This conversation actually happened in my office.

This conversation actually happened in my office.

Visitor: “I need five million dollars to retire.”

Me: “When do you want to retire?”

Visitor: “In five years.”

I did some quick number crunching. Based on his age and an average life expectancy, he wanted to spend about $130,000 per year in retirement even though he was only spending a third of that amount now. When I asked why his expenses would triple in retirement, he had no real answer. It became obvious there was no reasoning behind it. The $5 million retirement fund simply sounded good to him.

He also indicated he had been spooked by the 2008-2009 market crash and had a very low tolerance for risk.

I explained to him that with only five years to work with, we would need a 26% annual rate of return to grow his account from its current size to $5 million. To put it into perspective, that’s more than double the historical return of the S&P 500. In order to make a go at that kind of return, we’d have to take on a lot of risk, far more than he was willing to accept.

When I told him this, his response was that it’s my job to figure out how to get him the amount he wanted without too much risk and that’s what I get paid to do. I don’t know who his current advisor is, but I wish them luck.

What is truly sad about this story is that exchanges like the above are often the extent of financial planning for many people.

The Retirement Environment Has Changed

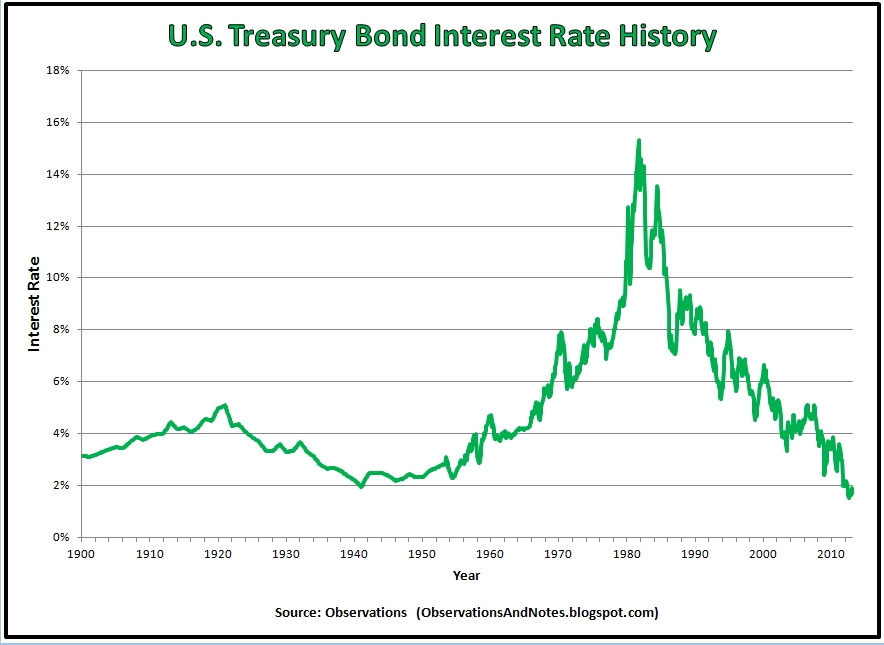

I completely agree with the idea that retirement should not be based solely on age. I also believe it should not be based solely on a single number. Focusing on investment assets, like my visitor above, largely stems from a recent, although brief, point in time when 10-year Treasury yields were high enough to fund a “low risk” retirement.

From the mid 1960’s up until about 2008, you could convert a $1,000,000 stock portfolio into 10 Year Treasury bonds and collect at least $50,000 per year before taxes. It was easy to calculate the amount you needed to accumulate for retirement.

In September, 2020, however, the current 10-year treasury yield is 0.68%. Good luck trying to live on the $6,800 a million-dollar investment will generate annually. And even if you were to commit to 30-year Treasury bonds instead of 10-year bonds, you would still only generate about $14,000 a year per million dollars invested.

How Much Do You Really Need?

The focus needs to shift back to the lifestyle you want once you no longer have employer-provided income and benefits. The first step is to figure out how much money you will need yearly in retirement to support the lifestyle you desire.

You can (and should) figure this out immediately.

The difference between your annual spending amount and your retirement income (if any) is your retirement cash flow requirement. This is the amount your investments will have to provide to bridge the gap between your income and your expenses.

A Simple Process

The best way to get started is with your current spending levels. Many people envision a very different lifestyle in retirement. It turns out that retirement is not that different from your working life. You will absolutely continue to need food, clothing, and shelter. You will most likely eat out as often, go to movies, take vacations, and celebrate holidays as you do now.

