The Piggy Bank Portfolio

By the time your child reaches age eight, there is a chance that they may have started to accumulate some savings and might even have a savings account at a local bank or credit union.

With the standard bank savings account paying only 0.01% (yes, 1 one hundredth of a percent!) and charging fees for accounts with less than certain minimums, the only positive lesson your child can glean from having one is that at least their “savings” are safe (except for the corrosive effect of inflation).

With the standard bank savings account paying only 0.01% (yes, 1 one hundredth of a percent!) and charging fees for accounts with less than certain minimums, the only positive lesson your child can glean from having one is that at least their “savings” are safe (except for the corrosive effect of inflation).

A different option to try instead is to open a custodial account with a discount broker and use those savings to buy stock in companies that your child likes.

The goal here is not to double their money in one year or turn one hundred dollars into a million, but to teach them the concept of business ownership and how they can participate in the success of a business. In many cases, you may not be buying them at the most “opportune time” based on different market fundamentals or measures. Those things don’t matter here, you are “investing” in an education that they are highly unlikely to get at any school they attend (including most colleges).

You may be surprised to find out that your child is a better stock picker than most money managers.

They know what products and services they like and dislike and quite often those trends are popular not only with kids but with investors in general.

As an example, let’s say your child plays with Transformers or Barbie, wears clothes bought from Target while eating Cheerios for breakfast, an occasional Happy Meal at night while watching shows streamed on Netflix.

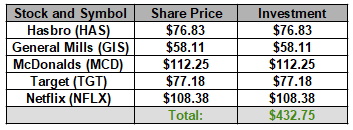

Transformers and Barbie are made by Hasbro (HAS), Cheerios are made by General Mills (GIS), the Happy meal is from McDonalds (MCD), and both Target (TGT) and Netflix (NFLX) are listed on the New York Stock Exchange and the Nasdaq respectively.

If just five years ago you had created a portfolio with one share of each of those five stocks, according to Yahoo Finance, on 10/30/15, your portfolio would have been:

Five-Year Results 10/30/2020:

Not bad for a kid!

Of course, you don’t have to buy all five stocks to make this work. When I was growing up, my grandfather bought me one share of one company, the one he worked for, and I was thrilled to be one of “his bosses!”

This is a great opportunity for your child to “get paid to learn”. I would suggest looking at the broker statements with your child every 3 months to see how their companies are doing. Checking them more often than that can create a level of impatience as many stocks don’t move very much week to week or even month to month.

I also want to direct your attention to the Dividends Received column. Too often we tend to focus on the stock price, which is what people on television will talk about.

One of the benefits of owning a successful business is sharing in the profits.

Many public companies, like four of the five above, let you share in the profits by paying dividends to the owners and make no mistake, your child is now one of those owners. In my experience doing this with kids, I have found nothing gets them more excited than to see money showing up in their accounts.

Have fun with this and let the stocks they pick mean something to them.

Do they have a relative that works for a company that issues stock?

Do they have a favorite food, movie, or toy?

What would they would make if they owned a company?

Again, the idea is not to pick stocks that double your money overnight but to identify businesses they’d like to own and to teach them how they can become owners and how their ownership can be rewarded.