Fourth Quarter Market Review

A Sea Change in the Markets?

This headline from Yahoo Finance on Friday, December 30, pretty much says it all:

S&P 500 falls 19.4% in 2022, worst year since 2008 financial crisis

More from the article:

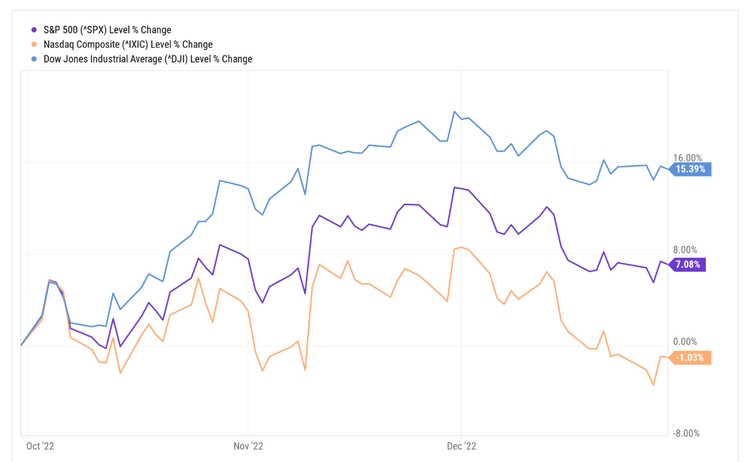

With Friday’s losses, the S&P 500 fell 19.4% in 2022, its largest calendar-year decline since a 38% drop in 2008. Closing at 3,839.50 on Friday, the S&P 500 now stands at the same level as March 2021. The Nasdaq Composite dropped 33% and stands at the same level as July 2020. The Dow, meanwhile, fell a comparably modest 9% in 2022, while the bond market suffered through its worst year in modern history.

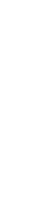

Zooming in on the 4th quarter, we see a strong gain in the S&P 500 and a very strong gain in the Dow, while the more interest rate sensitive Nasdaq saw a modest loss.

Adding TNX (the CBOE Ten Year Treasury Note Yield Index) to the full year chart, we see confirmation that the Fed is driving market returns through its rate actions.

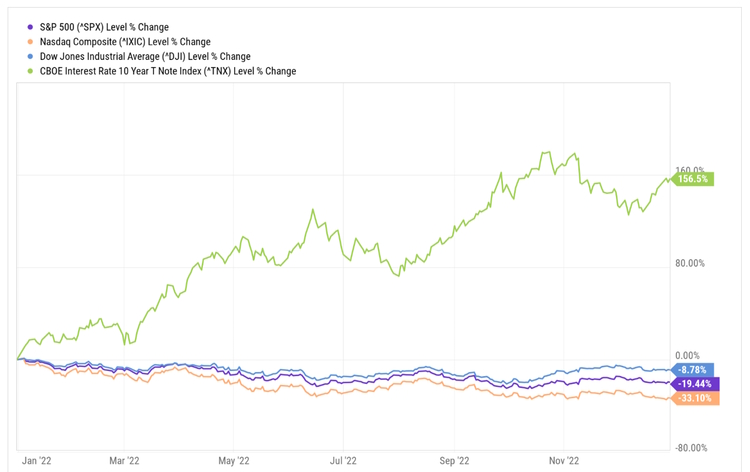

This Index is based on the yield-to-maturity of the most recently auctioned 10-year Treasury note. The notes are usually auctioned every three months in February, May, August, and November. We use TNX as a good “general” gauge of the current interest rate environment. Keep in mind that the index moves inversely with bond prices, so the gain in the index reflects a substantial drop in the value of bonds or funds that invest in bonds such as the iShares 7-10 Year Treasury Bond ETF (ticker symbol IEF).

This is one reason why we are seeing so many articles announcing the demise of the “60 / 40” portfolio, usually accompanied by an alternative strategy that has a very short performance history.

