (green line) is “getting steeper” than it was back in December (red line). Since World War II every yield curve inversion has been followed by a recession in the following 6-18 months.

Officials at the New York Federal Reserve use the yield curve to calculate the probability that the U.S. economy will be in a recession in 12 months. The calculation is forward-looking, to the next 12 months from the time of the calculation, not anytime in the subsequent 12 months.

Noting the blue line, we see that that the curve first began to invert about a year ago. This means that if the historic pattern holds, there is a better than 50% probability that the U.S. could soon be entering into a recession and remain there at least through February 2024.

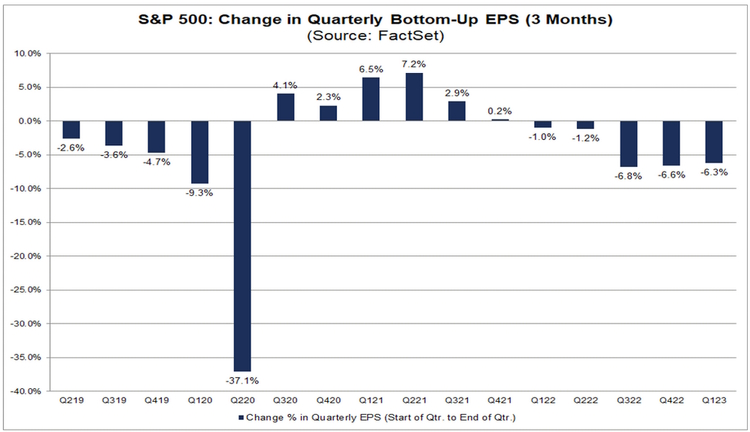

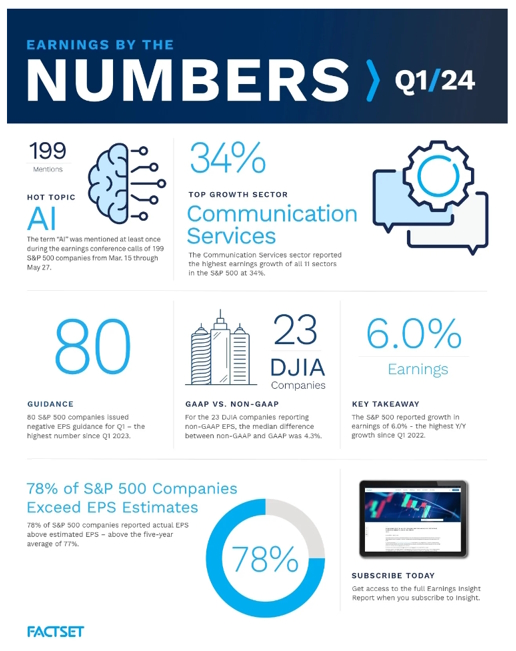

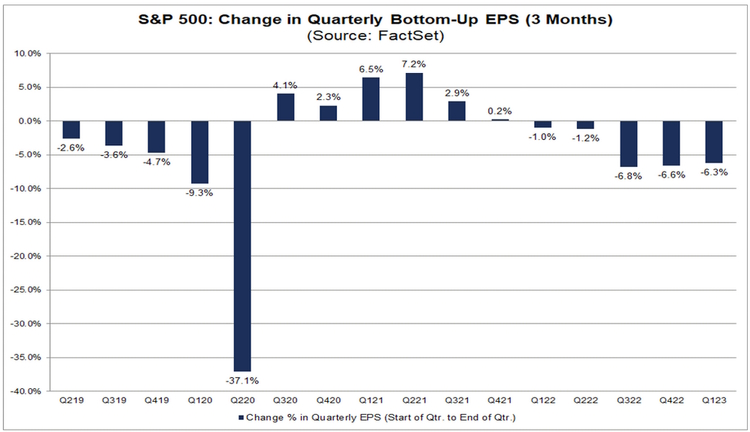

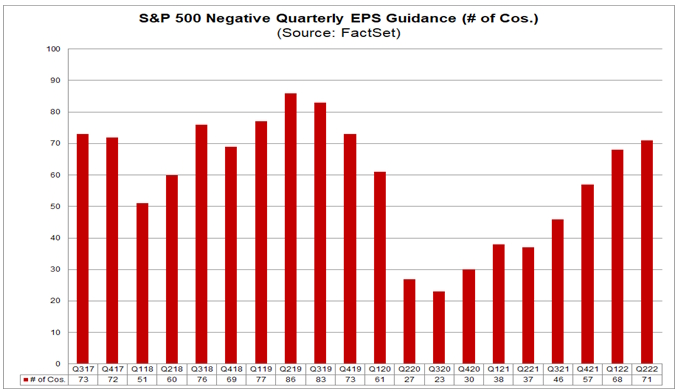

The prospect of an imminent recession aligns with recent estimates of corporate earnings. According to the financial data and analytics company FactSet, analysts lowered EPS estimates for the first quarter of 2023 by a larger margin than average. From their post, dated 3/31/2023:

The Q1 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q1 for all the companies in the index) decreased by 6.3% (to $50.75 from $54.13) from December 31 to March 30.

The post goes on to say that the decline in the bottom-up EPS estimate recorded during the first quarter was larger than the 5-year average, the 10-year average, the 15-year average, and the 20-year average.

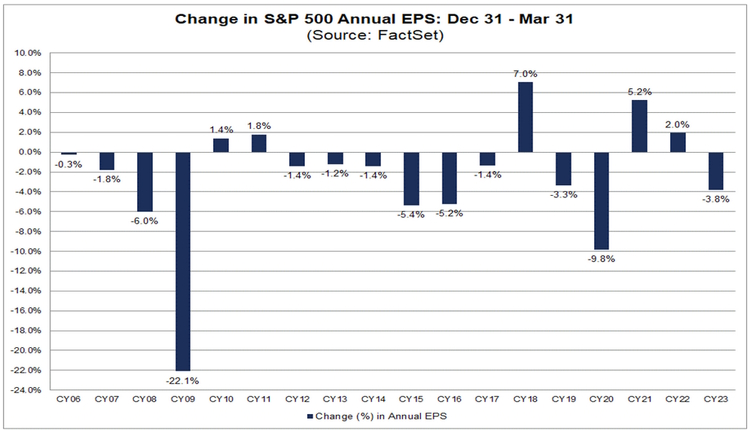

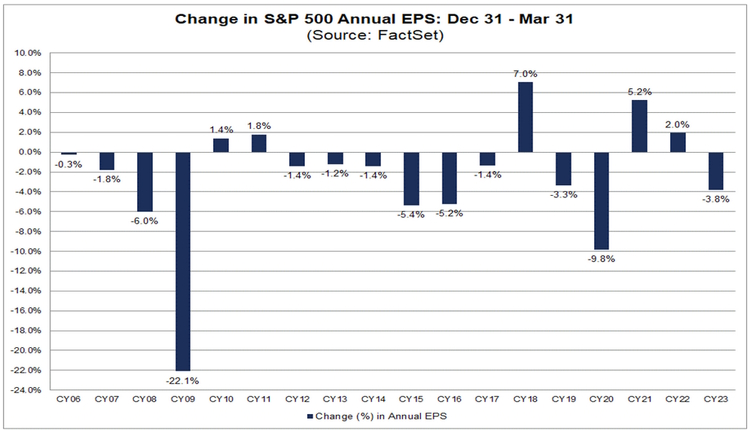

While analysts were decreasing EPS estimates in aggregate for the first quarter, they were also decreasing EPS estimates in aggregate for all of calendar year 2023. The bottom-up EPS estimate for 2023 declined by 3.8% (to $221.50 from $230.33) from December 31 to March 30.

