With the current stock market uptrend now the second longest bull market on record, and the economic expansion the third longest since the end of WWII, there’s been a lot of talk and, in some cases warnings, that both of these trends are in danger of coming to an end. Our short answers to these two questions are no and no.

First the economy. While we admit that very recent economic releases have come in somewhat below expectations, there are a number of solid reasons to believe that economic growth will continue to move forward. First and foremost, the Federal Reserve, while gradually bringing short term rates up to more normal levels, continues monetary policies that are far from being restrictive and has no desire to slow or stop economic growth since inflation is well below the target of 2%. The Fed, of course, also understands that the continuation of economic growth is important to lowering government deficits.

And because U.S. Corporations today derive about 50% of their profits from overseas, we are also benefiting from the recent upturn in Europe and Japan, as well as from the policies of their Central Banks which are on the same growth objective as our Federal Reserve. This synchronization of global markets presents a strong case that economic growth will continue to grow in the U.S. despite having already achieved one of the longest expansions over the past 70 years. In our opinion, there is a near zero percent chance a recession will present itself in the next 12 – 18 months.

That’s very good news for the stock market which tends to react to, with leads and lags, to the ups and downs of the economy. Other factors, such as a major geopolitical crisis or a financial crisis, can also cause a bear market. At the current time, however, we do not recognize there to be any critical financial issues or serious geopolitical risks.

While it’s unfortunate that North Korea apparently has nuclear weapon capability, they suffer from shortages of motor fuel, food, equipment and sanitation and health care for troops in the field. The Kim family regime recognizes they would lose control of the country should they start a war they have no chance of winning against the U.S. and its allies.

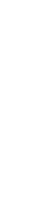

We have been positive on the outlook for U.S. stocks over most of the past eight years. One day we will turn bearish, but that won’t happen until we believe a recession is on the horizon. Right now we see more positive factors than negative ones. U.S. business and consumer confidence and corporate earnings are at record levels.

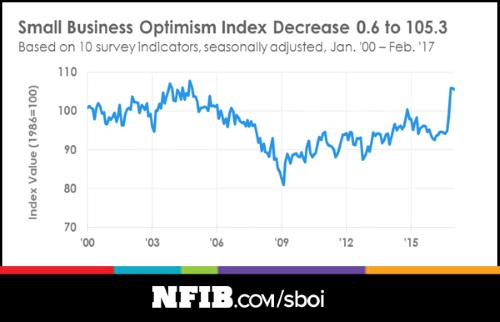

The number of available jobs is near record levels and more people are returning to the workforce. Consumer and business sentiment are near record highs while low inflation and interest rates justify (support) current stock prices, in our opinion.

Other issues that could temporarily derail the current uptrend of the market are unfortunate events like the recent Virginia disturbance and past Government shut-downs due to politicians bickering over the nation’s debt ceiling. These and similar issues tend to cause only short term disruptions for the market.