With 2022 now firmly in the rear-view mirror, let’s look at those issues that may impact the markets in 2023.

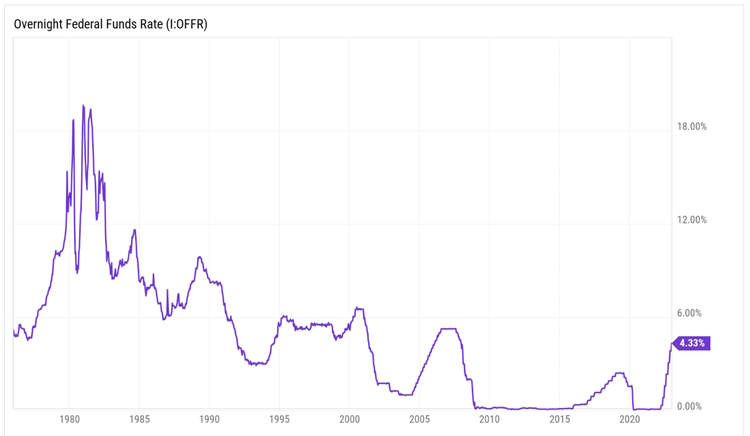

The Federal Reserve

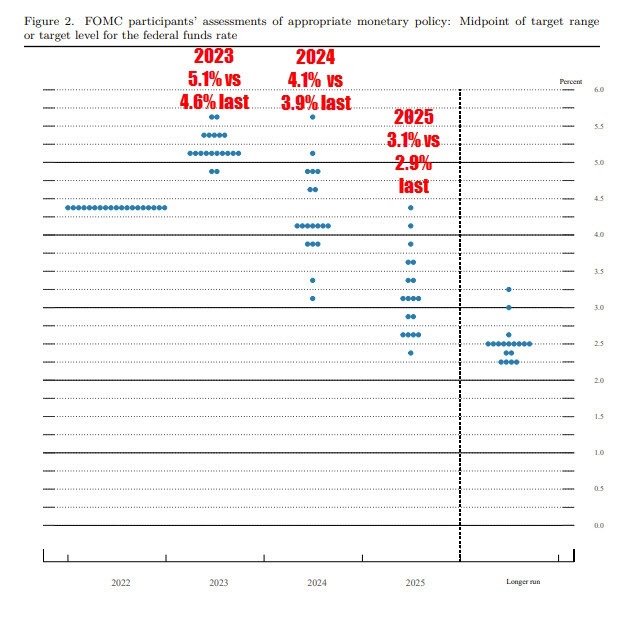

The Federal Reserve “slowed” their rate of interest rate hikes in December by increasing the Fed Funds Rate by only 50 basis points (bps), taking it to a targeted range between 4.25% and 4.50% after four consecutive hikes of 75 bps from June to November. The current Dot Plot is projecting 5.1% for end of year 2023 versus a forecast of 4.6% back in September 2022 and that there will not be a pivot from rate hikes to rate cuts until 2024.

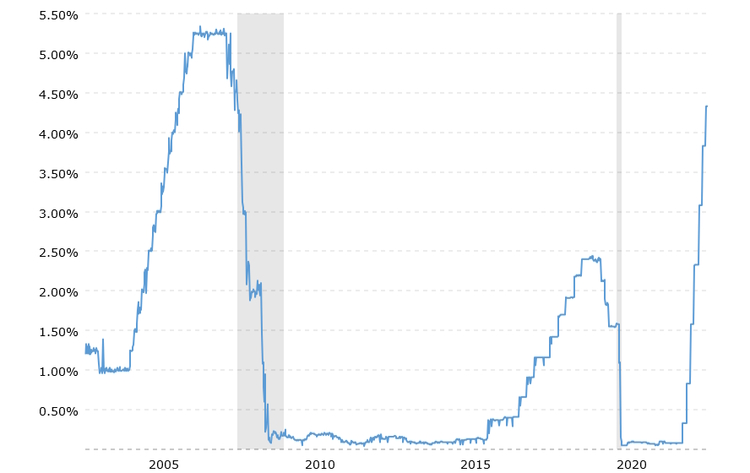

So far, the forecast aligns with our Q3 projections that Powell is using “inflation” to raise rates back up to a pre-2008 range of 4%-6% which will provide more room for cuts in the face of the next economic downturn, even if the Fed causes it.