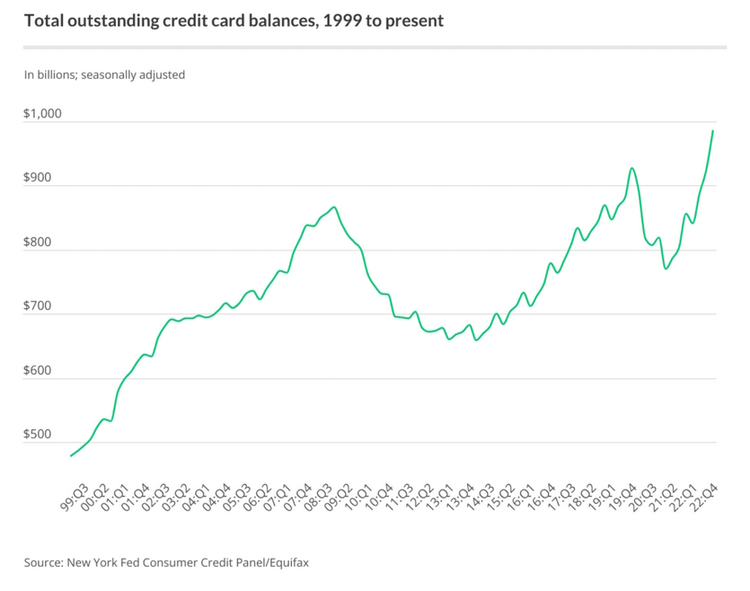

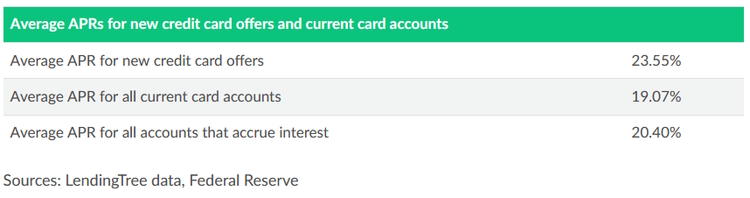

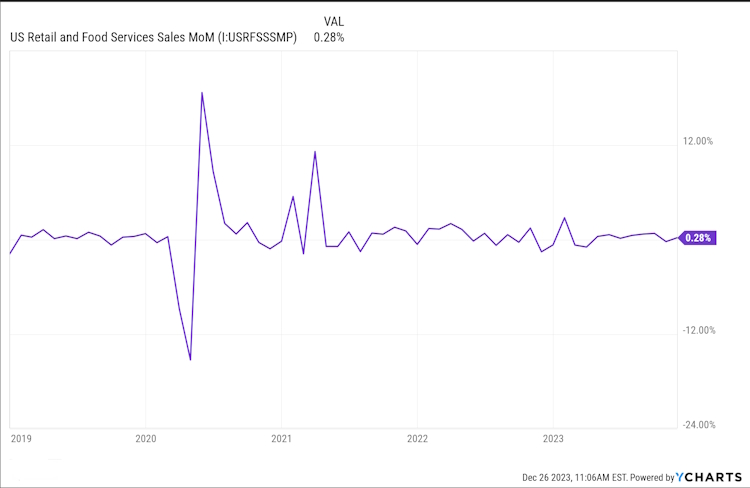

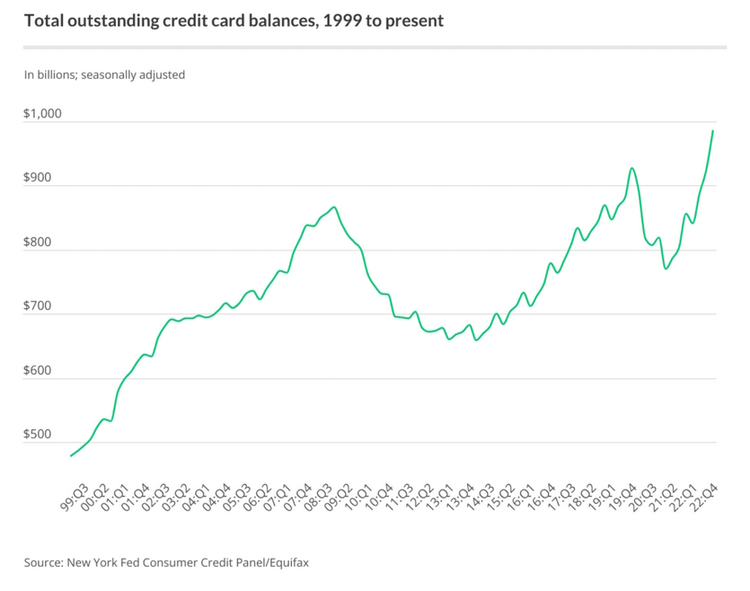

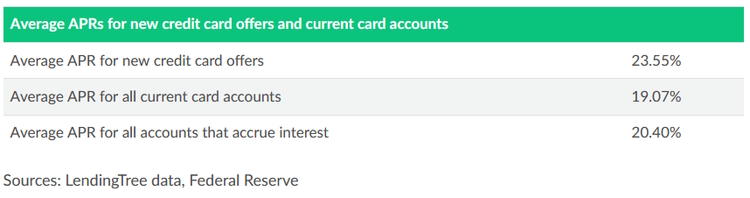

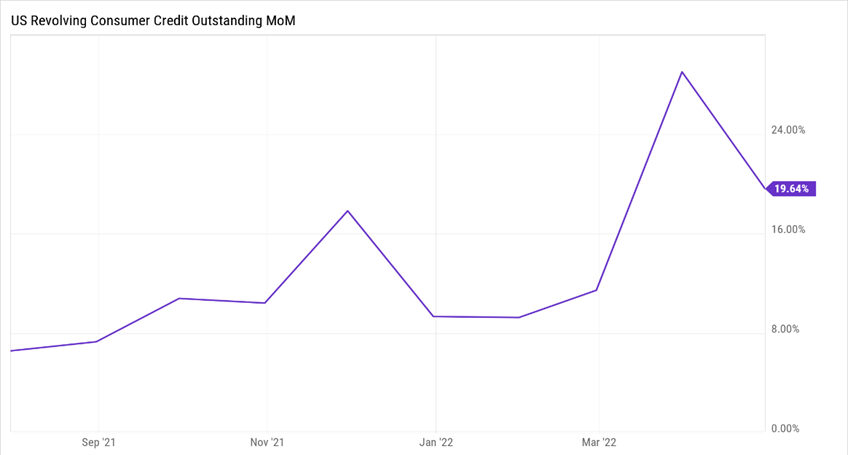

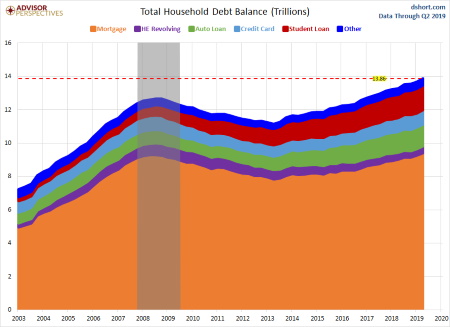

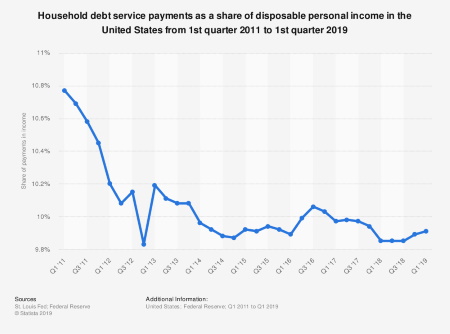

Consumer debt has also been giving off warning signals as Americans’ total credit card balance was $986 billion in the fourth quarter of 2022, according to the latest consumer debt data from the Federal Reserve Bank of New York. That is the highest total since the New York Fed began tracking the level in 1999. It marks a $61 billion jump from $925 billion in the third quarter of 2022, which is the largest quarterly increase in the history of the report.

Overall, the national average card debt among cardholders with unpaid balances in December 2022 was $7,279. That includes debt from bank cards and retail credit cards.

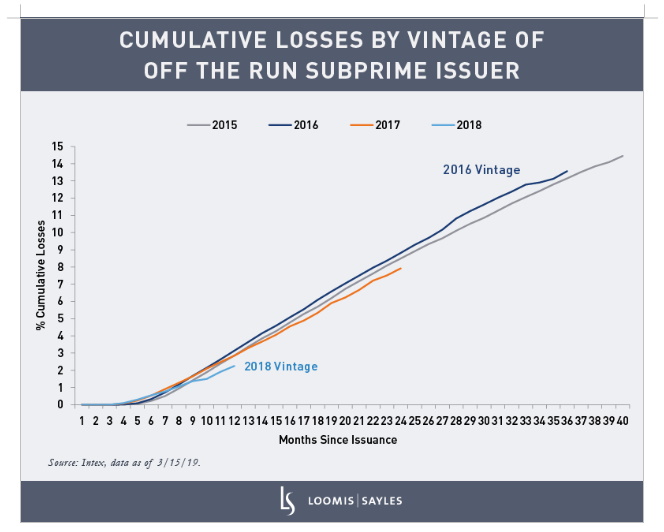

To us, it appears that, likely out of necessity, consumers are dealing with higher prices by taking on higher credit balances. As most of us have experienced at least once in our lives, usually in college or shortly after, this is an unsustainable situation. At some point, those cards will be maxed out and people will be forced to cut back. Cracks may already be starting to form. According to TransUnion, the volume of borrowers more than 60 days behind on their auto loans in Q3 and Q4 2022 crept up by 0.13 percent—nearly double the seasonal average of 0.07—to 1.78 percent.

The most notable hike concerns subprime borrowers, 5.67 percent of whom were two months behind on their payments according to Fitch Ratings, per Bloomberg. That is up from just 2.58 percent in April 2021, and above the 5.09 percent high reached in January 2009.

And, according to a recent American Bankruptcy Institute (ABI) report, new bankruptcy filings in February 2023 registered double-digit increases year-over-year across all U.S. major filing categories, according to data provided by Epiq Bankruptcy, the leading provider of U.S. bankruptcy filing data.

Is Commercial real estate in trouble?

Commercial real estate has been through a pandemic, very rapid recovery, then massive tightening of financial conditions unlike anything we’ve seen in our lifetimes. Many commercial real estate owners have lots of space sitting empty in major city centers as a result of more hybrid and remote work arrangements resulting from the pandemic. Now they’ve come under pressure from the Federal Reserve’s aggressive campaign to raise interest rates, which raised borrowing costs and lowered building values.

Beleaguered banks, especially smaller ones, could get more aggressive with real estate lending terms, giving landlords even less room to breathe as they try to refinance loans coming due.

This year, roughly $270 billion in commercial mortgages held by banks are set to mature, according to Trepp, and $1.4 trillion over the next five years.

Two early warnings of the danger that rising interest rates pose to commercial real estate came last month. Giant landlord Columbia Property Trust defaulted on $1.7 billion in floating-rate loans tied to seven buildings in New York, San Francisco, Boston and Jersey City, N.J. That followed a default by giant money manager Brookfield Asset Management on more than $750 million in debt backing two 52-story towers in Los Angeles.

Still, in a recent press conference, Jerome Powell acknowledged that despite a tightening of credit conditions as banks pull back, which will help cool the economy, he did not see the current conditions presenting the kind of systemic risk that we saw in the 2008 mortgage crisis. Of course, two years ago he said that inflation was transitory…there are no experts.

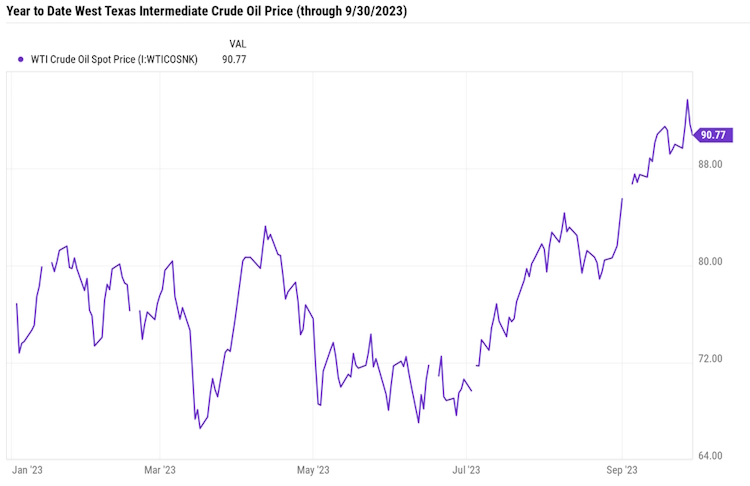

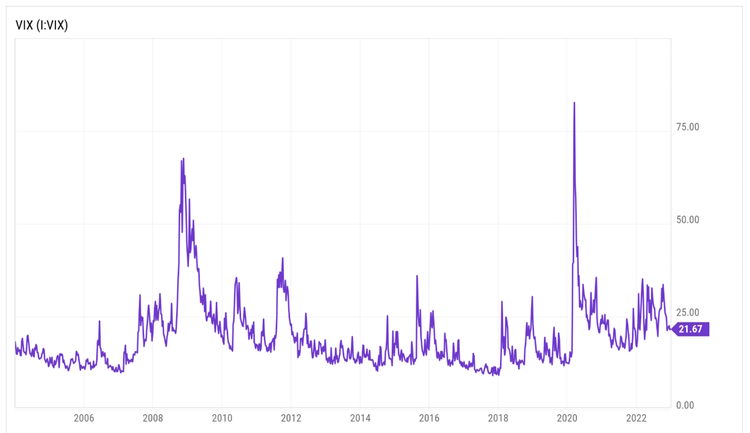

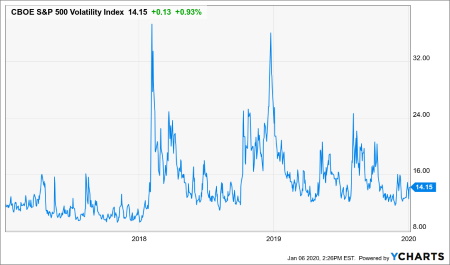

What this means for investors is that as economic conditions deteriorate, inflation, especially as measured today, should moderate which will allow the Federal Reserve to pause interest rates and, if things get bad enough, even cut them, given the amount of room they have given themselves in the past year. That, as we’ve learned, will be “good” for stock prices. So, it may soon be time to take advantage of short-term volatility to finish our bargain shopping before prices begin to rise again.

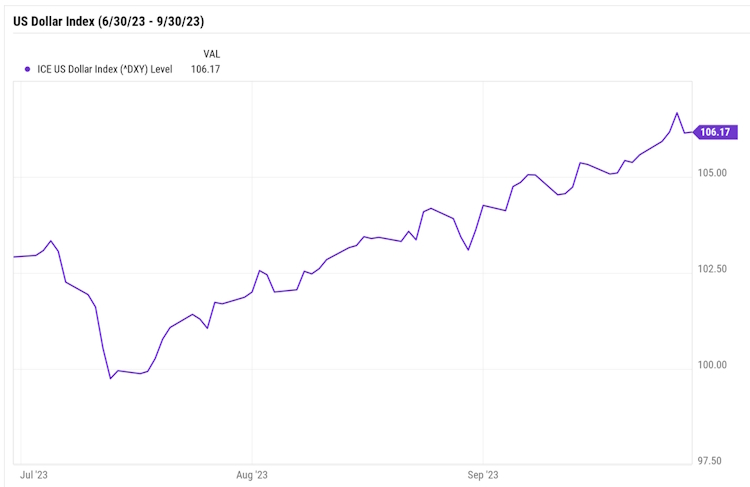

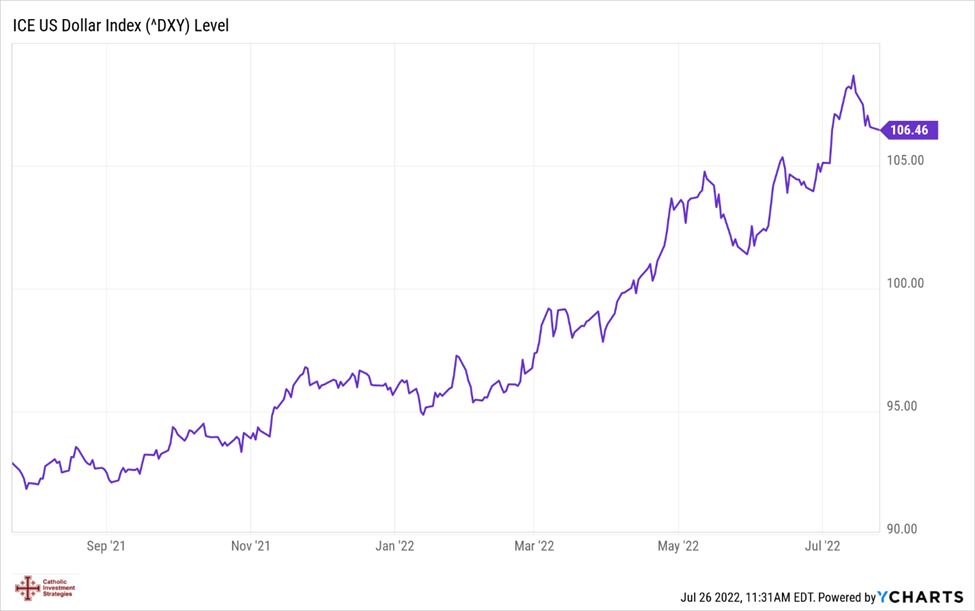

The Demise of the Dollar?

