The Dividend Magnet Effect

Obligatory Disclaimer: This article is for illustration purposes only and in no way should it be considered as a recommendation for a particular stock, ETF or Mutual Fund. All investing involves the risk of loss.

Visa (V) is an example of a “terrible” dividend paying stock.

The current dividend yield, as quoted on Yahoo Finance, is just 0.61% (as of 10/20/2020). That means that $10,000 invested in Visa will generate a meager $61 of annual income for your account.

But does that make Visa a bad investment? A deeper dive into the data provides a little more insight into the true value of the stock.

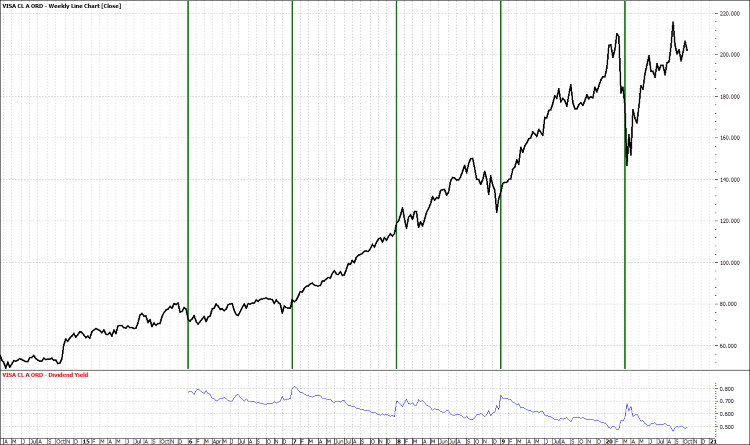

Visa started paying a dividend of $.0263 per share in the 3rd quarter of 2008. In October of 2009, they increased the dividend by 19% to $.0313. In October of 2010, they raised the dividend another 19% to $.0375. In October 2010, the increase was 46%. In fact, since 2008, the average annual increase in dividends paid out to shareholders is 20.95%; certainly a very solid performance.

Why then, with nearly 21% average annual increases, is the yield still paltry and less than 1%?

The answer is that the price of the stock has risen faster than the rate of dividend increases, keeping the yield, which is calculated as the dividend divided by the share price, relatively low.

Visa Weekly Price Chart Versus Dividend Yield

While some will argue that the stock is being driven up by growth investors, its 5-year average rate of sales growth is only 12% and its 5-year average rate of earnings per share growth at 18% is very good. In comparison, though, according to the Stock Screener at Finviz.com, there are 491 companies sporting 5-year sales growth above 25% and 754 companies with 5-year EPS growth above 25% despite the COVID19 pandemic. The attractions of “growth” alone do not adequately explain the stock’s performance.

So, if the stock price is rising even faster than the dividend despite less than exceptional sales and earnings growth, what explains the stock’s strong price performance?

It may be that the price is being driven by something called the dividend magnet affect. In essence, the stock’s price return is simply following (more or less) the dividend payments like a bar of iron follows a magnet. In the case of Visa, the stock’s price return has averaged more than 28% annually over the same 5-year period.

We always hear about dividend investors and growth investors, however, there exists a hybrid category of dividend growth investors.

These investors seek out companies that are consistently growing their dividend payments. They are willing to pay up for future dividend growth, pulling the share price up in line with dividend growth.

This strategy of investing in dividend growers is not without risk. The company could have a year where the dividend is not increased at all or the increase is disappointing relative to expectations. In these cases, it would not be surprising to see the stock sell off. And, it goes almost without saying, that a dividend cut, or complete omission of the dividend, would be devastating. So, additional analysis regarding dividend safety needs to be done before one can buy shares with a reasonable level of conviction.

At Summit, we include a multi-dimensional analysis of dividend safety of all stocks under consideration for our dividend-based strategies before they are added to a portfolio. Even the most sophisticated analysis, though, will not be right every time, and there is always a risk of a dividend reduction. But employing a sound and thorough analysis, we believe it is possible to push the odds of success in our favor.