Target Federal Funds Rate 2000 – Present

With the December rate hike putting the current range at 4.25% – 4.50%, it would not surprise us to see another 50 bp hike at the January / February meeting and then a 25 bp hike in the March meeting taking the range to 5.00% – 5.25% before announcing a pause.

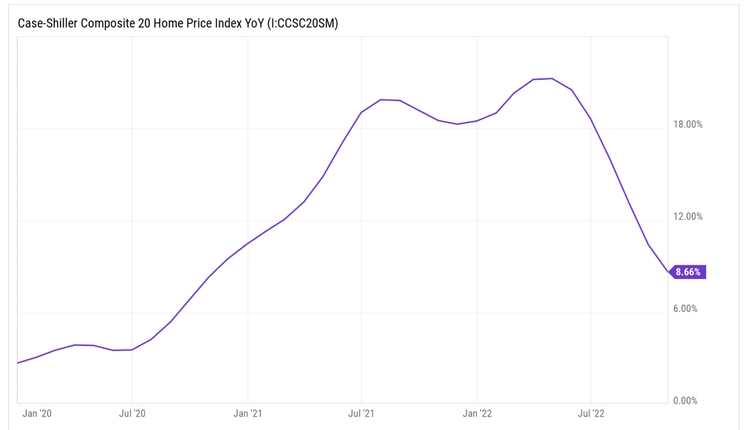

This would fit with our belief that the year over year rate of inflation from March 2022 to March 2023, will be substantially “lower” than what we saw between March 2021 and 2022, as the intial spikes from the various inputs have subsided and home prices in particular have “crashed” from June highs.

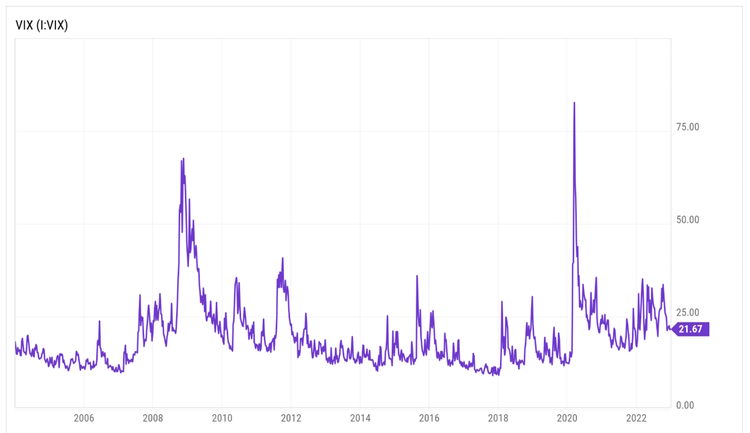

An announced pause in rate hikes will help to establish a floor for the markets and serve to reduce market volatility which remains elevated compared to recent levels.

There are two caveats to our theory that we must point out.

“Push me-Pull you” Economic Policies

We know that Federal Reserve and government officials speak with each other both in formal hearings as well as behind closed doors. The current Treasury Secretary IS the previous Fed Chair before Powell. We also know the official narrative is that this inflation is caused by all the stimulus spending over the past two years. Yet, since the end of the year, Congress has passed two massive spending bills; the Orwellian, “Inflation Reduction Act” and the more aptly named “Omnibus Spending Bill.”

The two bills combined will add approximately $2.4 trillion of new spending to the $2.8 trillion (fiscal 2021) budget deficit.