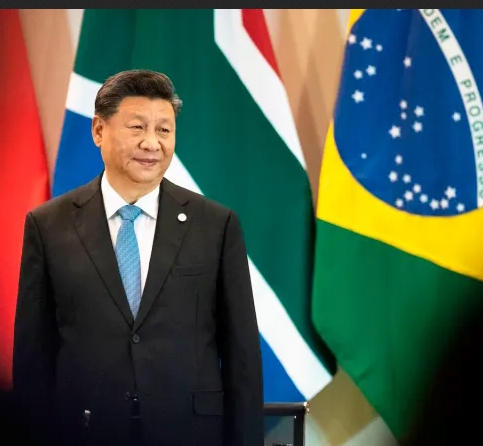

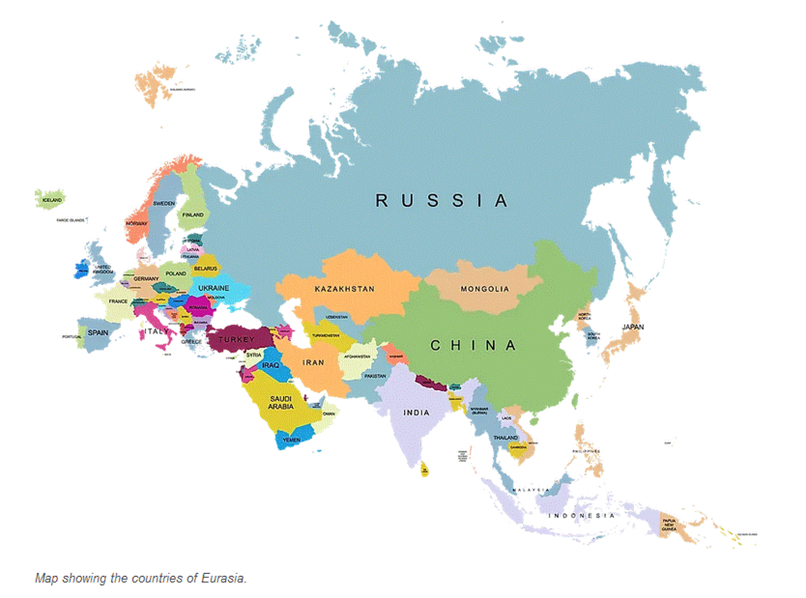

Over the past year, particularly after Russia invaded Ukraine, the BRIC nations have increased their efforts to create an alternative global financial system to compete with the West in general and, obviously, the U.S. in particular.

Earlier this month, Xi Jinping and Vladimir Putin signed an agreement solidifying their “No Limits” Partnership, much of which involves economic cooperation and trade.

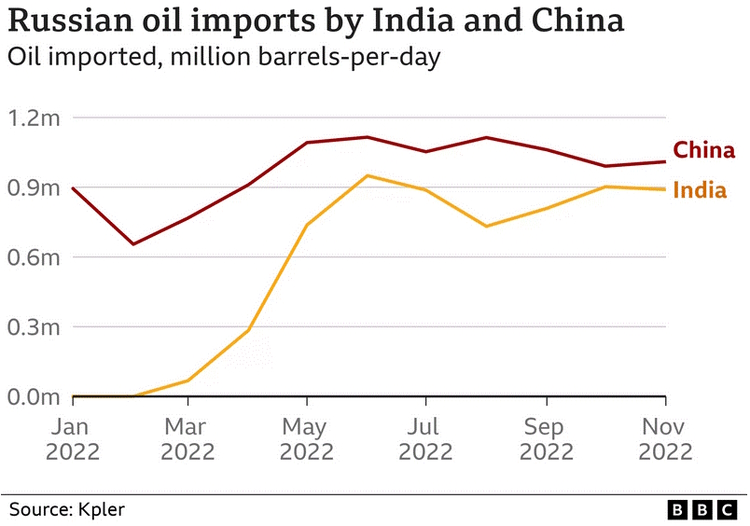

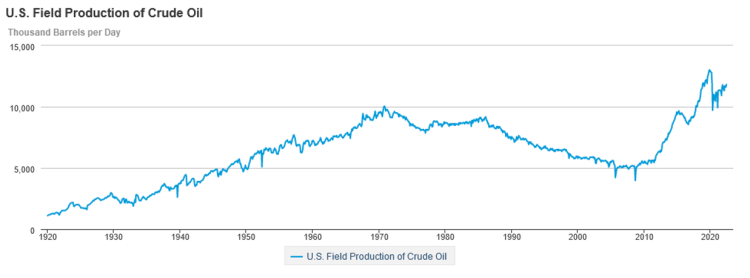

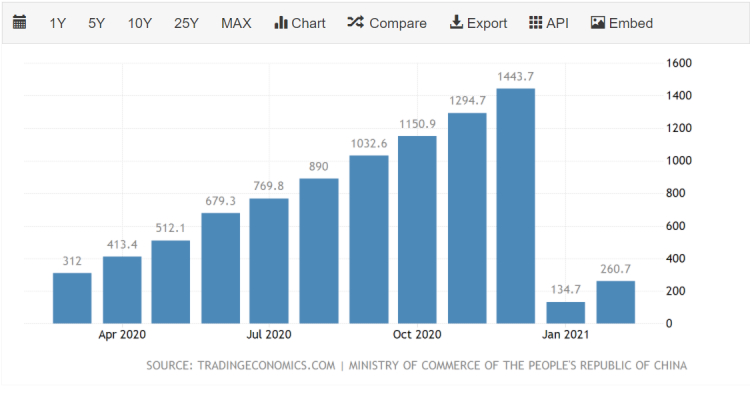

China has emerged as a major buyer of sharply discounted Russian oil and gas as Western buyers have banned energy imports. Russia was China’s top oil supplier in January and February at 1.94 million barrels per day, up from 1.57 million in 2022, according to Chinese customs data.

China’s imports of Russian pipeline gas and liquefied natural gas last year jumped 2.6 times and 2.4 times, respectively, to $3.98bn and $6.75bn.

Meanwhile, China’s imports of Russian coal surged 20 percent to 68.06 million tons.

While Russia has been selling energy to China, Russia has been ramping up imports of Chinese goods, including machinery, electronics, base metals, vehicles, ships, and aircraft.

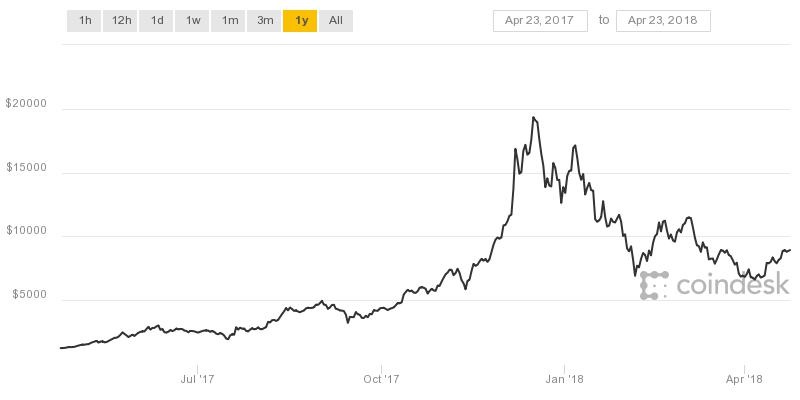

With Russia blocked from using the dollar-dominated international financial system after the West cut off Russian financial institutions from the international payments system SWIFT and Western banks and credit card companies stopped doing business in Russia, the Chinese yuan and cryptocurrency have stepped into the void.

The share of yuan-based transactions grew from 0.4 percent to 14 percent of the total in a nine-month period, according to the Carnegie Endowment for International Peace. In September, two Russian banks began to lend in yuan and also use the currency for money transfers in lieu of SWIFT.

The Russia/China agreement also pushed forward the planned Power of Siberia 2 pipeline, which would deliver 50 billion cubic meters (bcm) of natural gas per year from Russia to China via Mongolia. The pipeline has gained urgency as Moscow seeks to replace Europe as its major gas customer.

Russia’s news agency, TASS, reported that the two leaders also discussed the internet and agreed that they stand “against militarization of information and communication technologies and support multilateral, equal and transparent management of the Internet.”

“[They] support creation of a multilateral, equal and transparent global management system of the Internet with the support of sovereignty and security of all countries in this sphere,” TASS quoted the agreement as saying.

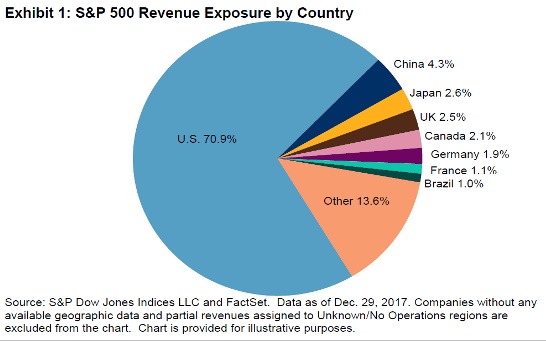

But Russia is not the only country China has been negotiating with. On March 29, it was reported that Brazil and China have reportedly struck a deal to ditch the U.S. dollar in favor of their own currencies in trade transactions. The deal will enable China and Brazil to carry out trade and financial transactions directly, exchanging yuan for reais – or vice versa – rather than first converting their currencies to the U.S. dollar.

China is Brazil’s largest trading partner, accounting for more than a fifth of all imports, followed by the United States, according to the latest figures. China is also Brazil’s largest export market, accounting for more than a third of all exports.

Additionally, Honduras just aligned with China, ending their diplomatic recognition of Taiwan. Saudi Arabia is reported to be considering using China’s currency for oil trades. China owns 15 of the 19 cobalt mines in the Congo, which are considered to be the largest cobalt reserves in the world. Cobalt is vital to electric vehicle production, a priority for our Departments of Energy and Transportation, among others.

Finally, according to a recent article in the New York Times, China is emerging as a new heavyweight in providing emergency funds to debt-ridden countries, catching up to the International Monetary Fund (IMF) as a lender of last resort.

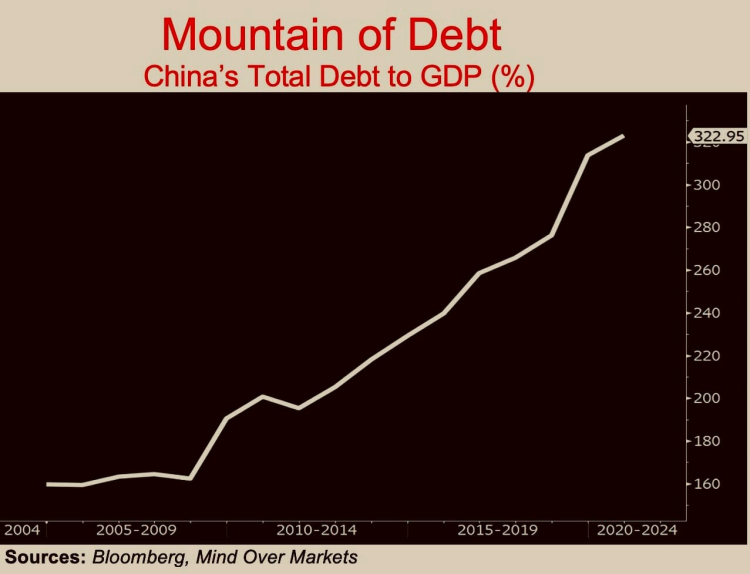

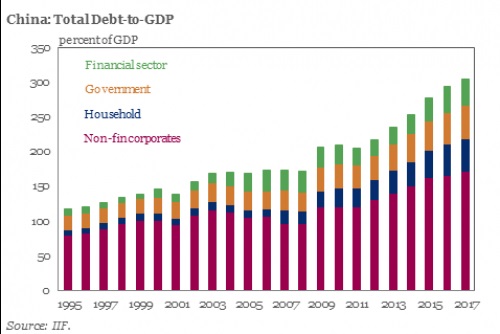

To say that China has become an influential player in the global financial markets and geopolitics is an understatement; and now with the West distracted with economic turmoil and the war in Ukraine they seem poised to take their place on the world stage as a global superpower equal or even superior to the U.S.

Even Bridgewater’s Ray Dalio has predicted that the Chinese yuan would displace the U.S. dollar as the world’s leading reserve currency in a matter of time.

We are not experts in foreign relations. In truth, domestic relations are challenging enough for us. We do see implications in China’s efforts that will affect western economies in general, particularly the U.S.

