The Hierarchy of Financial Goals

During their initial training, financial advisors are taught to ask about a client’s goals for incorporation into their personal financial plans. Some of these goals can be “retirement at a certain age”, “a comfortable retirement”, “putting the kids through school”, “a condo in Aspen, Florida, Spain”, etc.

During their initial training, financial advisors are taught to ask about a client’s goals for incorporation into their personal financial plans. Some of these goals can be “retirement at a certain age”, “a comfortable retirement”, “putting the kids through school”, “a condo in Aspen, Florida, Spain”, etc.

While it is very important to engage with clients and create a plan that incorporates their tangible goals, I believe that it is incumbent upon us to guide them through their goal setting so that over time, investment positioning is truly in harmony not only with a client’s financial goals, but their financial risks.

To create this harmony, the purpose of each investment position needs to be aligned with the block of money allocated to any single or set of related goals. Just as important though, is for the goals to be established in a logical hierarchy of building a client’s “financial house”. In other words, you don’t start digging a swimming pool when you haven’t first funded and then completed the bathrooms and kitchen.

Every client has goals that are made up of a combination of wants and needs. We refer to these as “life’s aspirations” as they are highly individualized. These aspirations must be prioritized for the plan to be robust in all kinds of personal economic situations that the client may face throughout their life.

The first step is to work with the client to define their life’s aspirations so that they are both tangible and easily measured in terms of cash flow. For example, a comfortable retirement needs to be defined as spending $X thousand per month accounting for inflation while putting the kids through college would be $X thousands per year, for a certain number of years starting in year Y. It is important to understand that this list is highly dynamic and that items will most likely be added or removed as life’s journey continues.

Once this list has been sufficiently developed, these aspirations must be identified as either a need or a want with respect to the client’s financial situation. For instance, while they may feel that paying for an education from Stanford is a need, one can argue that even the desire to pay for tuition at the local community college is really a want as there are resources available to kids who desire to continue their education beyond high school. However, having enough life insurance to protect your assets in the event of your untimely death is clearly a need as a shortfall there could result in financial devastation for your loved ones.

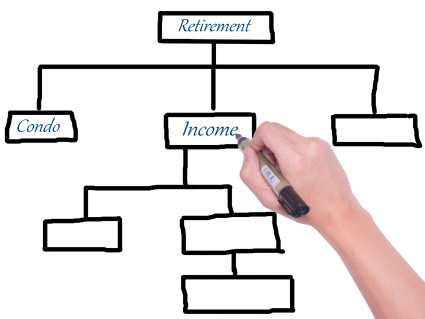

Therefore, prioritization must always favor needs over wants. While that may seem self-evident as you read this, I can assure you that many clients have a difficult time discerning needs from wants and an even harder time accepting the need to prioritize them, especially during times of financial abundance. Once the list has been divided into wants and needs, the prioritization can then take place starting with needs. In our Foundations of Wealth model, we define three levels of wealth that a client can attain:

Therefore, prioritization must always favor needs over wants. While that may seem self-evident as you read this, I can assure you that many clients have a difficult time discerning needs from wants and an even harder time accepting the need to prioritize them, especially during times of financial abundance. Once the list has been divided into wants and needs, the prioritization can then take place starting with needs. In our Foundations of Wealth model, we define three levels of wealth that a client can attain:

- Financially Secure

- Financially Comfortable

- Financially Affluent

It is through the creation of an initial financial snapshot that we determine what level of wealth a client has attained, if any, and; what gaps exist between where the client is and their next level of attainable wealth.

Financial security prioritizes two specific areas of investment:

- Asset protection

- Income

At the most basic level of personal finance, the first priority is to be properly insured, including not only property and casualty insurance, but also life and disability insurance as well. Nothing will derail a financial plan faster than damages from an untimely auto accident, even a small house fire, a lawsuit, or injuries that cause you to miss work.

After insurance, the next priority for asset protection should be a stash of emergency funds equaling at least six months to one year of living expenses. These funds should be kept in cash equivalent investments whose purpose is to store wealth, so that they can be accessed quickly and easily. Some advisors have suggested having credit lines available so that you don’t have to keep as much cash around, however, in the event of job loss, any borrowed funds could quickly become another headache if the duration of the layoff is longer than initially thought.

It is also important to adjust emergency funds to keep up with changes in lifestyle, as annual expenses change and usually increase so, therefore, should the emergency stash. I have used my emergency funds for even small emergencies such as a sudden appliance breakdown or new tires and minor medical payments. As a matter of habit, I just automatically add 5% of my take home pay to my emergency fund every month to make sure that it is always replenished when I use some of it.

The next priority is income. We believe Financial Security means that you can pay your basic living expenses without the need of a W-2 paycheck (50% income as Robert Kyosaki’s rich dad called it). It’s not any more complicated than that. Income can be derived either from capital gains or distributions also known as passive income. While each advisor will have their own opinion, we believe that the accumulation of good, income-producing assets is the foundation of any investment strategy.

The next level of wealth is the state of being financially comfortable. This simply means that on top of having enough income to cover our basic living expenses, we can now also cover what we call event based expenses.

It is here that the goals start to naturally shift from needs to wants. In the pursuit of financial security, we are generally focused on needs. Event based expenses start to creep into the category of wants, although some event based needs may also be identified. Events are temporary and usually one-time occurrences, although paying college tuition for three kids, while temporary, is a longer duration example.

The goals that consume event based expenses fall into typically consist of college expenses, weddings, once-in-a-lifetime trips, second / vacation homes and milestone birthdays. Nothing should be considered too small to fit in this category.

Achieving a financially comfortable state is the longest and most difficult goal to reach. The reason for this is that it is usually the hardest state to define. Financial comfort for a single person making a six-figure income is much different than a two-income family with three kids, and as we have either seen or experienced ourselves, single people can become married and childless couples can become parents in a very short period of time. On the flip side, married couples can become single through death or divorce and one-child families can become 4-child families through second marriages or similar events.

Achieving a financially comfortable state is the longest and most difficult goal to reach. The reason for this is that it is usually the hardest state to define. Financial comfort for a single person making a six-figure income is much different than a two-income family with three kids, and as we have either seen or experienced ourselves, single people can become married and childless couples can become parents in a very short period of time. On the flip side, married couples can become single through death or divorce and one-child families can become 4-child families through second marriages or similar events.

This highlights the importance of the annual financial snapshot. From year to year you may find the gap between where you are, and financial comfort has narrowed or widened. That means that adjustments and even compromises must be made. It is also important to use the snapshot throughout the year as you are faced with circumstances and decisions which can impact your ability to achieve your goal. A few minutes reviewing a what-if analysis can provide objective clarity to most financial decisions.

The third and final level of wealth, affluence, is made up entirely of wants. We call these life issues “Dreams and Visions” and they hold the least priority in your personal finances. Many clients dream of having a wing at a hospital or university named after them or establishing a charitable foundation to keep funding their favorite causes after they are gone. What ever these goals may be and whatever amounts are desired, they should only be addressed after all the previous goals have been attained.

In summary, the hierarchy of goals places needs over wants, the client over others (including family members) and security over luxury:

- Asset Protection – invest to protect wealth

- Emergency Funds – invest to store wealth

- Living Expenses – invest to derive income from wealth

- Event-based expenses – invest to grow and derive income from and to store wealth

- Dreams and visions – invest to grow and derive income from wealth

With life’s aspirations clearly defined and placed in the proper categories, investment choices become subject to a much easier analysis and the anticipated outcomes become much better aligned with the expected plan performance.