The spending initiatives are so vast that it is beyond our capability to know their short-term impact on costs. The likely case for the markets, and the rest of us for that matter, is that this new spending exacerbates upward pressure on prices and forces the Fed to raise rates higher for longer than currently planned.

Supply-Driven Inflation

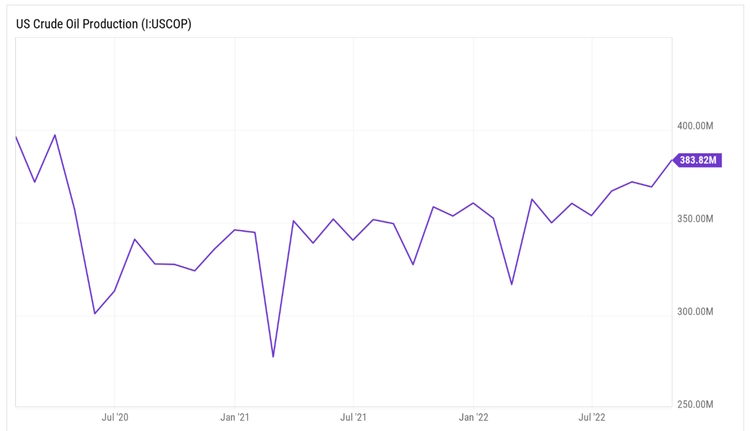

No modern economy can thrive without a source of low cost and reliable energy. Domestic oil production is still sitting below pre-pandemic 2020 levels which translates into higher prices as demand continues to increase.

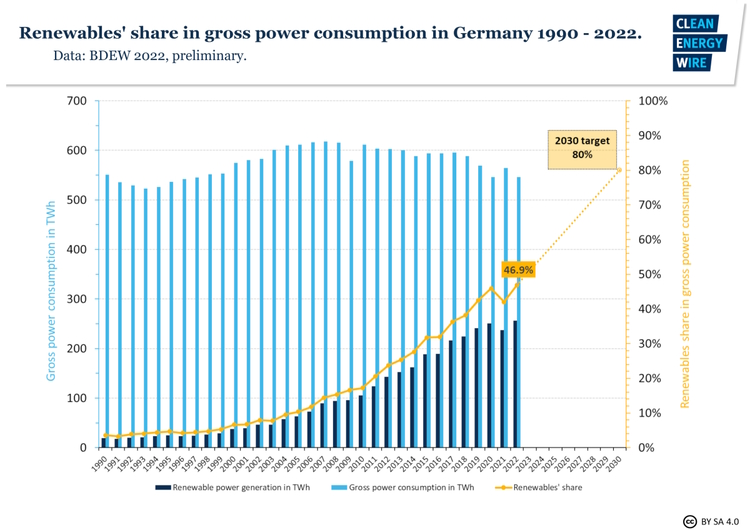

And while the Inflation Reduction Act allocates billions of dollars to the development of wind and solar power, those technologies cannot replace oil and gas as currently configured. In Germany, a country the size of the state of Montana, the government has spent nearly $500 billion to convert energy production to wind and solar from oil, natural gas and nuclear power, yet the economy remains highly dependent on (previously Russian) natural gas for energy production.

Instead of learning from Germany’s mistakes, the US Energy department seems determined to follow it and the EU down the same path.

In contrast, China, who did not connect its first nuclear power station to the grid until the early 1990s, now has a massive 228 nuclear reactors in development, according to GlobalData.

Should energy prices resume an upward trajectory, this will continue to impact prices across the economy and make taming inflation via the Fed’s current strategy even more difficult.

Balance Sheet Redux

In addition to direct rate hikes, the Fed continues to allow up to $60 billion in Treasury securities and $35 billion in agency mortgage-backed securities (MBS) to mature and roll off its $8.5+ trillion balance sheet each month (an operation coined “quantitative tightening”) as part of its battle against inflation. These actions will continue to prop up interest rates, even after an announced pause, and so it is hard to gauge if this will have a muting effect on the markets. They will however, better position the Fed for the next financial crisis as they have become the world’s central bank in these situations.