And since you have a reasonable understanding of what these things cost today, your current expenditures will provide a good baseline for an estimate of what your living costs will be in the future. At this point, you should account for as much of your necessary, unavoidable monthly spending as possible (e.g. loan payments, fees, utilities, taxes, etc.) in order to see what your spending level is today.

And since you have a reasonable understanding of what these things cost today, your current expenditures will provide a good baseline for an estimate of what your living costs will be in the future. At this point, you should account for as much of your necessary, unavoidable monthly spending as possible (e.g. loan payments, fees, utilities, taxes, etc.) in order to see what your spending level is today.

Once you’ve done this, the next step is to start eliminating any line items you know will not be needed in retirement. One word of caution from personal experience: my parents originally thought that they would be able to get by with just one car but soon realized that wasn’t possible. You will probably find that some items cannot be eliminated but can be reduced. As a side project, this is also a good time to reflect on everything you are spending money on and ask yourself what you really need. Anything you can cut out today makes it easier to live an enjoyable life tomorrow.

Now Consider Your Retirement Lifestyle

Now that you have a list of things you will need to spend money on in retirement, it is time to add in those items that you want to spend on. For many, it is spending a few months in a warm climate, taking an extra vacation every year, or joining a country club. Some want a “fun car” for warm summer days or a remodeled house if living out retirement in the same home is part of the plan.

Now that you have a list of things you will need to spend money on in retirement, it is time to add in those items that you want to spend on. For many, it is spending a few months in a warm climate, taking an extra vacation every year, or joining a country club. Some want a “fun car” for warm summer days or a remodeled house if living out retirement in the same home is part of the plan.

Whatever it is you would like to have or do while retired, add it in with a best estimate, even if it means getting quotes from local contractors. Better to get the numbers correct now than guess low and be low and unable to afford it in retirement.

Adjust for Retirement Income

After you have completed all the steps above, you now have a retirement budget based on your desired quality of life in today’s dollars. From these costs, subtract any known or expected sources of income that you are confident you will receive in retirement. These sources include Social Security benefits, pension and annuity payments, income from real estate rentals, even side or part time jobs. Just make sure that you can reasonably expect this income to continue well into retirement.

For example, let’s say that your current lifestyle expenses add up to $60,000 per year. You expect to receive $24,000 annually from Social Security and your spouse should receive another $12,000 per year. In addition, you have an annuity that will pay you $2,760 per year for the rest of your life.

Subtracting the income sources above from your anticipated annual expenses leaves $21,240. This is your net retirement cash flow requirement and represents the amount of money your investments will have to generate per year to provide for the lifestyle you desire.

Having determined your net retirement cash flow requirement, we can now focus on your accumulated savings and investment positioning to determine whether changes are needed to reach your retirement plans.

Determine Your Financial Independence Number

Continuing with our example, suppose you have a $250,000 portfolio of dividend-paying stocks yielding 4% in your IRA. The portfolio would provide $10,000 in distributions this year, just under 50% of the cash flow needed as calculated above. We can quickly approximate that a doubling of the amount in your investment portfolio or your investment return is necessary if you wish to retire this year, without having to deplete your principal through the sale of assets. Therefore, the size of the retirement nest egg you need, or your financial independence number, would be approximately $500,000 based on the current investment portfolio positioning.

Knowing your financial independence number, we can then look at different options available to close the gap between your Retirement Cash Flow Requirements and your financial freedom number. From here, we’ll put a plan together (with room for adjustments to spending, investments or retirement contributions) in harmony with your current situation and desired future.

Track Your Progress

Of course, none of this means anything without follow through. Just like with your overall health, your financial health needs annual check-ups. In any given year, you might change jobs, homes, or receive an unexpected windfall. All of these events would impact key numbers relating to your retirement and need to be accounted for.

Of course, none of this means anything without follow through. Just like with your overall health, your financial health needs annual check-ups. In any given year, you might change jobs, homes, or receive an unexpected windfall. All of these events would impact key numbers relating to your retirement and need to be accounted for.

At Summit, we call this your Annual Financial Snapshot. Just like many families have portraits taken every year to memorialize their changes through the years, we produce a snapshot of your current financial situation to keep up with your changing circumstances every year. The goal is to make sure that your finances are always in focus.

Additionally, we provide our clients with a “Projected Cash Flow” report every quarter to give clients a better understanding of the cash flow being produced by their current investment portfolio.

A survey by the Employee Benefit Research Institute showed that in 2020, only 44% of people said they had thought about how much money they will need to retire comfortably. More than half of respondents had not thought about it.

There is no reason for not knowing your financial health, any more than your physical health. With this simple process, you can restore order to your long-term plan and actively manage your path to a brighter retirement.