Remember Why You Bought It

Imagine that it’s 2007 and you own a rental property. You paid $175,000 for it and now it is currently worth approximately $200,000. It‘s located an older, but, good neighborhood with access to good schools and shopping close by. You have a full-time renter paying $1,000 monthly and you are realizing a net profit of $250 per month from the property after all taxes and expenses are considered.

Over the next year however, the 2008 financial crisis hits and, while your renter still has their job and is making the payments on time, the “pop” of the housing bubble has caused the market value of your property to drop 30%. In other words, what you could sell for $200,000 a year ago now would only sell for $140,000, less than what you originally bought it for. What do you do?

Think about it, the neighborhood is the same, the rent is the same, the only thing that has changed is what the home-buying market perceives the value of the property to be. Put another way, the new “value” is what a buyer is willing to pay for the property today. Would you sell and cut your “losses”? After all, your total net worth has been reduced by $60,000 already.

If you say you would sell and cut your losses, then you are in some pretty good company: equity investors have dumped shares of global powerhouse businesses such as Microsoft, McDonalds, Apple and Disney in April, sending the share value down dramatically in a very short time.

McDonalds Weekly Bar Chart

Microsoft Weekly Bar Chart

Apple Weekly Bar Chart

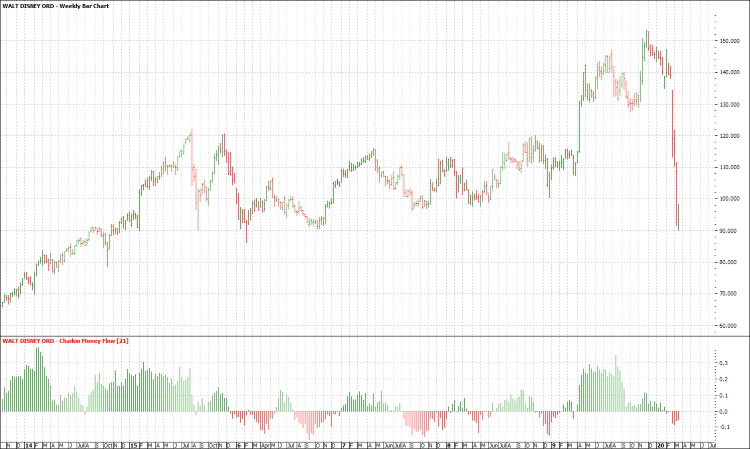

Walt Disney Weekly Bar Chart

Each of these companies pays a dividend, and have a history of raising their dividends over time as revenue and earnings grew, so why would shareholders sell now? Because the market has priced them lower than they were a month ago?

Sure, their short-term financial performance may sour due to the Coronavirus response. But does anyone not think that Disney theme parks won’t reopen and fill up again just as they did after all the other global pandemics we’ve had just in this century alone? Will their new streaming service become less valuable as more people are forced to stay indoors? Is anyone using their phones and tablets less because of the virus? Here in California, restaurants were limited to pick-up, carryout or drive through services, when was the last time you ate or even ordered food inside a McDonalds? While we are not making a recommendation to purchase these stocks and this does not suggest that people don’t trade these stocks for capital gains, they do serve as examples of “great rental properties” impacted by short-term market turmoil.

There are two basic ways that people make money in real estate. Some of them “fix n flip” while others build a portfolio of investment properties that will provide a stream of income through rent collection. We do not hold one out as superior to the other. Similarly, there are two broad ways people make money in the markets; trading for capital gains or investing for income through dividends, interest or other types of distributions.

The point is to be very clear on what your strategy is before buying so that in times of market turmoil, as we are currently experiencing, you will have the emotional clarity to stick with your plan. If you are investing for income and believe that the companies you own will survive and prosper in a post-coronavirus world, then a market sell-off should not frighten you and may even be presenting an opportunity.