Persistent Higher Prices

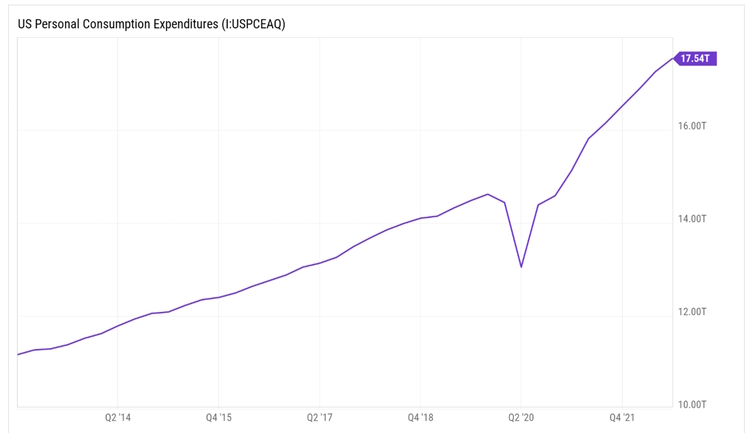

Remember that PCE (Personal Consumption Expenditures) is a measure of the prices people in the United States pay for goods and services. So, while the Fed can play games with year over year changes to justify rate decisions, the hard truth is that the cost of everyday goods and services have continued to increase and will continue to increase at an uncomfortable rate.

Not only do higher costs impact our quality of life, often forcing painful tradeoffs regarding annual spending decisions, they also impact profitability if input costs cannot be fully passed through to the consumer. Which leads to the next concern:

Earnings

According to FactSet:

For Q4 2022, the estimated earnings decline for the S&P 500 is -2.8%. If -2.8% is the actual decline for the quarter, it will mark the first time the index has reported a (year-over-year) earnings decline since Q3 2020 (-5.7%).

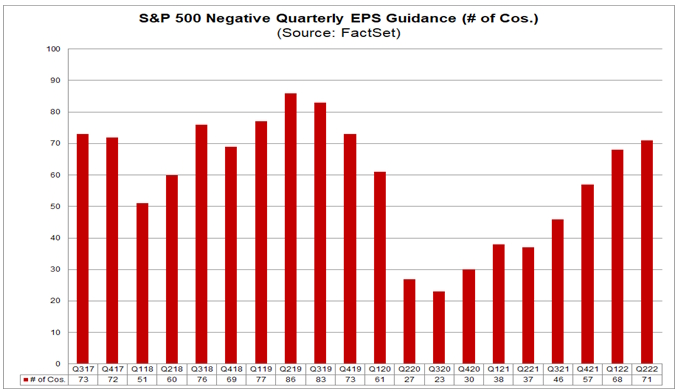

Additionally, for Q4 2022, 63 S&P 500 companies have issued negative EPS guidance and 34 S&P 500 companies have issued positive EPS guidance.

For perspective, 73 companies issued negative guidance for Q4 2019, so while this is not a good situation, it is certainly not catastrophic.

However, when combined with the current interest rate environment, it certainly can lead to more market volatility in the short term, at least until the Fed announces a pause.

This also matters to us because, regardless of short-term market direction, earnings drive dividends. Specifically, dividends are a distribution of corporate earnings to eligible shareholders as determined by a company’s board of directors. Any slowdown in earnings growth can have a negative impact on annual increases of dividend payments made by the companies we own.

Recession

As of 12/30/22, the yield curve remains inverted, again signaling the possibility of a recession occurring in 2023.

Looking beyond the US, International Monetary Fund Managing Director Kristalina Georgieva said the group anticipates one-third of the global economy will experience a recession in 2023.