First, since all of us get inundated with hyperbolic emails with every economic or geopolitical event, let’s start with an understanding of terms.

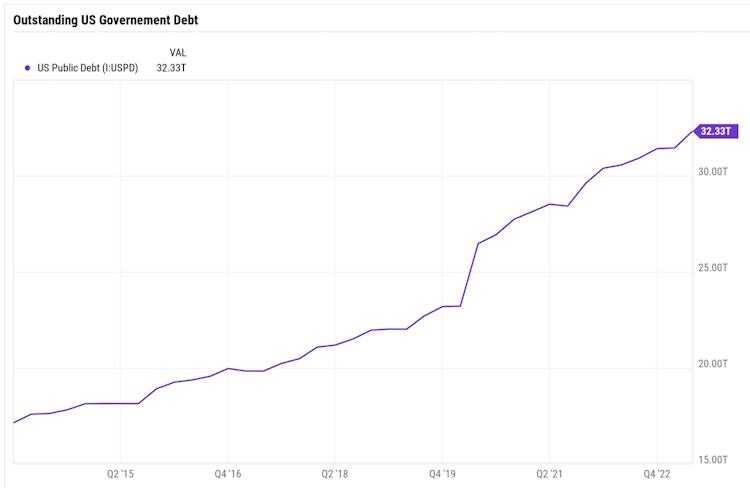

Many financial outlets as well as newsletter writers tend to confuse the idea of reserve currency versus the currency used for global payment systems. A reserve currency is, essentially, the currency in which your cash and cash reserve holdings are denominated. Most countries don’t hold piles of dollar bills in some vault. Instead they use those dollars to buy securities, usually U.S. Treasuries.

A great example of this is, in fact, China. Chinese exporters receive U.S. dollars (USD) for their goods sold to purchasers in the U.S., but they need yuan to pay their workers and store money locally. The People’s Bank of China (PBOC), buys the available excess U.S. dollars from the exporters and gives them the required yuan. China hence accumulates USD as forex reserves.

China needs to invest its huge stockpile of dollars to earn at least the risk-free rate. With trillions of U.S. dollars, China has found the U.S. Treasury securities to offer the safest investment destination for Chinese forex reserves. Since U.S. Treasuries are denominated in the U.S. dollar, the dollar is considered the reserve currency. And while it has been reported that both China’s and Russia’s central banks have been using some of their cash reserves to accumulate gold, the truth is that they are among the top five gold producers in the world and are likely buying those gold reserves in yuan and rubles.

This is different from a global payment currency where all parties are using the same currency for cross-border transactions. The best example of this is the idea of the “Petro Dollar,” where oil transactions were all made using U.S. dollars.

The truth is that anything can be used as a currency, but as technology has improved and global trade has increased, it makes sense that the world’s major importers will make transactions in their currencies. As late as January 2023, the Euro and U.S. dollar together made up more than seven out of 10 SWIFT payments worldwide, outperforming all other currencies.

This is where the USD is going to suffer, as financial sanctions will push countries to enact transactions in something other than the USD or the Euro. Still, if you’re a net exporter, you will still be trading with the largest importers in their currency, not yours. Based on 2020 data, the world’s largest importers, by a factor of 10, are the U.S., China and Germany. According to Marc Chandler (no relation), the chief market strategist for Bannockburn Global Forex, the dollar is on one side of 88% of currency trades, little changed from 1989 (when the dollar was one side of 90% of currency trades). China may be the most important trade partner for more countries than the U.S., but the dollar’s role remains paramount. You can read the entire article printed by Barron’s: The Dollar Rules the Financial Universe. China Can’t Change That.

A More Immediate Threat?

What we believe China is doing is securing energy sources and strategic materials for its manufacturing-based export economy. While they do have mining resources, they lack oil and natural gas reserves. They are still heavily reliant on coal for generating electricity as well as metallurgy while they are transitioning to nuclear power (as opposed to wind and solar). Russia, Iran and now Saudi Arabia are all secure sources of oil and natural gas.

Additionally, you may recall that Russia secured vast amounts of uranium when in 2013 they acquired a Canadian uranium mining company known as Uranium One which owns assets in the U.S. Many of Africa’s most mineral-rich states currently rely on China for a sizable margin, if not all, of their exports (crude petroleum from Angola and South Sudan, zinc and copper ore from Eritrea, cobalt from DR Congo, raw tobacco from Zimbabwe, iron and titanium from Sierra Leone).

By securing global resources, China appears to be cornering the market for critical as well as noncritical supplies. China now dominates the world’s production of new generation batteries that are essential for electric vehicles and most portable consumer electronics such as cell phones and laptops. “China controls the processing of pretty much all the critical minerals, whether it’s rare earth, lithium, cobalt or graphite,” according to Pini Althaus, the chief executive of USA Rare Earth.

China may feel that, by controlling major components and resources that the U.S. and EU have become dependent on, they will be more likely to realize their ambition to become the dominant world power within 30 years (as detailed in a 2021 speech by Xi).

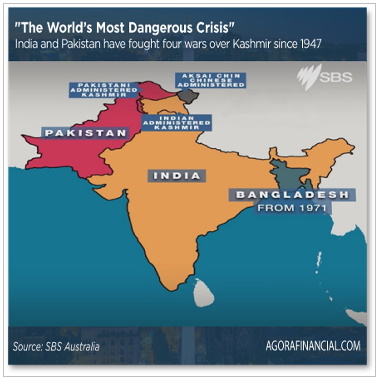

A major part of that speech involved resolving the “Taiwan question.” China has become increasingly direct in its threats to invade Taiwan. Taiwan Semiconductor (TSM) accounts for more than 50% of global chip manufacturing and, therefore, it is of vital interest to Western economies. China faces real headwinds of debt, demographics, and the potential for decoupling of trade with the West. Chinese leaders might feel that this is the moment to seize control of the Western Pacific and South Asia while so many Western resources are being expended on Ukraine. While we don’t believe that this would result in an all-out war, it would certainly increase stress on the already fragile global supply chain and throw the U.S. economy into further chaos.

Conclusion

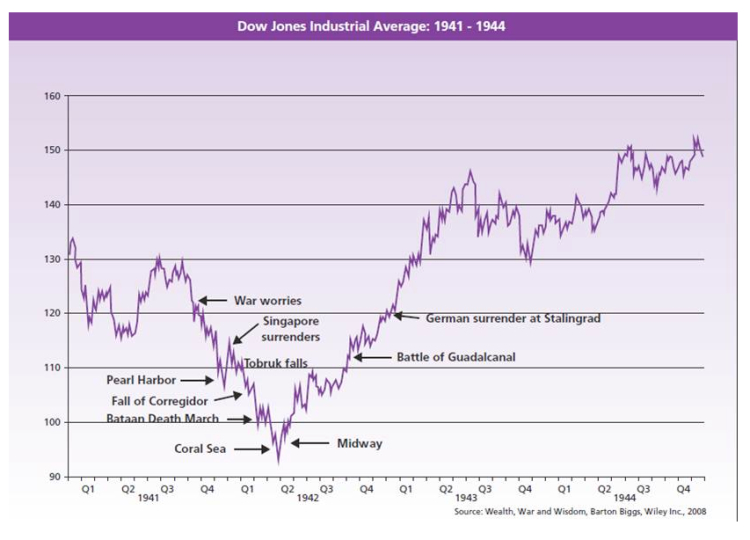

We apologize for the heaviness of this letter, we’d much rather be writing about sunshine, rainbows and 20% annual returns as far as the eye can see. But the world rarely, if ever, cooperates when we want it to. There are times like these when it does feel like darkness is closing in from all sides, but for most of us, that means that we simply haven’t lived long enough.

As an example, I present my 93-year-old Carlsbad neighbor, Jack, who, along with his family, was sent to an internment camp during World War II for the crime of being Japanese. He later enlisted in the US military and fought in the Korean War, came back to the U.S., got an engineering degree and is responsible for much of the current water and sewage systems still in use in Carlsbad today.

When discussing the issues of the day, Jack just smiled at me and said, “You know, I’ve seen a lot of ‘stuff’ in my life, and I’ll tell you what, this is nothing new and this is still the best country to be born and to live in.”

And we’ll end with a quote from a successful investor in his most recent letter to shareholders:

“I have been investing for 80 years – more than one-third of our country’s lifetime. Despite our citizens’ penchant – almost enthusiasm – for self-criticism and self-doubt, I have yet to see a time when it made sense to make a long-term bet against America. And I doubt very much that any reader of this letter will have a different experience in the future.”

As always, we appreciate you and the trust you place in us as we pursue your financial goals together.

Read More

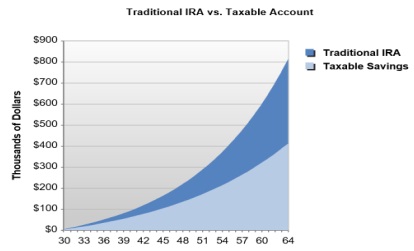

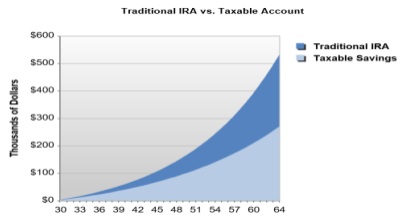

Here is one great way to get started. The next time you have the happy experience of being called into your boss’s office to be told you’re getting a raise, do this. Forget about it. That’s right, you should go home, celebrate a little, and then forget about the raise, except to arrange to have the additional income invested on an ongoing basis. You are living on a budget with your current income already, just continue on and spend that extra income on your future self. Let’s put some flesh on those bones and see what could happen.

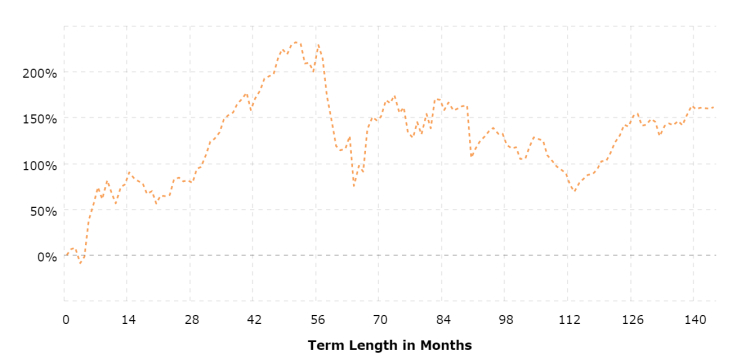

Here is one great way to get started. The next time you have the happy experience of being called into your boss’s office to be told you’re getting a raise, do this. Forget about it. That’s right, you should go home, celebrate a little, and then forget about the raise, except to arrange to have the additional income invested on an ongoing basis. You are living on a budget with your current income already, just continue on and spend that extra income on your future self. Let’s put some flesh on those bones and see what could happen. Here’s another way to provide for your future self: make a budget cut and invest it. Continuing on with Carly, she is so enthused by the numbers above that she decides that she wants to invest even more. She knows that she is spending too much every day on little things, like getting breakfast on the way to work. Every morning on her way in she stops at a convenience store and buys herself coffee and maybe an energy bar.

Here’s another way to provide for your future self: make a budget cut and invest it. Continuing on with Carly, she is so enthused by the numbers above that she decides that she wants to invest even more. She knows that she is spending too much every day on little things, like getting breakfast on the way to work. Every morning on her way in she stops at a convenience store and buys herself coffee and maybe an energy bar.

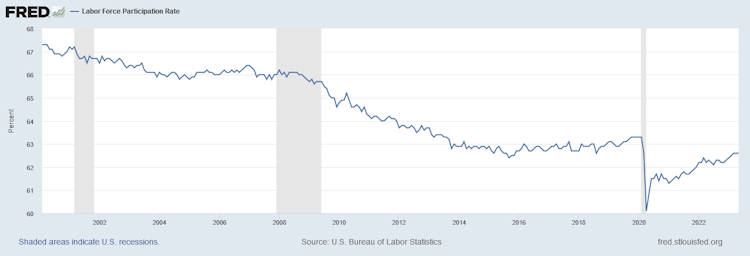

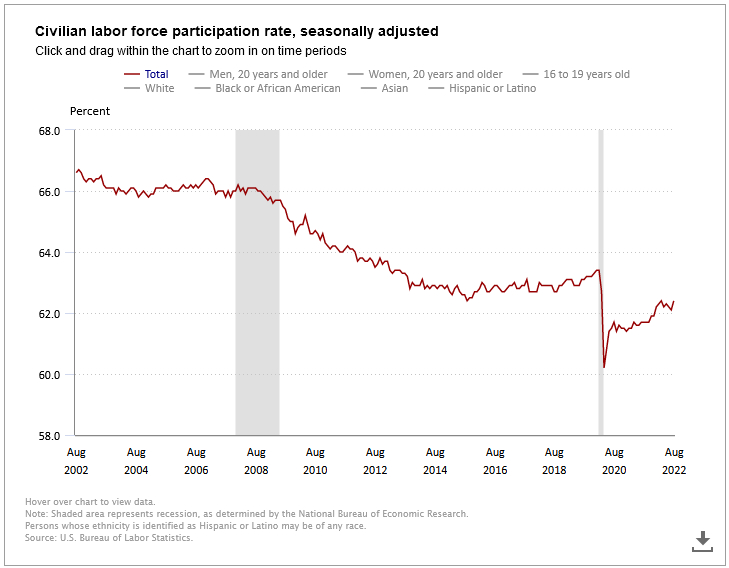

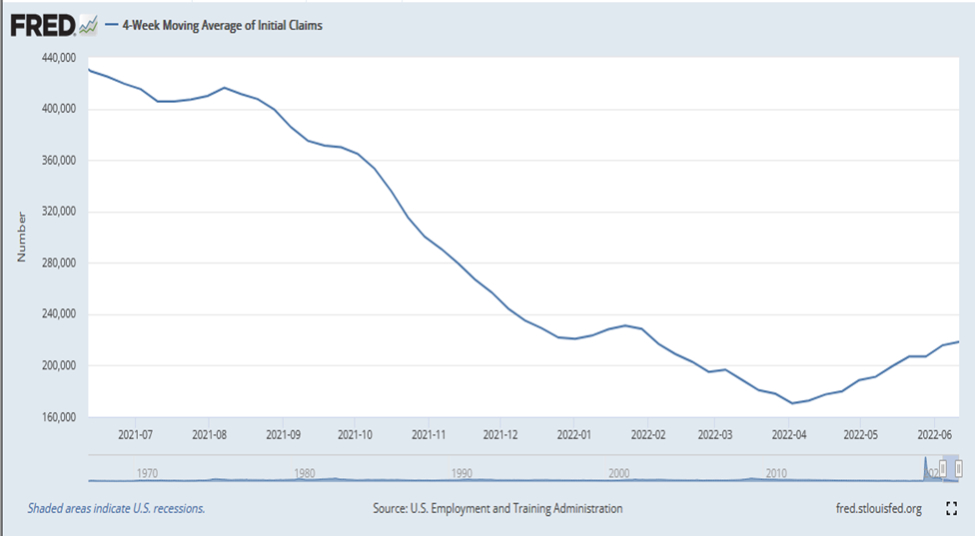

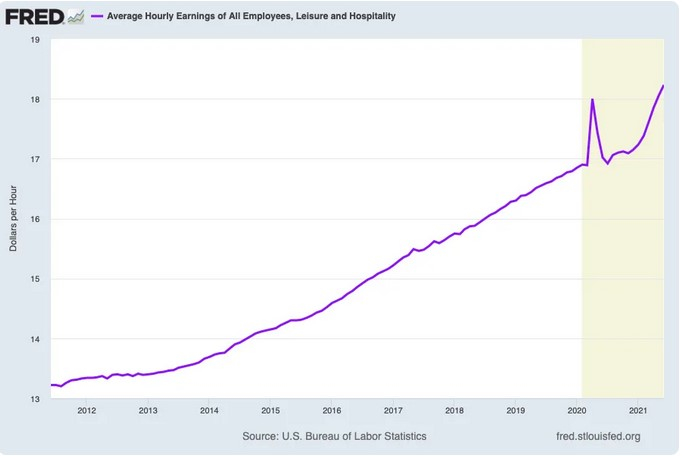

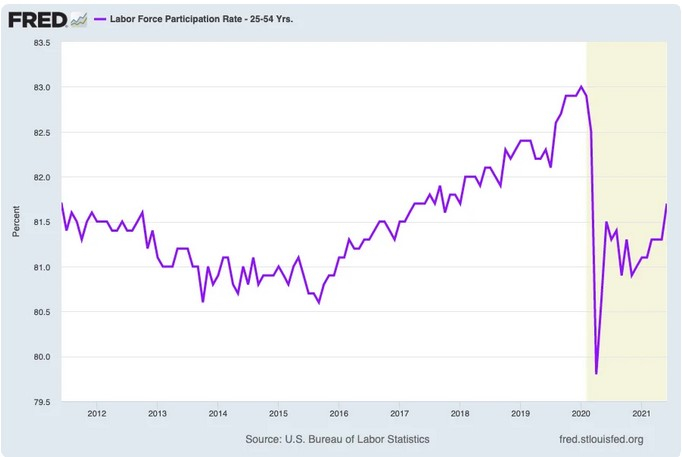

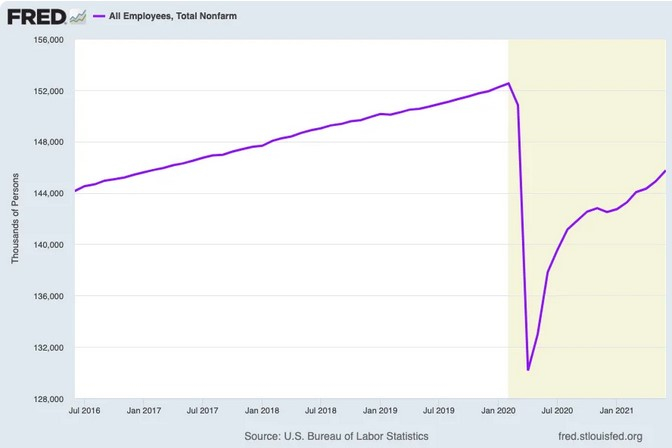

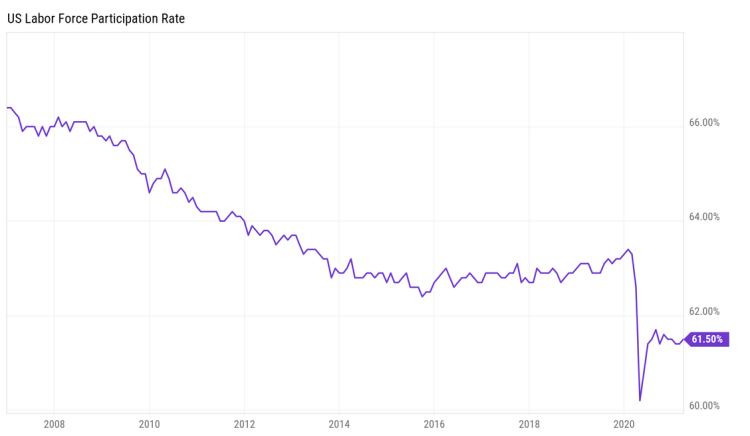

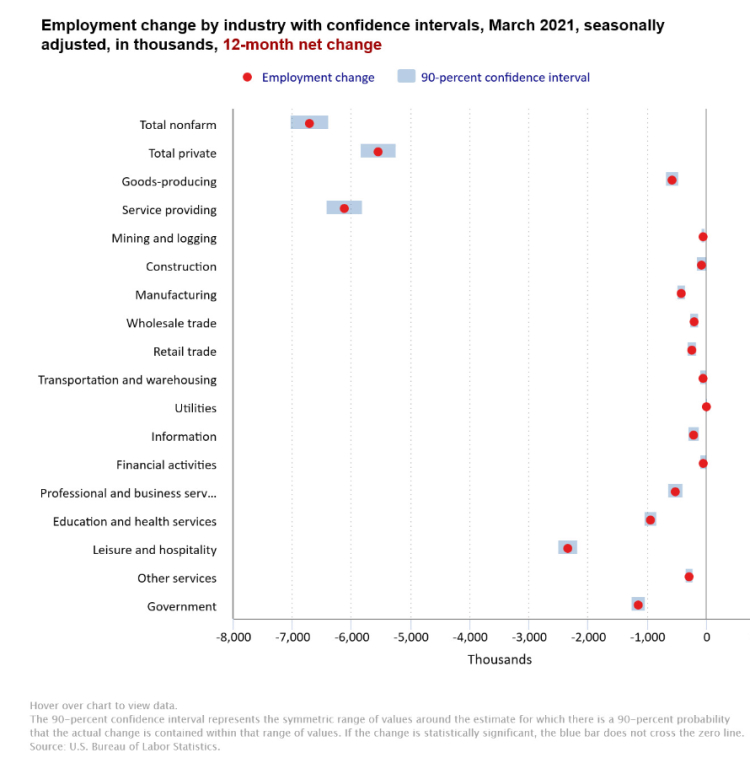

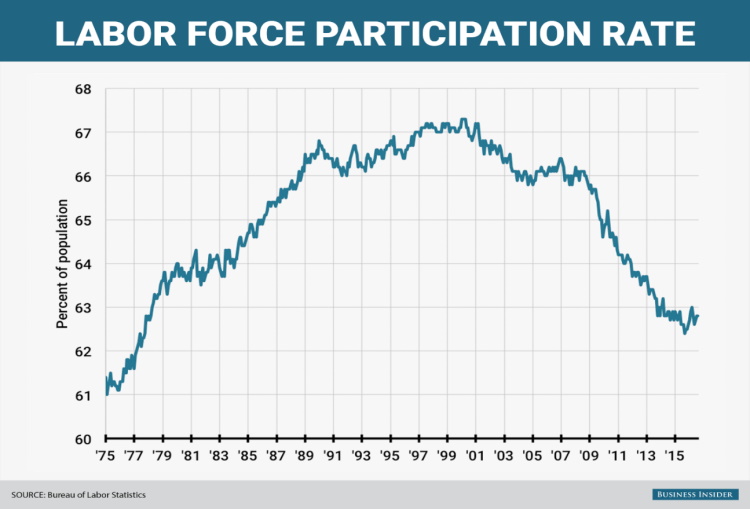

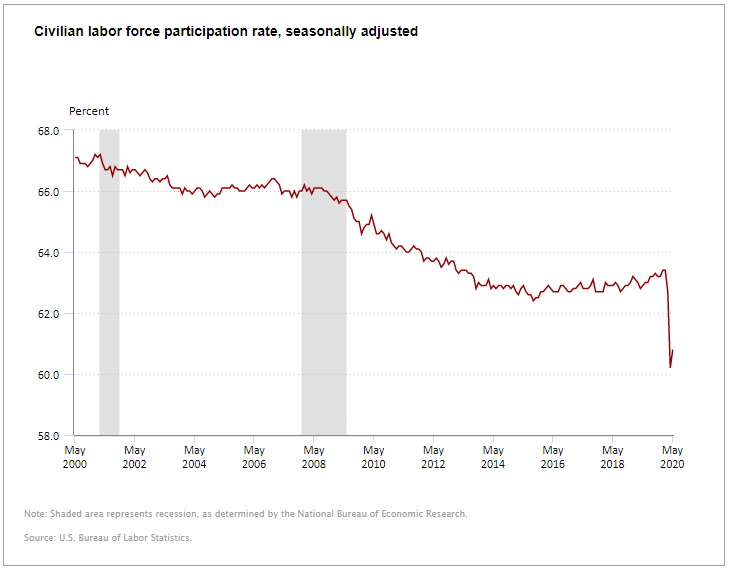

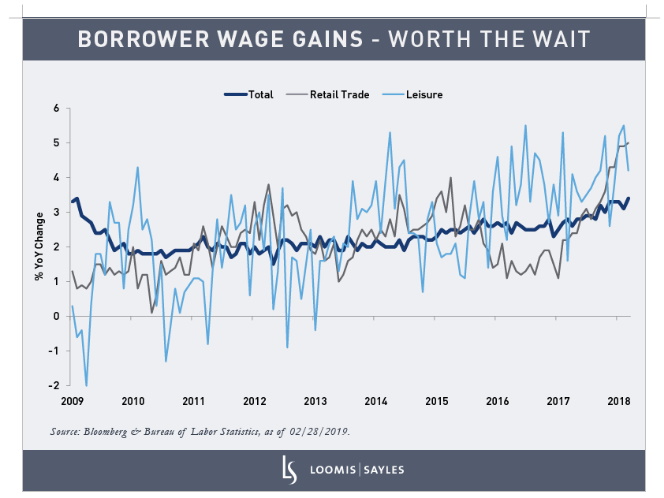

Here is another graph which shows how the current job recovery has been distributed:

Here is another graph which shows how the current job recovery has been distributed:

Being very sensitive about client information, I create a composite investor based on people I know or have known in the past. One of those people was wealthy by most people’s standards. She owned two businesses and had nearly a million dollars in investment property. She also couldn’t get a mortgage because she could not show enough income to prove to the bank that she was good for the loan repayment. Part of her problem was self-inflicted; a strategy to minimize income taxes resulted in many years of filing, really reporting, a very low income.