In these days of non-stop government intervention, a recession can be a double-edged sword. On one side, we see higher unemployment, lower economic activity, higher deficit spending, and typically lower sales and earnings (see above). On the other hand, a slowdown would certainly force the Fed to pause on interest rate hikes or possibly to slowly cut rates as indicated in their latest dot plot, which would likely provide at least a short-term boost for the markets.

Looking at the three most recent recessions, we can see that the Fed has been quick to drop rates and drop them substantially with each succeeding downturn, and the market has responded positively.

The worst-case situation would be “stagflation” where the economy dips into recession, but supply-side cost drivers, particularly energy, continue to push the Fed’s measure of inflation higher. It wasn’t that long ago we were reading that the Fed had “painted themselves into a corner” with zero interest rates and a wobbly economy. Now it seems that they could be sitting in a different corner with stubbornly high inflation and a recession. We addressed stagflation in our First Quarter 2022 Market Review.

Ukraine / Nuclear War

As the war drags into its 11th month with no end in sight, Russian President Vladimir Putin devoted his annual New Year’s address on Saturday to rallying the Russian people behind his troops and pledging victory over Ukraine and a West “intent on destroying Russia.”

Again, it is difficult to find facts through the fog of war, but we are clearly seeing Ukraine as a proxy for a larger conflict.

Even before the latest Omnibus Spending Bill, which pledges an additional $48 Billion in military support, the US was already the largest contributor of resources to Ukraine from among a large contingent of western countries.

This data suggests that we are once again in a proxy war with Russia (see Charlie Wilson’s War). In addition to money and military hardware, the US is also providing a large amount of intelligence support enabling the Ukrainians to navigate around the supposedly superior Russian forces. So, while the Ukrainian forces are doing the actual fighting, the US is firmly in their corner with money, technology, and weapons.

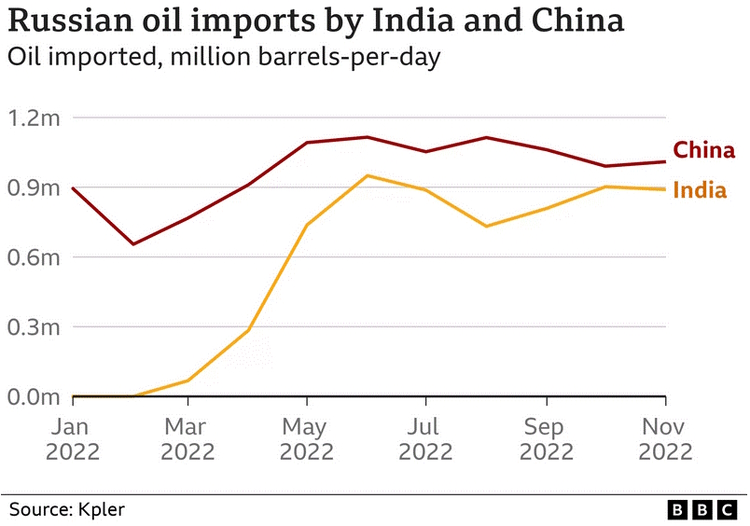

While the West is providing support for Ukraine, it is reported that Iran and North Korea are providing resources including military drones to Russia while both China and India continue to purchase oil from them.

The US government had been critical of these purchases, although it’s now made clear that it accepts that India can continue to buy discounted Russian oil.

While these actions likely mean that this war will drag on much longer, these alliances could potentially reduce the possibility of a desperate move by Putin, such as setting off a nuclear bomb. It also suggests a larger divide of the global economy than was thought possible even a few years ago.

We alluded to this in our Q2 Market Review in which we discussed a virtual Summit among the BRICS nations (Brazil, Russia, India, China and now, South Africa) and their ambitious list of proposals for strengthening the group’s economic and political influence.

We may be seeing a continuing realignment of the world’s countries, and certainly stronger ties between China, India, and Russia. China is the world’s second largest economy with stated global ambitions and India has now overtaken France as the sixth largest economy and has also overtaken China as the world’s fastest growing economy according to Business Insider. Both countries see the unprecedented economic warfare the US-led coalition has unleashed against Russia including expulsion from the SWIFT system which is used for international financial transfers and the freezing of the hard currency reserves of the Russian central bank.