Being very sensitive about client information, I create a composite investor based on people I know or have known in the past. One of those people was wealthy by most people’s standards. She owned two businesses and had nearly a million dollars in investment property. She also couldn’t get a mortgage because she could not show enough income to prove to the bank that she was good for the loan repayment. Part of her problem was self-inflicted; a strategy to minimize income taxes resulted in many years of filing, really reporting, a very low income. Saving creates capital with which you can invest.

Saving creates capital with which you can invest.

Private foundations can own nearly any type of asset while DAFs are typically limited to cash, marketable securities, life insurance policies, and real estate (unencumbered by a mortgage). We ran into this issue a couple years ago with a client who wanted to donate a collection of very valuable musical instruments. To use a DAF, the instruments would have had to be auctioned off first with the cash proceeds going to the DAF.

Private foundations can own nearly any type of asset while DAFs are typically limited to cash, marketable securities, life insurance policies, and real estate (unencumbered by a mortgage). We ran into this issue a couple years ago with a client who wanted to donate a collection of very valuable musical instruments. To use a DAF, the instruments would have had to be auctioned off first with the cash proceeds going to the DAF.

With the standard bank savings account paying only 0.01% (yes, 1 one hundredth of a percent!) and charging fees for accounts with less than certain minimums, the only positive lesson your child can glean from having one is that at least their “savings” are safe (except for the corrosive effect of inflation).

With the standard bank savings account paying only 0.01% (yes, 1 one hundredth of a percent!) and charging fees for accounts with less than certain minimums, the only positive lesson your child can glean from having one is that at least their “savings” are safe (except for the corrosive effect of inflation).

She started with Monopoly Junior Party, which is still her favorite, but will play classic Monopoly if it means Mom and her big sister (who does not like board games) will join in.

She started with Monopoly Junior Party, which is still her favorite, but will play classic Monopoly if it means Mom and her big sister (who does not like board games) will join in. Anyone who has played the game knows that feeling of desperation when you’re hoping to reach “Go” without landing on an expensive property just to avoid going bust.

Anyone who has played the game knows that feeling of desperation when you’re hoping to reach “Go” without landing on an expensive property just to avoid going bust.

As we were discussing what we should do with the money, I brought up the idea of using her money to make more money through something we called investing.

As we were discussing what we should do with the money, I brought up the idea of using her money to make more money through something we called investing.

This conversation actually happened in my office.

This conversation actually happened in my office.

And since you have a reasonable understanding of what these things cost today, your current expenditures will provide a good baseline for an estimate of what your living costs will be in the future. At this point, you should account for as much of your necessary, unavoidable monthly spending as possible (e.g. loan payments, fees, utilities, taxes, etc.) in order to see what your spending level is today.

And since you have a reasonable understanding of what these things cost today, your current expenditures will provide a good baseline for an estimate of what your living costs will be in the future. At this point, you should account for as much of your necessary, unavoidable monthly spending as possible (e.g. loan payments, fees, utilities, taxes, etc.) in order to see what your spending level is today. Now that you have a list of things you will need to spend money on in retirement, it is time to add in those items that you want to spend on. For many, it is spending a few months in a warm climate, taking an extra vacation every year, or joining a country club. Some want a “fun car” for warm summer days or a remodeled house if living out retirement in the same home is part of the plan.

Now that you have a list of things you will need to spend money on in retirement, it is time to add in those items that you want to spend on. For many, it is spending a few months in a warm climate, taking an extra vacation every year, or joining a country club. Some want a “fun car” for warm summer days or a remodeled house if living out retirement in the same home is part of the plan. Of course, none of this means anything without follow through. Just like with your overall health, your financial health needs annual check-ups. In any given year, you might change jobs, homes, or receive an unexpected windfall. All of these events would impact key numbers relating to your retirement and need to be accounted for.

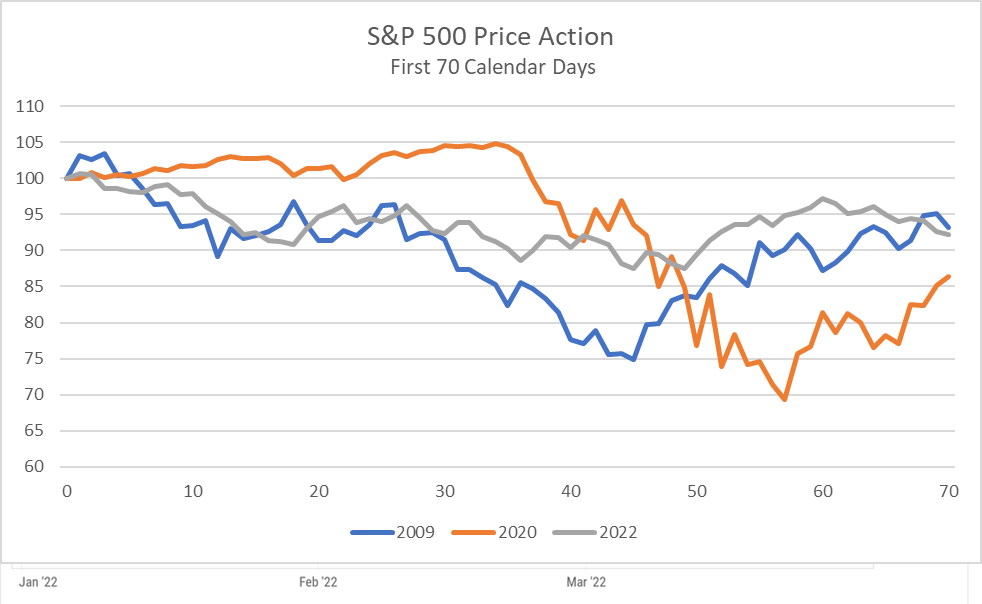

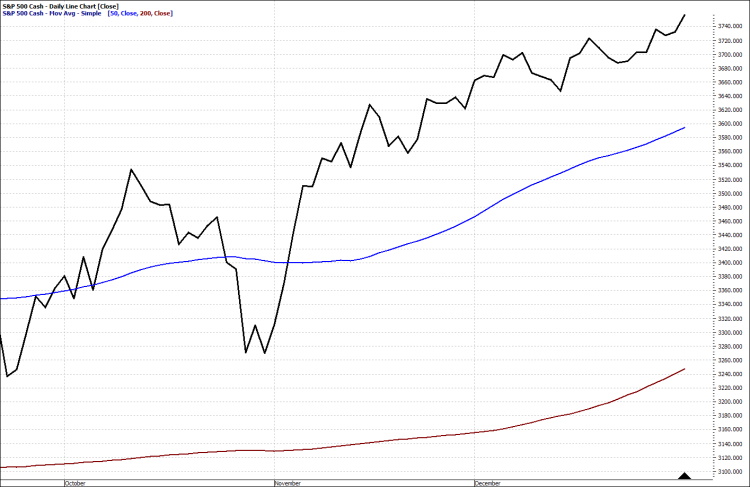

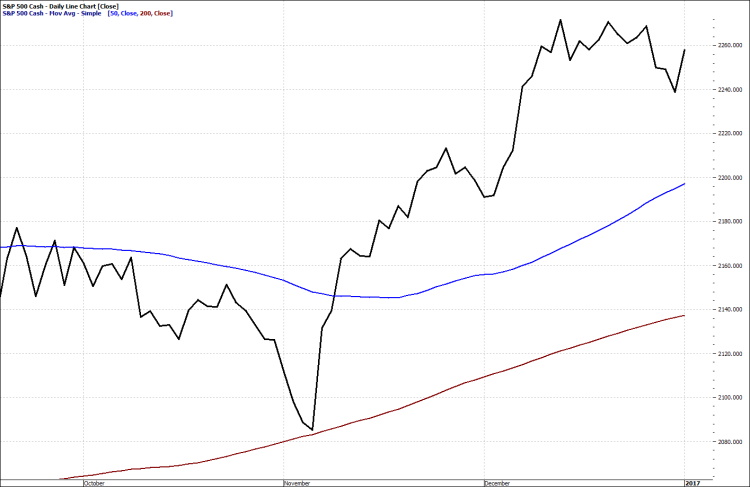

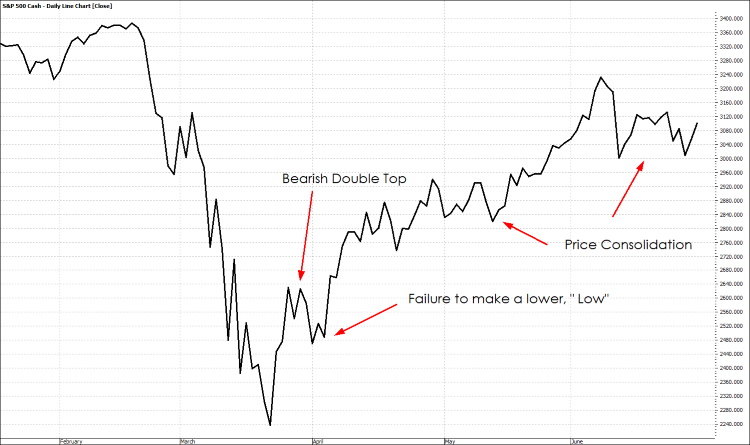

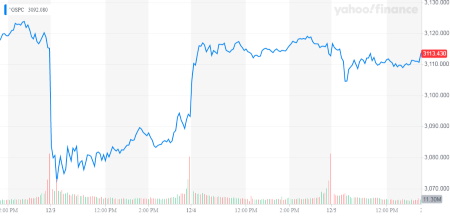

Of course, none of this means anything without follow through. Just like with your overall health, your financial health needs annual check-ups. In any given year, you might change jobs, homes, or receive an unexpected windfall. All of these events would impact key numbers relating to your retirement and need to be accounted for. After suffering a significant drop in March and April, the S&P 500 index (SPX), a very commonly-used benchmark for many funds and advisors, and what many people consider to be “The Market” has recovered from the crisis and pierced the 2020 highs established in February.

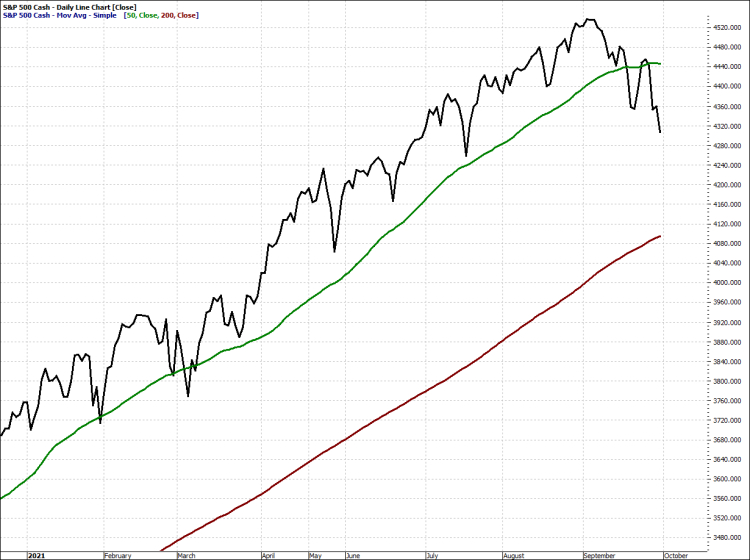

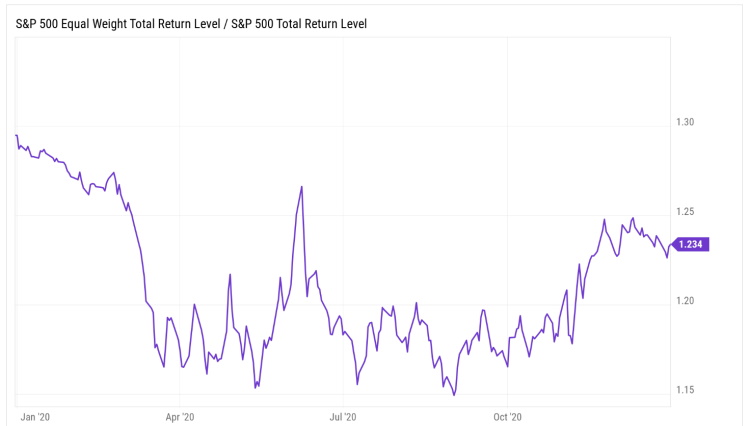

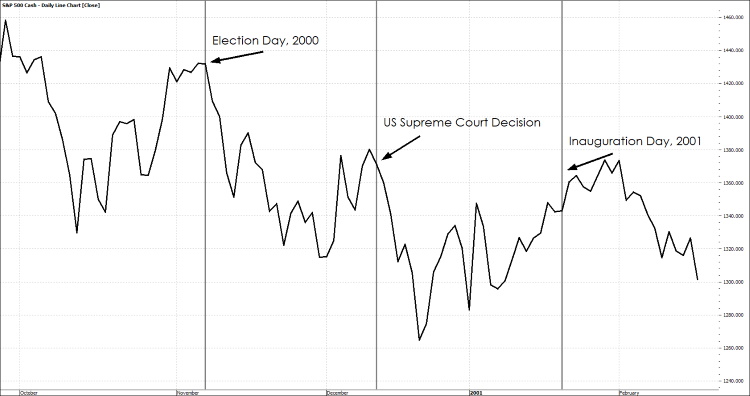

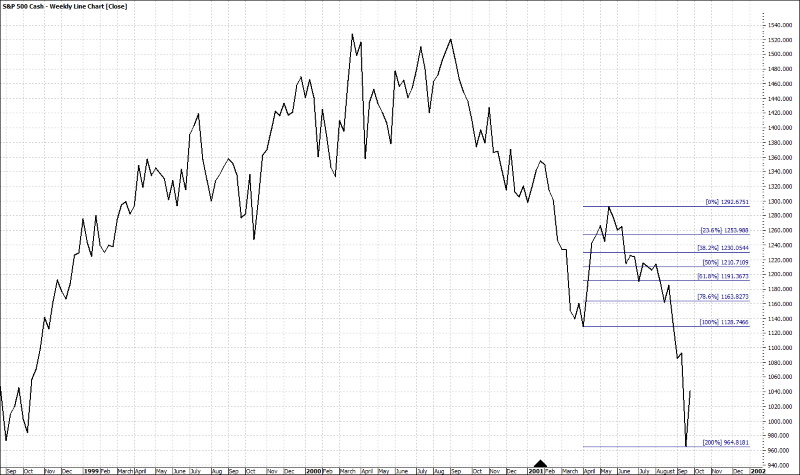

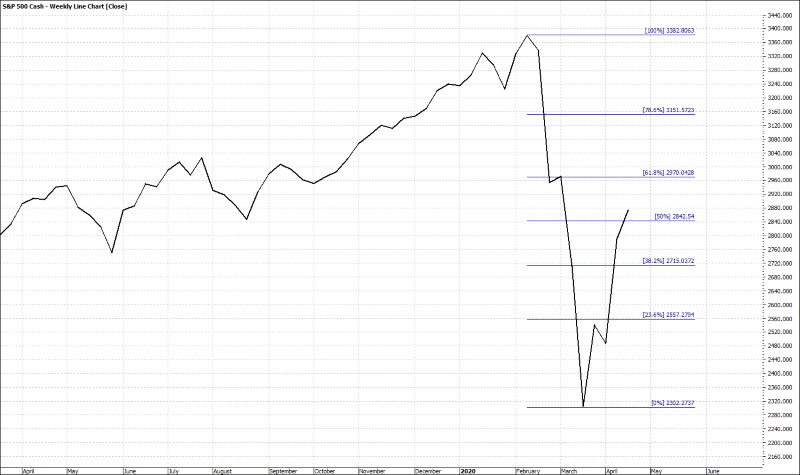

After suffering a significant drop in March and April, the S&P 500 index (SPX), a very commonly-used benchmark for many funds and advisors, and what many people consider to be “The Market” has recovered from the crisis and pierced the 2020 highs established in February.