These actions are not lost on Chinese and Indian leadership, and they may decide that it is in their long-term best interest to reduce financial vulnerability by setting up alternative systems.

This will continue to be a situation to be watched as the West, already dependent on “cheap labor” in developing countries, continues to become more dependent on resources from other countries as a consequence of refusing to utilize their own. We think eventually the developing countries will begin to see the amount of leverage they hold and once again throw a wrench into the American-led world order.

In the 1990s, the US and its Western European allies accounted for 70% of global GDP and today that number is under 50%. The oil embargo of the 1970s is a useful example of how quickly economic fortunes can turn.

Obviously, the key player in all of this is…

China

It doesn’t seem right to finish our letter without a look at the world’s second largest economy. As we have documented, China has been struggling with the effects of its Covid lockdown policies as well as the collapse of its real estate market.

Despite efforts to spur demand, China’s real estate crisis remains an issue as it appears prices are declining at an accelerating pace thereby putting more pressure on their credit markets and requiring ongoing intervention from the banking system.

We thought that Chinese President Xi had backed himself into a corner with his strict Covid lockdown strategies. Despite shutting down entire cities and implementing ruthless testing protocols, the policies failed to eliminate the disease from the country of over one billion people.

However, as with nearly every world leader we follow, Xi has followed the number one rule of politics: never admit you’re wrong. He seemed to be stuck with a policy that was doing nothing to curb infections while at the same time causing serious damage to his economy.

Then, in November, a fire broke out in a locked down residential building which resulted in the deaths of 10 people and injury to nine others. Soon afterwards, videos appeared to show crowds of people protesting the government’s strict “zero-COVID” policy in the streets of cities across the country.

While many in the West saw this as a political uprising, Xi saw this as an opportunity to gain more public support and escape the economic box he had created by announcing sweeping changes to the policy including allowing home quarantine, scrapping the health QR code that had been mandatory for entering most public places, restricting lockdowns to only “high-risk areas,” and making domestic travel within China easier.

In an address to the nation’s top political advisory body, Xi announced “We have optimized Covid control strategy based on time and situation in order to best protect people’s lives and health, and minimize the impact on economic and social development.”

China appears to be playing three-dimensional geopolitical chess with the rest of the world. Within a span of five days, the following headlines have come across our newsfeed:

New Chinese Foreign Minister Qin Gang sought better Sino-U.S. ties in a phone conversation with Secretary of State Antony Blinken on New Year’s Day, according to a statement from the Ministry of Foreign Affairs in Beijing. – Bloomberg

Putin and Xi to speak by video link on Friday Russian President Vladimir Putin will speak with Chinese President Xi Jinping via video link on Friday to discuss a host of bilateral and regional issues. – Reuters

While the U.S. has sought to persuade countries to reduce their dependence on China, trade ties Between the world’s second-largest economy and the rest of Asia are deepening as economies grow and companies refashion supply chains – WSJ

There is a delicate balance going on here. China is still a predominantly export based economy with a nearly $1.0 trillion difference between exports and imports and is still highly reliant on the US ($577.1 billion) and the EU ($472.2 billion) as trading partners. These flows must continue to fund their global ambitions.

At the same time, energy and agriculturally rich Russia shares a border with China and the two countries recently announced the opening of a new bridge to symbolize their strengthening alliance.

They announced a “no limits” partnership in February of 2022 and China declined to condemn Russia’s actions in Ukraine while they criticized the Western sanctions on Moscow. In order to grow their economy, China (like the US) needs a low cost, reliable source of energy and Russian oil is a close and cheap supplier until the build out of the Chinese nuclear power program is completed and can substantially replace it.