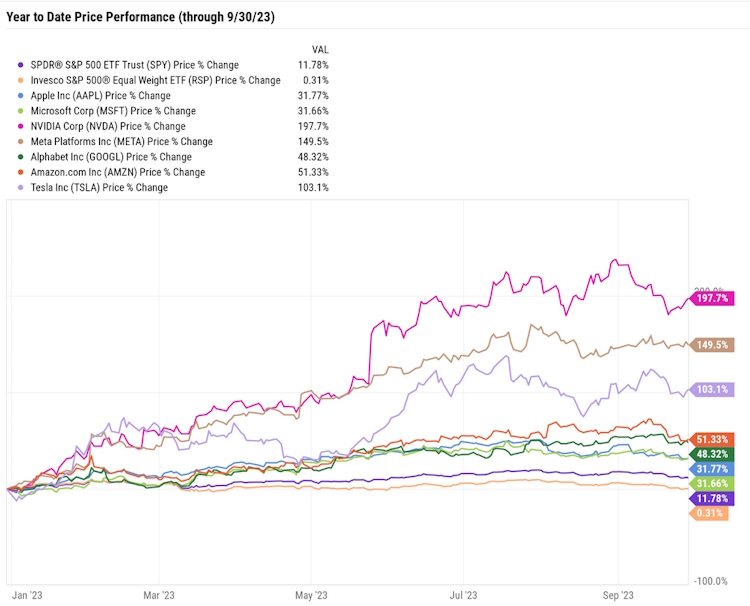

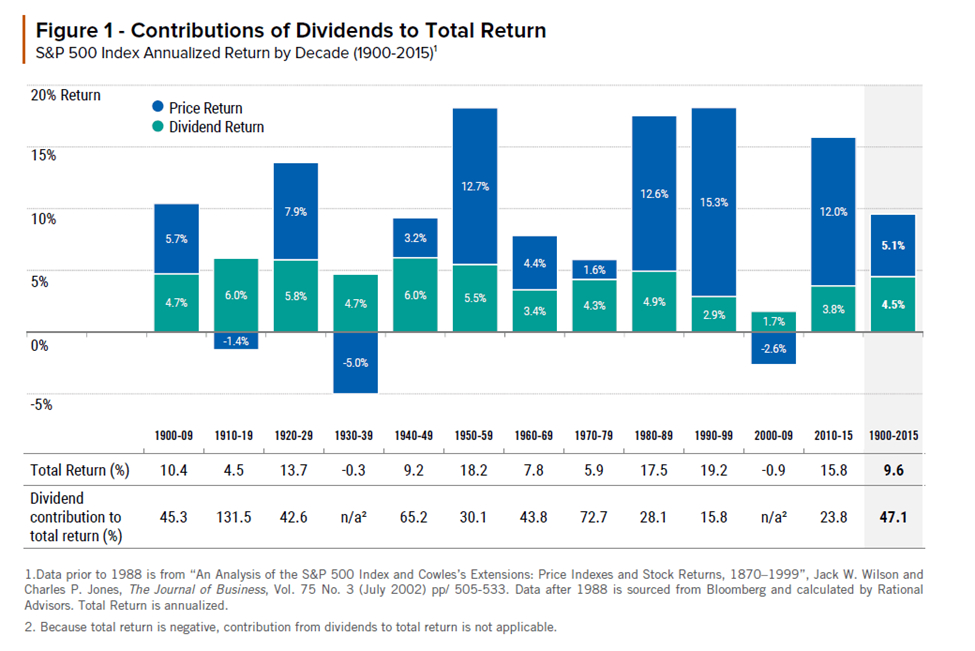

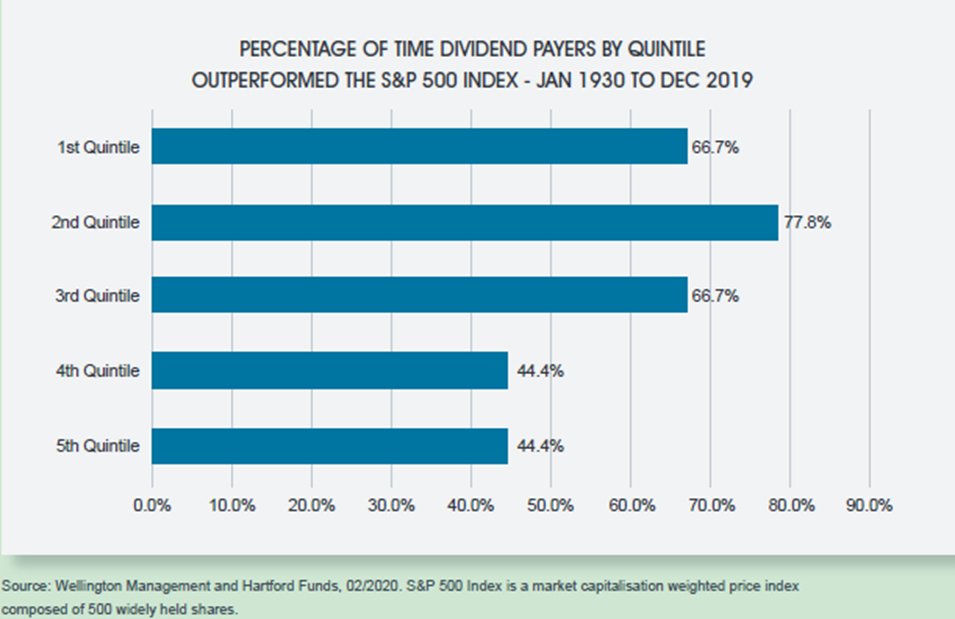

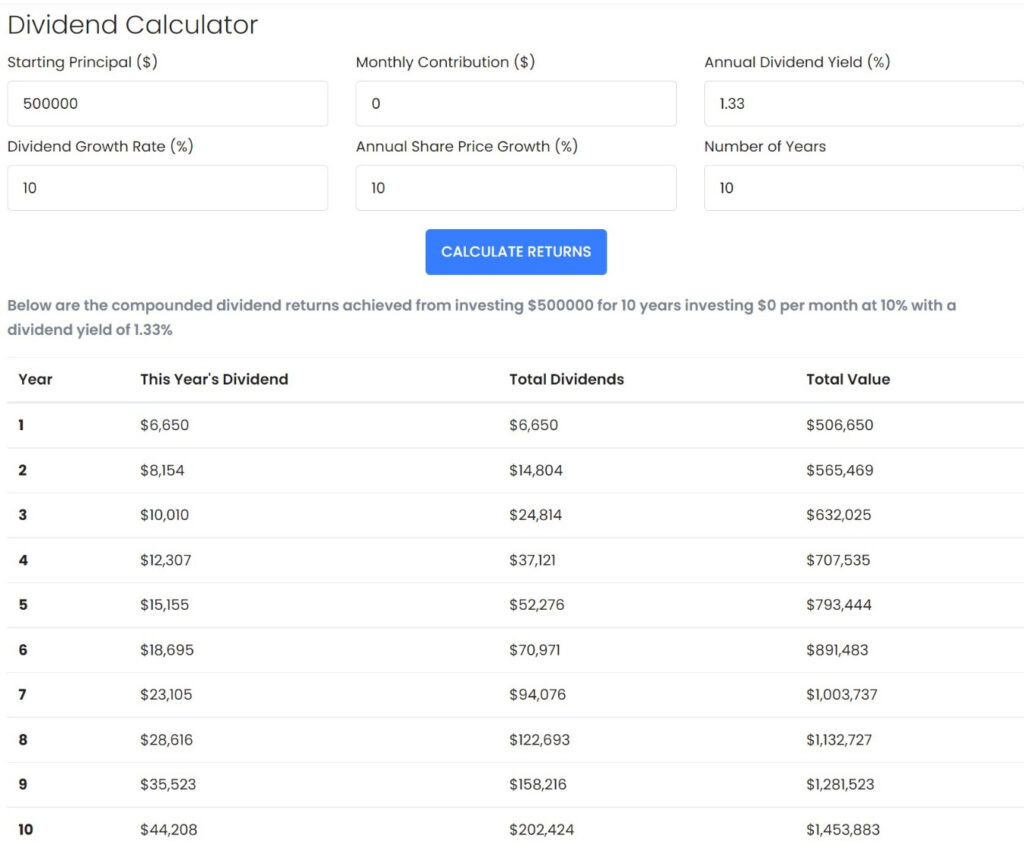

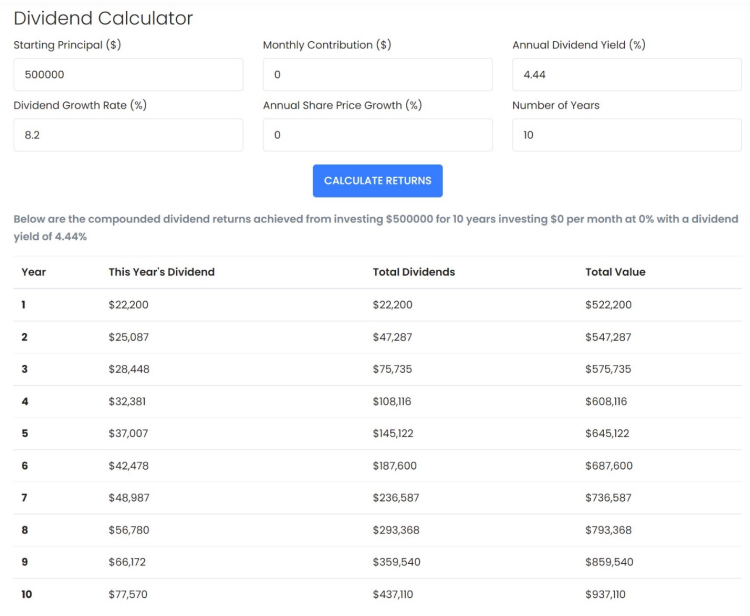

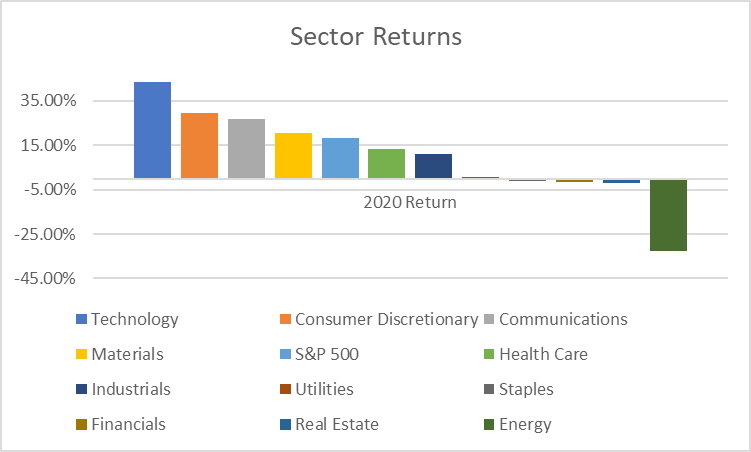

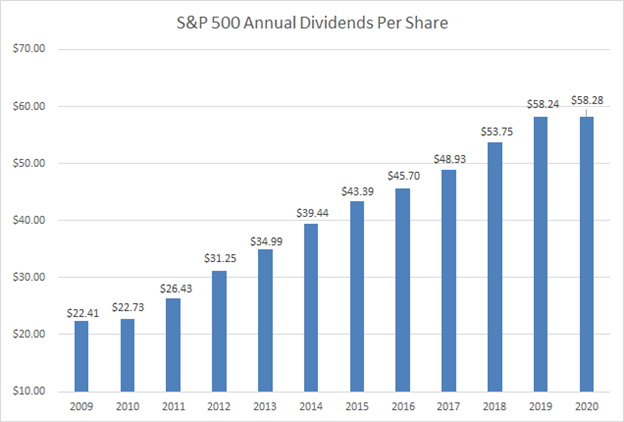

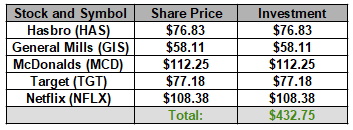

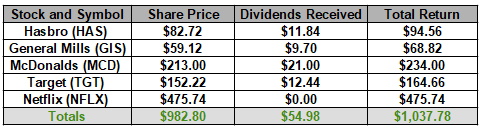

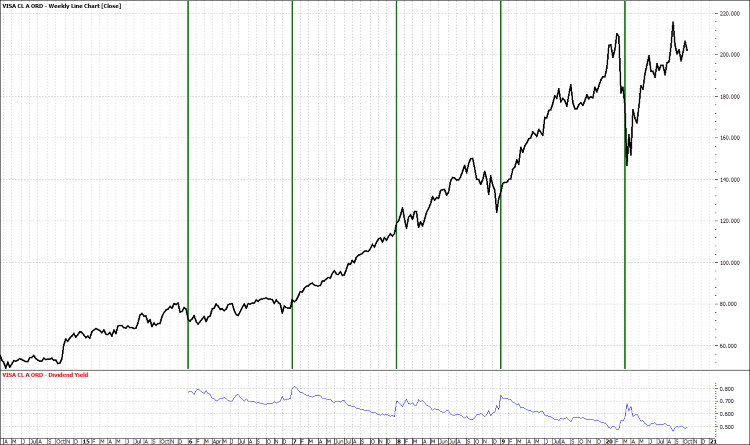

At Summit, this is an important conversation with our clients as purpose drives expectations. If you are investing primarily as a source of income, then your stock allocation is more likely to contain a healthy portion of dividend-paying stocks. Only two of the above mentioned FAANGM stocks pay dividends. Any income derived from the other four would have to come in the form of capital gains.

At Summit, this is an important conversation with our clients as purpose drives expectations. If you are investing primarily as a source of income, then your stock allocation is more likely to contain a healthy portion of dividend-paying stocks. Only two of the above mentioned FAANGM stocks pay dividends. Any income derived from the other four would have to come in the form of capital gains. Here is a simple activity to start teaching your child the different ways of managing their cash flow and the consequences. This idea builds on an article I read before I even knew I was going to be a parent. It was written by someone writing under the name of Michael Masterson in one of the first email newsletters I ever subscribed to called “Early to Rise.”

Here is a simple activity to start teaching your child the different ways of managing their cash flow and the consequences. This idea builds on an article I read before I even knew I was going to be a parent. It was written by someone writing under the name of Michael Masterson in one of the first email newsletters I ever subscribed to called “Early to Rise.” Just a quick note, we have seen, and in fact our oldest daughter at one time received, a bank like this one pictured here, from a well-intentioned friend, However, as you’ll hopefully note below, this style of one-for-all bank doesn’t provide as much of a physical impact for the child as having the three separate ones.

Just a quick note, we have seen, and in fact our oldest daughter at one time received, a bank like this one pictured here, from a well-intentioned friend, However, as you’ll hopefully note below, this style of one-for-all bank doesn’t provide as much of a physical impact for the child as having the three separate ones.

By age four, your child will probably understand concepts like food, money, appliances, and time. Almost every family has at least one relative who sends money to your child for birthdays or holidays. Assuming that the money was in lieu of a gift, you will want to take your child to the store and let them exchange the money for something they want (toy, pet, clothes, whatever is deemed appropriate). If the money is intended for savings, then take your child to the bank and have them deposit it with you or, if they already have a savings bank at home, have them place it in there.

By age four, your child will probably understand concepts like food, money, appliances, and time. Almost every family has at least one relative who sends money to your child for birthdays or holidays. Assuming that the money was in lieu of a gift, you will want to take your child to the store and let them exchange the money for something they want (toy, pet, clothes, whatever is deemed appropriate). If the money is intended for savings, then take your child to the bank and have them deposit it with you or, if they already have a savings bank at home, have them place it in there. If you don’t want to take the chance that you will end up going home and driving right back to the store, you can always “lend” your child the money to buy the toy with the understanding you will be paid back as soon as you get home. I tried this once and it did not end well. Not only was there another stuffed animal to pick up every day, but there was also a very sad little girl who, upon seeing how empty her bank had become, quickly decided that she didn’t want the toy anymore.

If you don’t want to take the chance that you will end up going home and driving right back to the store, you can always “lend” your child the money to buy the toy with the understanding you will be paid back as soon as you get home. I tried this once and it did not end well. Not only was there another stuffed animal to pick up every day, but there was also a very sad little girl who, upon seeing how empty her bank had become, quickly decided that she didn’t want the toy anymore.

During their initial training, financial advisors are taught to ask about a client’s goals for incorporation into their personal financial plans. Some of these goals can be “retirement at a certain age”, “a comfortable retirement”, “putting the kids through school”, “a condo in Aspen, Florida, Spain”, etc.

During their initial training, financial advisors are taught to ask about a client’s goals for incorporation into their personal financial plans. Some of these goals can be “retirement at a certain age”, “a comfortable retirement”, “putting the kids through school”, “a condo in Aspen, Florida, Spain”, etc. Therefore, prioritization must always favor needs over wants. While that may seem self-evident as you read this, I can assure you that many clients have a difficult time discerning needs from wants and an even harder time accepting the need to prioritize them, especially during times of financial abundance. Once the list has been divided into wants and needs, the prioritization can then take place starting with needs. In our Foundations of Wealth model, we define three levels of wealth that a client can attain:

Therefore, prioritization must always favor needs over wants. While that may seem self-evident as you read this, I can assure you that many clients have a difficult time discerning needs from wants and an even harder time accepting the need to prioritize them, especially during times of financial abundance. Once the list has been divided into wants and needs, the prioritization can then take place starting with needs. In our Foundations of Wealth model, we define three levels of wealth that a client can attain: Achieving a financially comfortable state is the longest and most difficult goal to reach. The reason for this is that it is usually the hardest state to define. Financial comfort for a single person making a six-figure income is much different than a two-income family with three kids, and as we have either seen or experienced ourselves, single people can become married and childless couples can become parents in a very short period of time. On the flip side, married couples can become single through death or divorce and one-child families can become 4-child families through second marriages or similar events.

Achieving a financially comfortable state is the longest and most difficult goal to reach. The reason for this is that it is usually the hardest state to define. Financial comfort for a single person making a six-figure income is much different than a two-income family with three kids, and as we have either seen or experienced ourselves, single people can become married and childless couples can become parents in a very short period of time. On the flip side, married couples can become single through death or divorce and one-child families can become 4-child families through second marriages or similar events.

As time went on, I noticed that most of the people surfing were in a state of constant motion. With each wave that rose up, they would scramble to get in front of it and stand on their boards, only to end up back in the water within seconds. They would then retrieve their boards and try to catch the very next wave, often not even making it back out to their original starting point before attempting another ride.

As time went on, I noticed that most of the people surfing were in a state of constant motion. With each wave that rose up, they would scramble to get in front of it and stand on their boards, only to end up back in the water within seconds. They would then retrieve their boards and try to catch the very next wave, often not even making it back out to their original starting point before attempting another ride.

That’s how I usually get started when I’m ready to climb on my soap box and discuss building wealth with anyone willing to listen. While I believe all of these institutions are reputable (in fact I have an account with Ameritrade), the “trade” in each of their names represents what I feel is a disturbing aspect of the investment industry; short-term thinking.

That’s how I usually get started when I’m ready to climb on my soap box and discuss building wealth with anyone willing to listen. While I believe all of these institutions are reputable (in fact I have an account with Ameritrade), the “trade” in each of their names represents what I feel is a disturbing aspect of the investment industry; short-term thinking. Compared to the excitement of finding the next moonshot stock, dividend investing is boring. In using dividends to secure financial independence, a portfolio of securities is run like a rental real estate portfolio. Each investment is made in anticipation of a future cash flow and judged versus the initial cost of that investment. The investor does not make any assumption of the future price of the stock as that price could be momentarily “unfairly” impacted by the market’s lack of enthusiasm for the business.

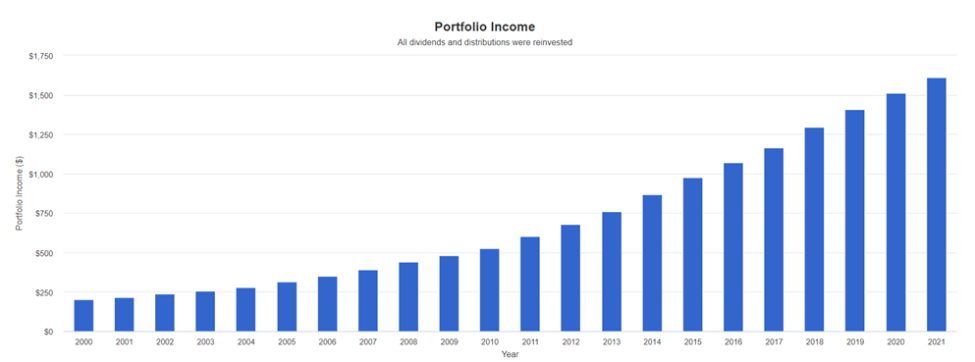

Compared to the excitement of finding the next moonshot stock, dividend investing is boring. In using dividends to secure financial independence, a portfolio of securities is run like a rental real estate portfolio. Each investment is made in anticipation of a future cash flow and judged versus the initial cost of that investment. The investor does not make any assumption of the future price of the stock as that price could be momentarily “unfairly” impacted by the market’s lack of enthusiasm for the business.