Finally, since 2013, China has been revitalizing ancient overland trading routes connecting Europe and Asia. Built largely with Chinese expertise, the initiative is integral to China’s efforts to create more secure trade routes and to make participating nations dependent on the Chinese economy thereby building economic and political influence for China.

Should they succeed, China would certainly rival, if not surpass, the US as an economic superpower. While that alone is not cause for concern, we are sure that as part of their newfound influence, China would take aggressive actions to dethrone the US Dollar as the world’s reserve currency (for more on this, we recommend Ray Dalio’s book, The Changing World Order).

At a current level of $31 trillion, the US debt burden is high and, by most estimates, too high to ever be paid off. However, since the debt is denominated in US dollars, our Reserve Currency status allows us to simply “print” more money to service the debt. If the US dollar were to lose its reserve currency status, we would very quickly find ourselves in severe financial trouble.

On the other hand, if their plan were to fail, a potential Chinese economic collapse could reverberate across the globe. The impact would vary with the rest of the world’s reliance on China for critical goods and services. During the pandemic it became apparent just how many prescription drugs, medical devices, and other vital supplies had been outsourced to China or other countries dependent on China for inputs. While there has been a lot of talk about reducing our dependency, we have seen little in the way of concrete actions by companies to onshore production.

Neither of these scenarios are good, but neither are they inevitable. China has a lot of problems, many of which are not in its control, so it might be forced to “optimize” its ambitions, much the way it did with its COVID-Zero policy.

Conclusion

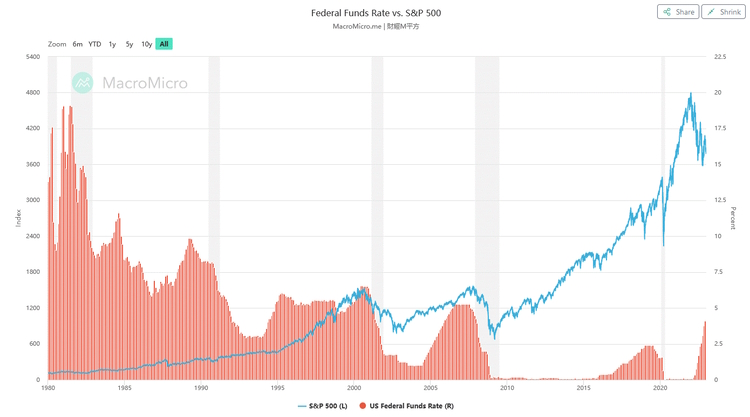

In his latest memo, Oaktree Capital founder, Howard Marks, another successful investor we follow, stated that he believes we are in the midst of a “sea change” in the investment world, the third in his career. You can read the memo in its entirety but, in essence, he believes that the main driver of investment returns over the last 40 years was the massive drop in interest rates which started in the early 1980’s.

Furthermore, after a series of fits and starts, we have made the turn from a low-interest rate environment to a higher-interest rate environment where investors will once again be able to make reasonable returns with bond investments. Lenders and “bargain hunters” will have much better prospects going forward than they did from 2009-2021 and many of the hot investment strategies that worked so well the last ten years may not be the ones that outperform in the years ahead.

While we don’t disagree with Mr. Marks about the current environment, we have a lot less faith in the commitment of our institutions influencing that environment. We have seen how suddenly things can change when someone like Powell becomes the Fed Chairman and replaces someone who had no desire to raise interest rates. We have seen how fast the environment can change after an election. We know that there are long term trends in place such as energy demand, demographics, medicine/health, and war, and acknowledge that these trends can have major influences on the short-term investment environment. To our minds, the only thing that has lasted throughout our careers is change.

Therefore, we spend our time and money on research and doing our homework to find stocks to buy that will best fit our strategies. When those stocks are trading below their fundamental value as often happens in a bear market, we try to buy more of them.

This is how many of the legendary investors became legends. By realizing that they have no control over short-term stock prices, inflation, interest rates or geopolitical conflict, they focused on buying companies that can survive and even thrive whatever the current environment may be.